INSURANCE INSIGHTS

|

JULY 2017

14

15

JULY 2017 |

INSURANCE INSIGHTS

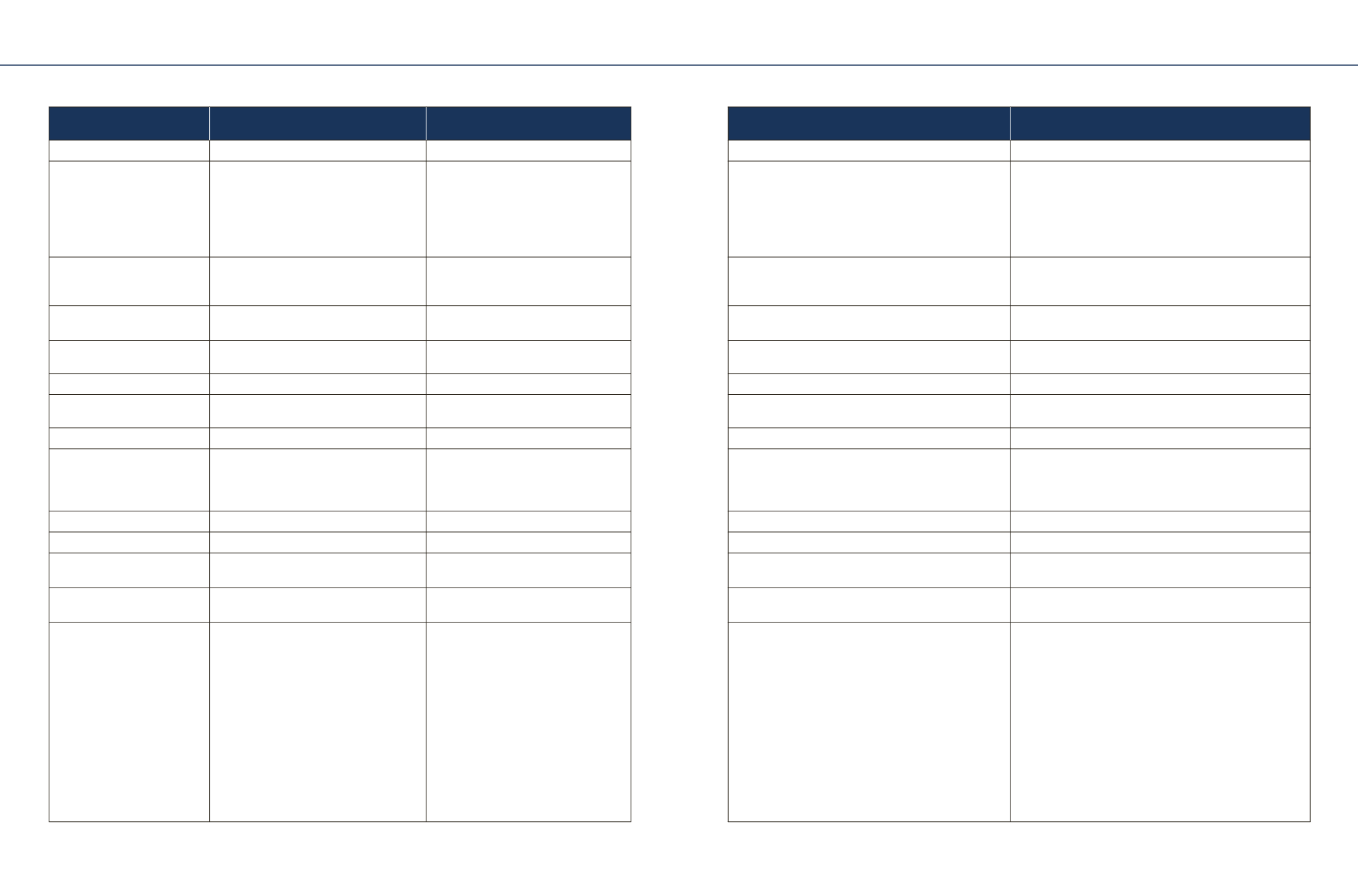

Insurer Name

HDFC Standard Life Insurance Company

Ltd.

Birla Sun Life Insurance Company Ltd

TATA AIA Life Insurance Company Ltd.

HDFC Standard Life Insurance Company Ltd.

