INSURANCE INSIGHTS

|

JULY 2017

22

23

JULY 2017 |

INSURANCE INSIGHTS

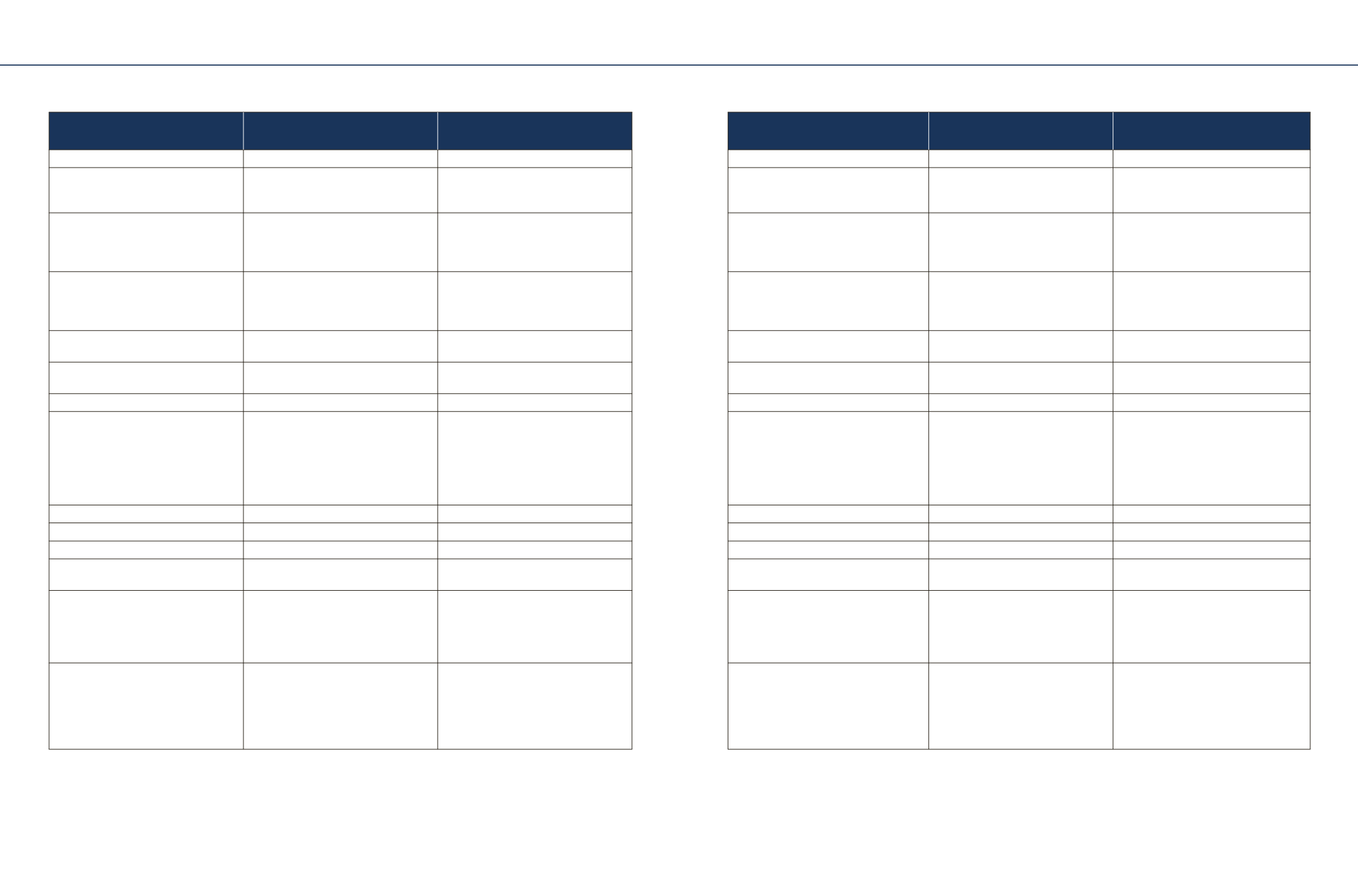

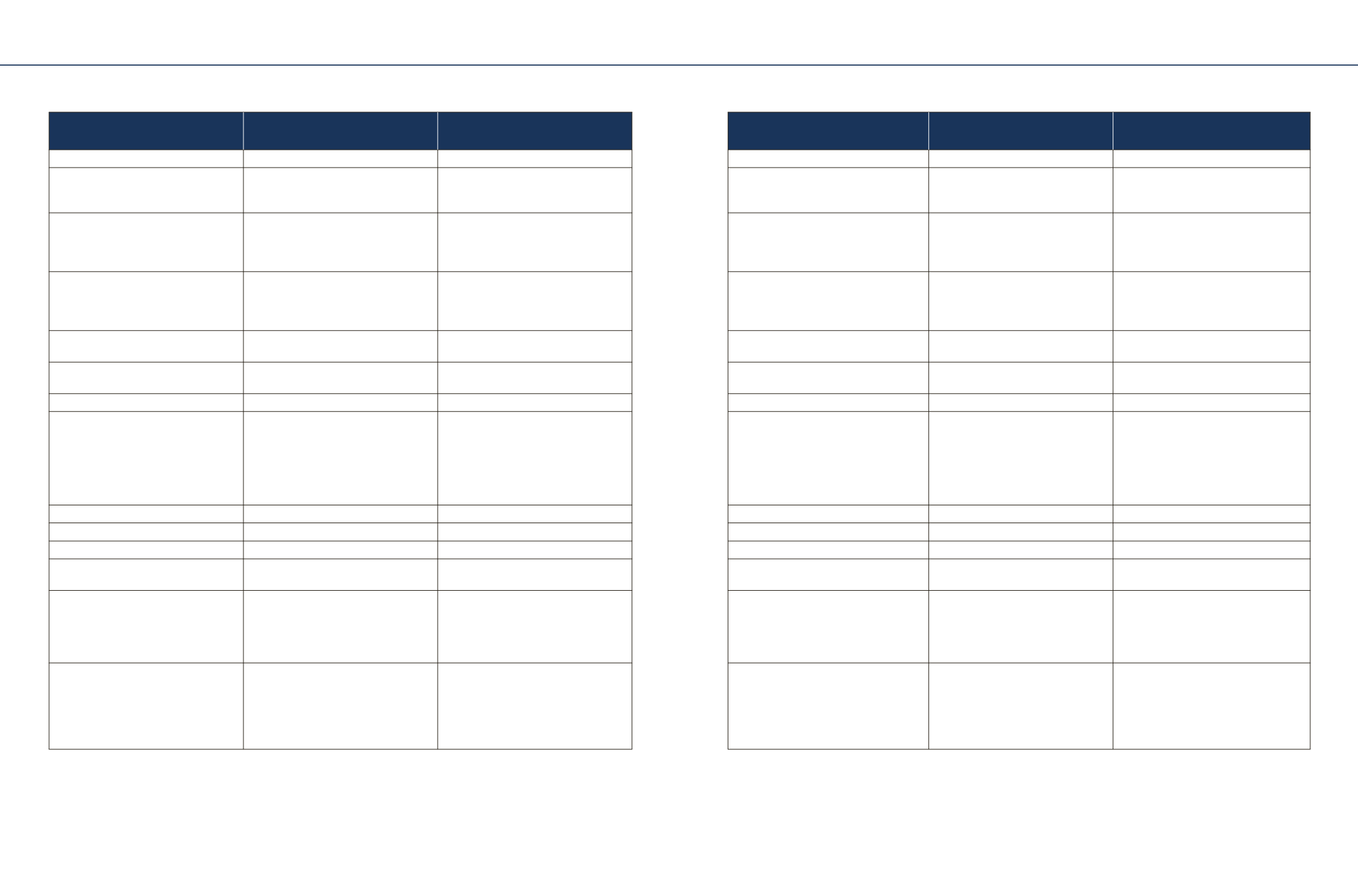

Insurer Name

HDFC Standard Life Insurance

Company Ltd.

HDFC Standard Life Insurance

Company Ltd.

Birla Sun Life Insurance Company Ltd.

TATA AIA Life Insurance

Company

Ltd.

Birla Sun Life Insurance Company

Ltd.

