INSURANCE INSIGHTS

|

JULY 2017

34

35

JULY 2017 |

INSURANCE INSIGHTS

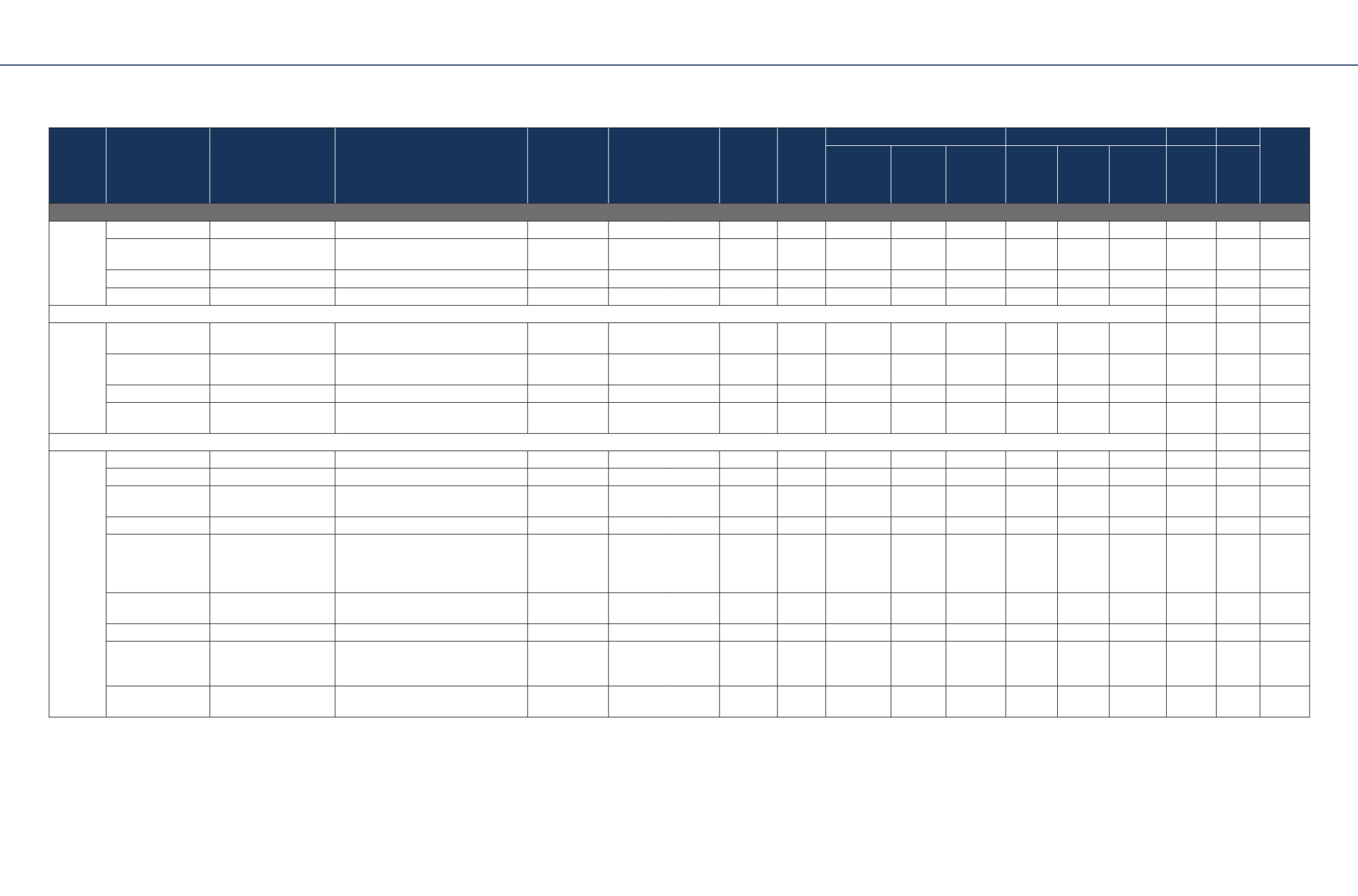

Insurer/

Classifica-

tion

Fund

Category

SFIN

Inception Date

YTM

Average

Maturity

(Years)

AUM

(Rs in

Cr.)