Product name

HDFC SL ProGrowth Flexi

BSLI Wealth Aspire Plan - Classic Option

TATA AIA Life Insurance Fortune Pro

HDFC SL Crest

Illustrative Maturity Benefit at

4% and 8% return for Premium

R

2,50,000 p.a. for a 35 year

old Male, non-smoker.(as per

insurer's illustration)

(Premium excluding taxes,

surcharge & cess)

R

61,73,825 (at 4%)/

R

96,33,496 (at 8%)

PPT - 20 years, PT - 20 years, Here maximum

premium of

R

1 Lakh is considered.

R

38,82,341 (at 4%)/

R

70,95,561 (at 8%)

PPT - 10 years, PT - 20 years

R

34,95,076 (at 4%)/

R

63,71,845 (at 8%)

PPT - 10 years, PT - 20 years

R

13,32,867 (at 4%)/

R

18,30,206 (at 8%)

PPT - 5 years, PT - 10 years

Key Plan Features

Regular Premium Payment plan with 2 plan

options and a choice of investment in 4 fund

options.

Guaranteed Additions in the form of ad-

ditional units will be added to your policy

and top up option available.

Flexibility to pay premium one time or for a limited period &

receive regular Loyalty Additions to boost investments.

Provides a choice of investment in 4 fund options.

Entry Age(Min/Max)

14/65 years (Life Option)

18/55 years (Extra Life Option)

30 days/50 (5 Pay), 55 (6 & 7 Pay), 60

years (8 Pay & above)

30 days/59 years

14/55 years

Maturity Age(Min/Max)

24/75 (Life Option), 24/70 years (Extra Life

Option)

18/70 years

18/75 years

24/65 years

Premium paying options

Regular Pay

Limited Pay, Regular Pay

Single Pay, Limited Pay, Regular Pay

Limited Pay

Premium Paying Term(PPT)/

Policy Term(PT)

10 to 30 years

5 to 40 years

SP, LP- 5,7,10 years, RP&LP – 15 & 20 years/15 to 40 years 5/10 years

Premium mode

Annual, Half-yearly, Monthly

Annual, Half-yearly, Quarterly, Monthly

Annual, Half-yearly, Quarterly, Monthly, Single

Annual

Sum assured (Min/Max)

Age<45 years:

Higher of 10 x AP or 0.5 x PT x AP/40 x AP

Age >=45 years: Higher of 7 x AP or 0.25 x

PT x AP/40 x AP

Age<45 years:

Higher of AP x 10 or AP x PT/2

Age>45 years:

Higher of AP x 10 or AP x PT/4

SP - 1.25 x SP

LP - Higher of 10 x AP or 0.50 x PT x AP / 30 x AP for entry

age 0-29 years*

Age<45 years: 10 x AP / 20 x AP

Age>=45 years: 7 x AP / 20 x AP

Minimum Annual Premium

R

24,000

R

30,000

R

50,000 (LP/RP)

R

50,000

Plan options

Life Option, Extra Life Option

BSLI Wealth Aspire - Classic Option

Not Available

Not Available

Premium Allocation Charges*

Year 1&2 : 7.5%, Year 3-5 : 5%

Year 1/Premium Band* 1 - 7%, Year 2+/

Band* 1 - 5%

Year 1&2 : 6%, Year 3-5 : 5.5%, Year 6-7 : 4.5%, Year 8-10 :

