INSURANCE INSIGHTS

|

JULY 2017

24

25

JULY 2017 |

INSURANCE INSIGHTS

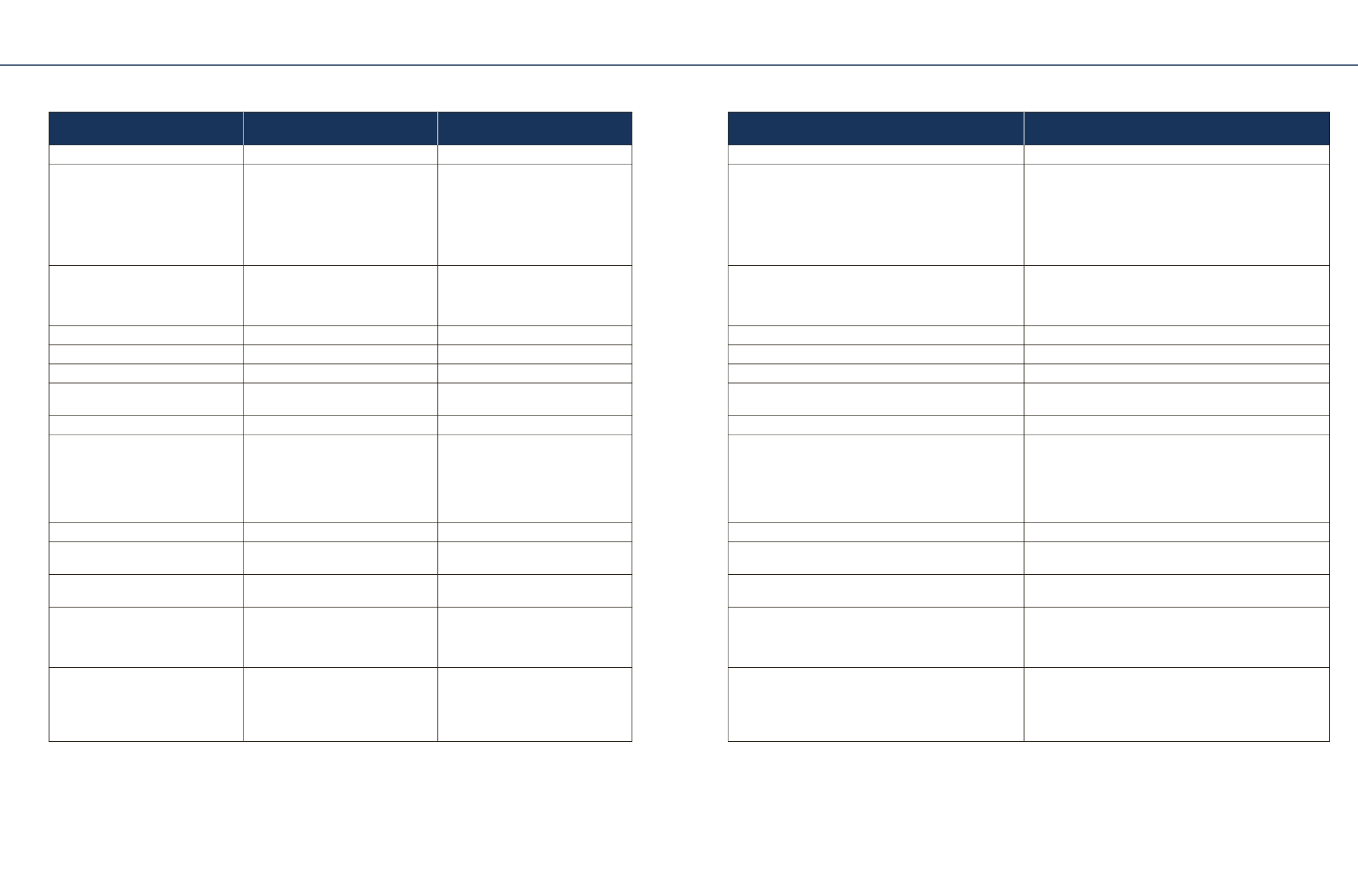

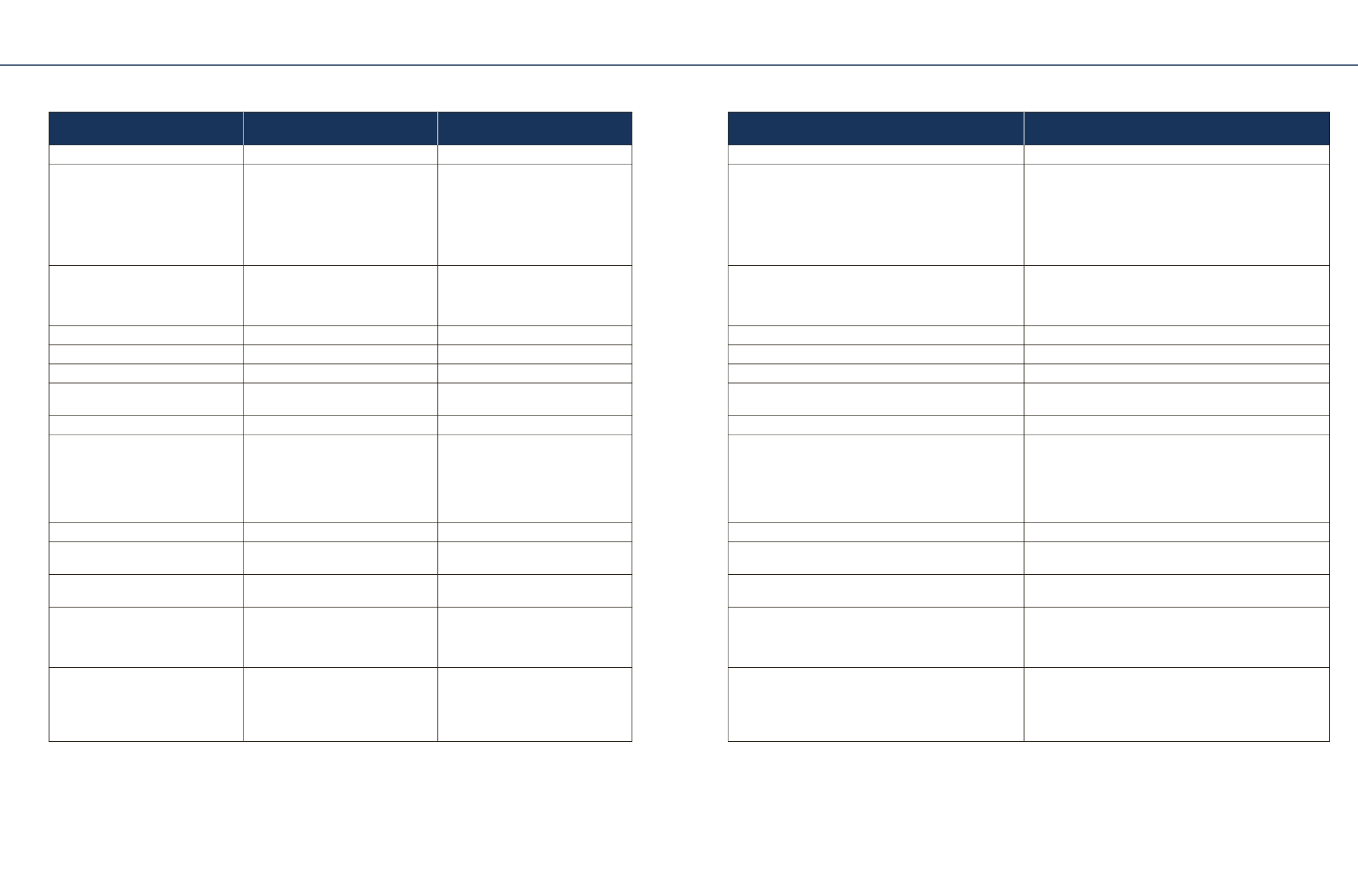

Insurer Name

Birla Sun Life Insurance Company

Ltd.

Birla Sun Life Insurance Company

Ltd.

HDFC Standard Life Insurance Company Ltd.