% Allocation

CAGR Returns as on 31st Mar 17

Since

Inception

Debt

Public

Deposits

and Money

Market

Equity

3M 6M

1 Yr

3 Yr

5 Yr

Equity Fund

HDFC Stan-

dard Life

Insurance

Company

Ltd.

Equity Plus Funds

Large Cap diversified

ULIF05301/08/13EquityPlus101

24-Jun-14

19.19 0%-20% 0%-20% 80%-100% 12.27% 8.81% 21.44% NA

NA 7.38%

Diversified Equity

Funds

Large Cap diversified

ULIF05501/08/13DivrEqtyFd101

1-Jul-14

16.16 0%-40% 0%-40% 60%-100% 15.08% 9.42% 23.03% NA

NA 12.81%

Opportunities Fund Mid Cap diversified

ULIF03601/01/10OpprtntyFd101

5-Jan-10

7,185.57 0%

0%-20% 80%-100% 17.15% 9.72% 33.54% 27.70% 17.44% 13.91%

BlueChip Fund

Large Cap diversified

ULIF03501/01/10BlueChipFd101

5-Jan-10

3,514.77 0%

0%-20% 80%-100% 12.31% 6.82% 20.40% 16.36% 13.47% 8.95%

Tata AIA Life

Insurance

Company

Ltd.