Product name

HDFC Life Personal Pension Plus Plan HDFC Life Guaranteed Pension Plan

BSLI Vision LifeIncome Plan

TATA AIA Life Insurance Freedom BSLI Immediate Annuity Plan

Premium p.a. (for a 40 year old Male,

non-smoker, for SA of

R

5 Lakh)

(Excluding taxes, surcharge & cess)

R

38,319

PPT - 15 years, PT - 15 years

R

70,126

PPT - 10 years, PT - 15 years

R

50,000

PPT - 15 years, PT - whole life (till age

100)

R

56,205

PPT - 10 years, PT - 15 years

Purchase Price -

R

5,00,000 (SP)

Illustrative Maturity/Vesting Benefit

at 4% and 8% return for above

premium and Sum Assured (as per

insurer's illustration)

R

6,67,650 (at 4%)/

R

9,07,347 (at 8%)

R

9,50,000

R

22,15,445 (at 4%)/

R

37,34,925 (at 8%)

R

6,56,940 (at 4%)/

R

9,39,149 (at

8%)

Life Annuity at Uniform rate -

R

27,388 p.a.

Key Plan Features

Participating Regular Premium Payment

Non-linked Pension plan with an

Assured Death Benefit of 101% of all

regular premiums.

Non-Participating Pension plan with

guaranteed & vesting additions.

Provides 5% of the Sum Assured

guaranteed plus bonus every year after

the Premium Paying Term.

Flexibility to Plan Retirement & 10%

Guaranteed Addition of Annualised

Premium.

Provides guaranteed income over your

entire life and no medical tests required

to purchase this plan.

Entry Age(Min/Max)

18/65 years

35/65 years

1/60 years

25/45 years (Option 1), 25/50 years

(Option 2)

30/90 years

Maturity/Vesting Age(Min/Max)

55/75 years

55/75 years

Whole Life

55 years (Option 1),

60 years (Option 2)

-

Premium paying options

Regular Pay

Limited Pay, Regular Pay

Limited Pay

Limited Pay

Single Pay

Premium Paying Term(PPT)/Policy

Term(PT)

10 to 40 years

10 to 20 years

5 to 40 years

1

/Whole Life (till age100)

7, 10 Pay/10 to 14 years

7,10,15 Pay/15 years and above

(Option 1: 55 – Age at entry; i.e. 10 to

30 years

Option 2: 60 – Age at entry, i.e. 10 to

35 years)

Single Pay

Premium mode

Annual, Half-yearly, Quarterly, Monthly

Annual, Half-yearly, Quarterly, Monthly

Annual, Half-yearly, Quarterly, Monthly

Annual, Half-yearly, Monthly

Annual

Sum assured (Min/Max)

R

2,04,841/No Limit

R

81,145/No Limit

R

2,00,000/No Limit

R

2,00,000/No Limit

2

NA

Minimum Annual Premium

R

24,000

R

24,000

R

18,000

R

15,278

R

2,00,979

3

Plan options

-

-

-

Option 1: Maturity age of 55 years

Option 2: Maturity age of 60 years

-

Maturity Benefit*

Higher of :

- Sum Assured on vesting plus accrued

bonuses

- Assured Benefit of 101% of all regular

premiums paid till date

Sum Assured on vesting + Guaranteed

Additions + Vesting Addition

Sum Assured + Terminal Bonus (if any)

Basic Sum Assured+ Compound

Reversionary Bonus +Terminal Bonus

Survival Benefit - Available

Convenient annuity payout modes

- monthly, quarterly, half-yearly and

annually from date of purchase.

Death Benefit*

^

Assured Death Benefit of 101% of

all regular premiums paid to date +

Accrued bonuses.

^

Assured Death Benefit of total

premiums paid to date accumulated at

a guaranteed rate of 6% per annum

compounded annually.

^

Death during premium paying term - Sum

Assured + Vested regular bonuses +

Terminal bonus (if any)

Death after premium paying term - Sum

Assured + Bonus from current year +

Terminal Bonus (if any)

^

*Sum Assured on death + Accrued

Guaranteed Additions till death +

vested Compound Reversionary Bonus

and Terminal Bonus, (if any)

NA

RETIREMENT PLANS (TRADITIONAL)

RETIREMENT PLANS (TRADITIONAL)

*Please refer to product brochure for more details.

^The minimum level of death benefit at all times will be 105% of the premiums paid (including top-up).

1

Attained age at the end of PPT must be 18 to 75 years

2

subject to underwriting policy

3

For a 40 year old Male, Annuity – 12,000 p.a., Lifetime annuity with uniform rate, Annuity Mode – Annual