3.5%, Year 11+ : 2%, SP - 3%

Year1&2 : 4%, Year 3 : 3%, Year 4&5 : 2%

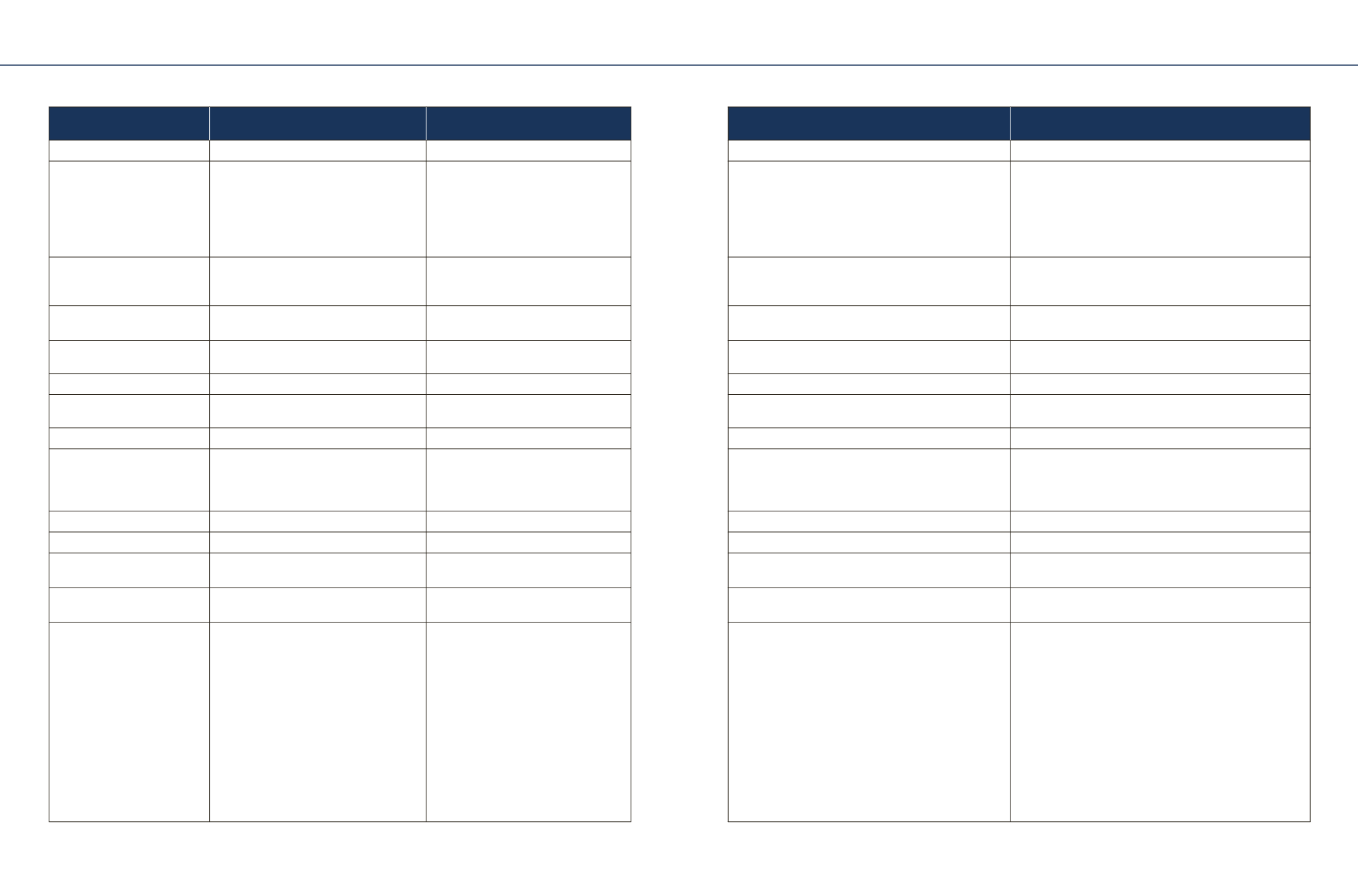

Maturity Benefit*

Fund Value

Fund Value

Settlement Option Available

Fund Value

Fund Value

Death Benefit*

Highest of:

Before attainment of age 60 years -

-Sum Assured (less all withdrawals made

during the two year period immediately pre-

ceding the date of death)

-The total fund value

- Minimum death benefit of 105% of the

premiums paid

On or after attainment of age 60 years -

-Sum Assured (less all withdrawals made

after attainment of age 58)

-The total fund value

-Minimum death benefit of 105% of the

premiums paid

^

Highest of -

Basic Fund Value or Basic Sum Assured

In addition, higher of

Top-up Fund Value or Top-up Sum Assured

Higher of:

- Higher of Sum Assured net off all “Deductible Partial

Withdrawal” or Fund Value

- 105% of the total premiums paid

Highest of:

Before attainment of age 60 years:

-Sum Assured (less all withdrawals made during the two year

period immediately preceding the date of death)

-The total fund value

On or after attainment of age 60 years:

-Sum Assured (less all withdrawals made after attainment of age

58)

-The total fund value

SAVINGS PLANS (ULIP)

SAVINGS PLANS (ULIP)