Large Cap Equity

Fund

Large Cap

ULIF 017 07/01/08 TLC 110

07-Jan-08

748.8 0%

3.73% 96.27% 12.16% 6.71% 19.19% 13.63% 14.25% 8.05%

Whole Life Mid Cap

Equity Fund

Mid Cap

ULIF 009 04/01/07 WLE 110

08-Jan-07

2350.95 0%

3.72% 96.28% 18.61% 8.68% 33.54% 31.11% 24.86% 14.82%

Multi Cap Fund

Large + Mid Cap

ULIF 060 15/07/14 MCF 110

05-Oct-15

0.03 0%

1.24% 98.76% 17.02% 11.13% 30.25% NA

NA 17.10%

India Consumption

Fund

Large + Mid Cap

ULIF 061 15/07/14 ICF 110

05-Oct-15

0.03 0%

9.12% 90.88% 17.02% 8.18% 28.99% NA

NA 16.37%

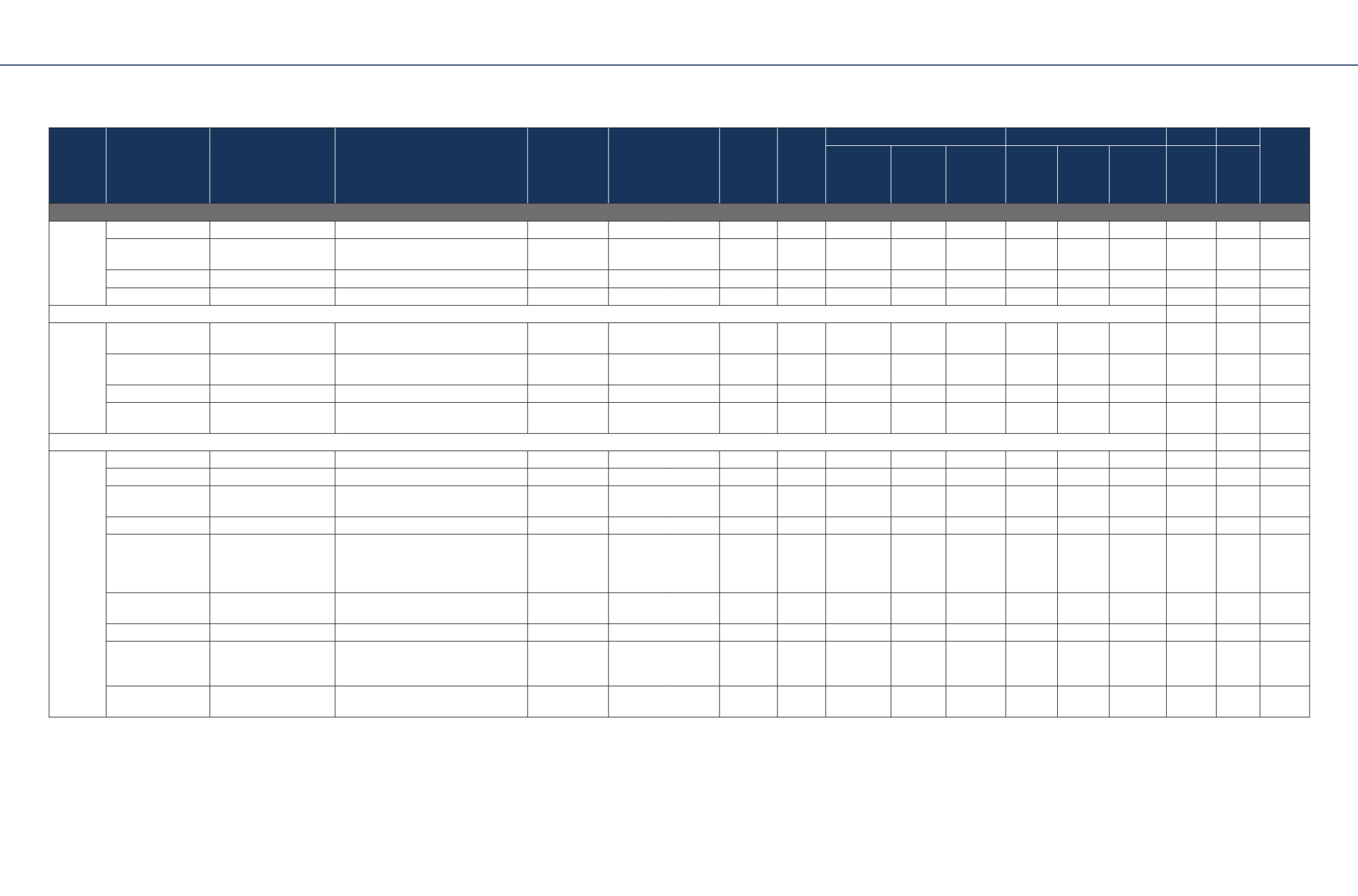

Birla Sun

Life

Insurance

Company.

Ltd.

BSLI Magnifier

Large cap

ULIF00826/06/04BSLIIMAGNI109

12-Aug-04

1062.74 10%-50 % 0%-40% 50%-90 % 12.09% 8.43% 22.20% 14.24% 13.27% 13.32%

BSLI Maximiser

Large cap

ULIF01101/06/07BSLIINMAXI109

12-Jun-07

1827.22 0%-20% 0%-20% 80%-100 % 13.60% 8.25% 24.23% 14.50% 13.12% 9.49%

BSLI Maximiser

Guaranteed

Large cap

ULIF03027/08/13BSLIMAXGT109

1-Jan-14

5.64

0%-20% 0%-20% 80%-100 % 12.01% 5.55% 19.51% 12.26% -

13.37%

BSLI Super 20

Large cap

ULIF01723/06/09BSLSUPER20109 6-Jul-09

839.68 0%-20% 0%-20% 80%-100 % 12.98% 7.91% 20.45% 11.76% 12.61% 11.69%

BSLI Pure Equity

Diversified portfolio across

various sectors excluding

Media, Financial and Liquor

sector

ULIF02707/10/11BSLIPUREEQ109 9-Mar-12

91.58 0%-20% 0%-20% 80%-100 % 14.36% 9.29% 26.72% 22.46% 19.65% 19.51%

BSLI Value

Momentum

MultiCap

ULIF02907/10/11BSLIVALUEM109 9-Mar-12

174.01 0%-20% 0%-20% 80%-100 % 16.45% 19.10% 45.91% 24.02% 17.76% 17.63%

BSLI Asset Allocation Asset Allocation

ULIF03430/10/14BSLIASTALC109

24-Sep-15

51.81 10%-80 % 0%-40% 10%-80 % 6.75% 5.98% 20.57% -

-

14.47%

BSLI Capped Nifty

Invested in all equity shares

forming part of the nifty

index

ULIF03530/10/14BSLICNFIDX109

24-Sep-15

30.80 0%-10 % 0%-10 % 90%-100 % 11.26% 6.08% 18.43% -

-

10.51%

BSLI Multiplier - Mid

cap

Mid Cap

ULIF01217/10/07BSLINMULTI109

30-Oct-07

600.92 0 - 20 % 0 - 20 % 80 - 100 % 17.10% 10.72% 39.17% 28.47% 21.73% 12.51%

FUND PERFORMANCE

Note: Money Market includes Current Assets - Tata AIA Life Insurance Co. Ltd.

*only for current funds available. Past performance is not indicative of future performance.