Birla Sun Life Insurance Company Ltd.

Product name

BSLI Empower Pension Plan

BSLI Wealth Secure Plan

HDFC Life Assured Pension Plan

BSLI Empower Pension – SP Plan

Illustrative Maturity/Vesting Benefit

at 4% and 8% return for Premium

R

1,00,000 p.a. (as per insurer's

illustration)

(for a 35 year old Male, non-smoker,

Premium excluding taxes, surcharge

& cess)

R

17,90,723 (at 4%)/

R

25,08,650 (at

8%)

PPT - 15 years, PT - 15 years

Risk Profile - Moderate

R

17,02,347 (at 4%)/

R

23,85,877 (at

8%)

PPT - 15 years, PT - Whole Life

R

7,99,001(at 4%)/

R

11.12.494(at 8%)

PPT - 15 years, PT - 15 years

R

1,39,298(at 4%)/

R

2,50,240 (at 8%)

PPT - 15 years, PT - 15 years, Risk Profile - Moderate

Key Plan Features

Guaranteed Additions in the form of

additional units will be added to your

policy.

Pay premiums for a limited term and

get life cover for whole life along with

flexibility to add top-ups whenever you

have additional savings.

Provides Assured vesting benefit and Loyalty additions from

11th year onwards.

One time investment is required and Guaranteed Additions in the

form of additional units will be added to your policy.

Entry Age(Min/Max)

25/70 years

1/60 years

18/65 years

25/70 years

Maturity Age(Min/Max)

30/80 years

Whole Life

45/75 years

30/80 years

Premium paying options

Regular Pay

Limited Pay

Single Pay, Regular Pay, Limited Pay

Single Pay

Premium Paying Term(PPT)/Policy

Term(PT)

5 to 30 years

5 to 30 years

1

/Whole Life

SP, 8,10 Pay/10,15 to 35 years

15 Pay/15 to 35 years

Single Pay

Premium mode

Annual, Half-yearly, Quarterly, Monthly

Annual, Half-yearly, Quarterly, Monthly

Annual, Half-yearly, Quarterly, Monthly, Single

Single Pay

Sum Assured (Min/Max)

-

Entry age < 45 years: Higher of AP x 10

or AP x no. of years to attain age 70/2/

Up to 300% of Minimum Basic SA

Entry age >= 45 years: Higher of AP x

7 or AP x no. of years to attain age 70/4

/ Up to 300% of Minimum Basic SA

-

-

Minimum Annual Premium

R

18,000

2

R

20,000

2

R

24,000 (LP/RP)

R

1,00,000

Plan options

Risk Profile -Aggressive, Moderate,

Conservative

Not Available

Not Available

Risk Profile - Aggressive, Moderate, Conservative

Premium Allocation Charges

Year 1 : 6%, Year 2-3 : 5.50%, Year

4-10 : 5%, Year 11+ : 4%

Year 1-2 : 6%, Year 3-6 : 5.50%, Year

7+ : 5%, Top-up premium - 2%

Year 1-5 : 5%, Year 6 onwards : 4%. Non-annual modes - 3.9% 3%

Maturity Benefit*

Higher of -

Guaranteed Vesting Benefit or Fund

Value

Not Available

Higher of -

- Fund Value

- Assured Vesting Benefit

Higher of -

- Guaranteed Vesting Benefit

- Fund Value

Death Benefit*

Higher of -

Guaranteed Death Benefit

Fund Value

^

Higher of -

Basic Fund Value or Basic Sum Assured

plus, higher of

Top-up Fund Value or Top-up Sum

Assured

Higher of -

- Fund Value

- 105 % of the total premiums paid till date.

Greater of -

(a) the Guaranteed Death Benefit or (b) Fund Value as on date of

intimation of death.

RETIREMENT PLANS (ULIP)

RETIREMENT PLANS (ULIP)

*Please refer to product brochure for more details.

^The minimum level of death benefit at all times will be 105% of the premiums paid (including top-up).

RP - Regular Pay, LP - Limited Pay, SP - Single Pay

1

Attained age at the end of PPT must be 18 to 75 years.

2

Depends on the premium mode chosen.