INSURANCE INSIGHTS

|

JULY 2017

18

19

JULY 2017 |

INSURANCE INSIGHTS

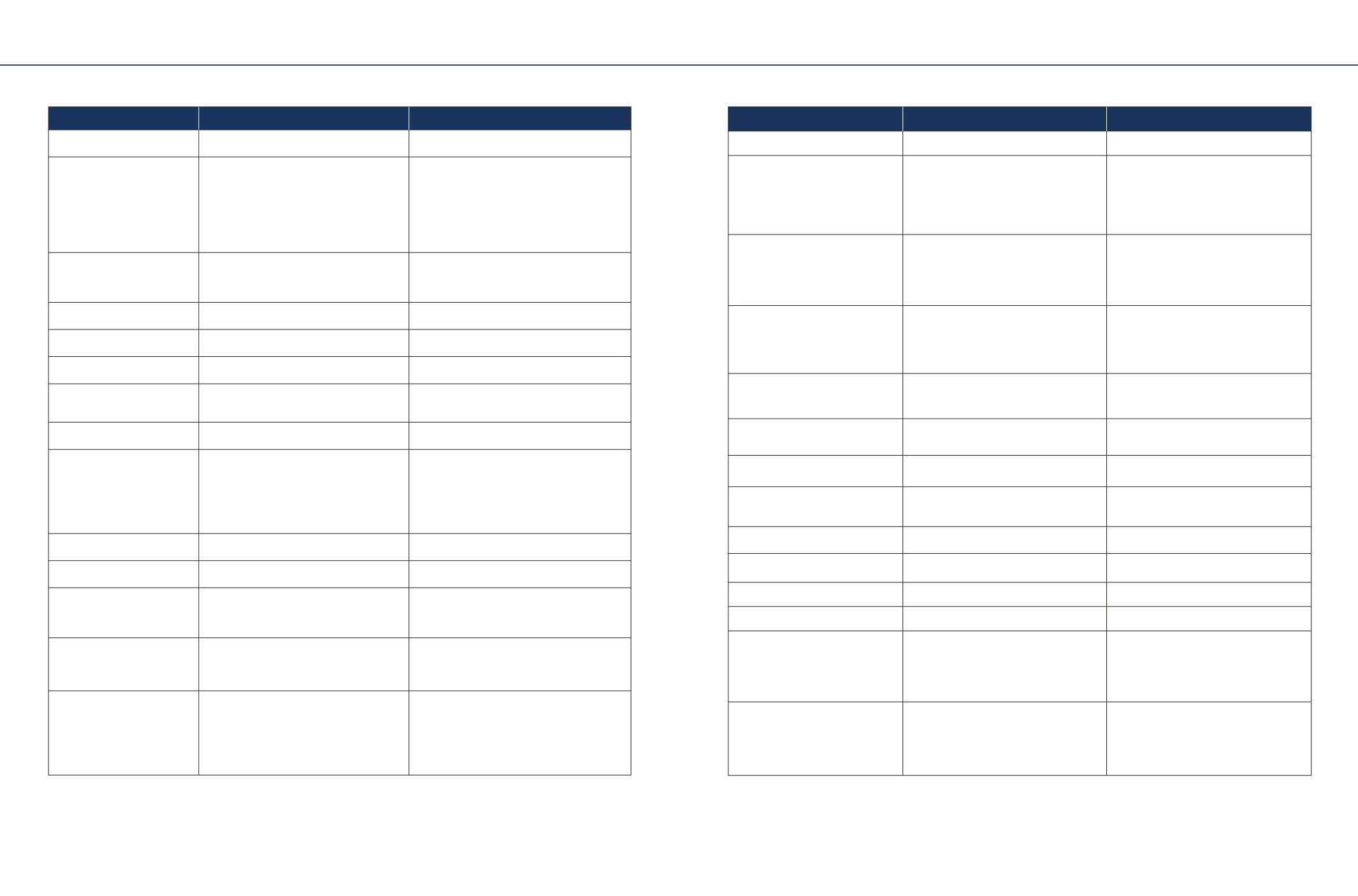

Insurer Name

TATA AIA Life Insurance Company Ltd.

HDFC Standard Life Insurance Company Ltd.

Product name

TATA AIA Life Insurance Fortune Maxima

HDFC Life Capital Shield

Illustrative Maturity Benefit at

4% and 8% return for Premi-

um

R

2,50,000 p.a. for a 35 year

old Male, non-smoker.(as per

insurer's illustration)

(Premium excluding taxes,

surcharge & cess)

R

1,12,64,964 (at 4%)/

R

11,71,36,602 (at 8%)

PPT - 10 years, PT - 65 years

R

12,98,216 (at 4%)/

R

17,80,146 (at 8%)

PPT - 5 years , PT - 10 years

Key Plan Features

Flexibility to pay premium one time or for a lim-

ited period & receive regular Loyalty Additions

to boost investments. Life cover for whole life.

Provides capital guarantee with an Assured Matu-

rity Benefit and increasing Loyalty Additions from

the end of 6th Policy year onwards.

Entry Age(Min/Max)

30 days/60 years

8/60 years

Maturity Age(Min/Max)

18/100 years

18/70 years

Premium paying options

Single Pay, Limited Pay

Single Pay, Limited Pay

Premium Paying Term(PPT)/

Policy Term(PT)

7,8,9,10,15&20 years/100 minus issue age

5 years/10 years

Premium mode

Annual, Half-yearly, Quarterly, Monthly, Single Annual, Half-yearly, Quarterly, Monthly, Single

Sum assured (Min/Max)

SP - 1.25 x SP

LP - 10 x AP/35 X AP

#

SP (Age < 45 years): 125% of SP

SP (Age >= 45 years): 110% of SP

LP (Age < 45 years): 10 x AP

LP (Age between 45 - 54 years): 7 x AP / 10

times AP

LP (Age >= 55 years): 7 x AP

Minimum Annual Premium*

R

50,000 (LP)

R

48,000

Plan options

Not Available

Not Available

Premium Allocation Charges*

Year 1&2 : 6%, Year 3-5 : 5.5%, Year 6-7 :

4.5%, Year 8-10 : 3.5%, Year 11+ : 2%, SP -

3%

4

Year 1: 9%, Year 2&3 - 7%, Year 4&5 - 6%, SP

- 3%

Maturity Benefit*

Fund Value

Higher of:

- Fund Value

- Assured Maturity Benefit

Death Benefit*

Higher of:

- [Higher of Sum Assured net off all “Deduct-

ible Partial Withdrawal” or Fund Value

- 105% of the total premiums paid]

Highest of:

- Sum Assured less an amount for partial with-

drawals made, if any

- Fund Value

- 105% of total premiums paid till the date of

death (Guaranteed Death Benefit)

*Please refer to the Product Brochure for more details.

SP - Single Pay, RP - Regular Pay, LP - Limited Pay, AP - Annualised Premium, SA - Sum Assured, ^The minimum death benefit will be at least 105% of

the premiums paid,

#

Max Sum Assured is dependent on Age and AP,

1

Different for other plan options.

2

Varies as per year, payment mode and premium band

3

Varies as per premium paying term and premium amount,

4

Different for non-annual mode

SAVINGS PLANS (ULIP)

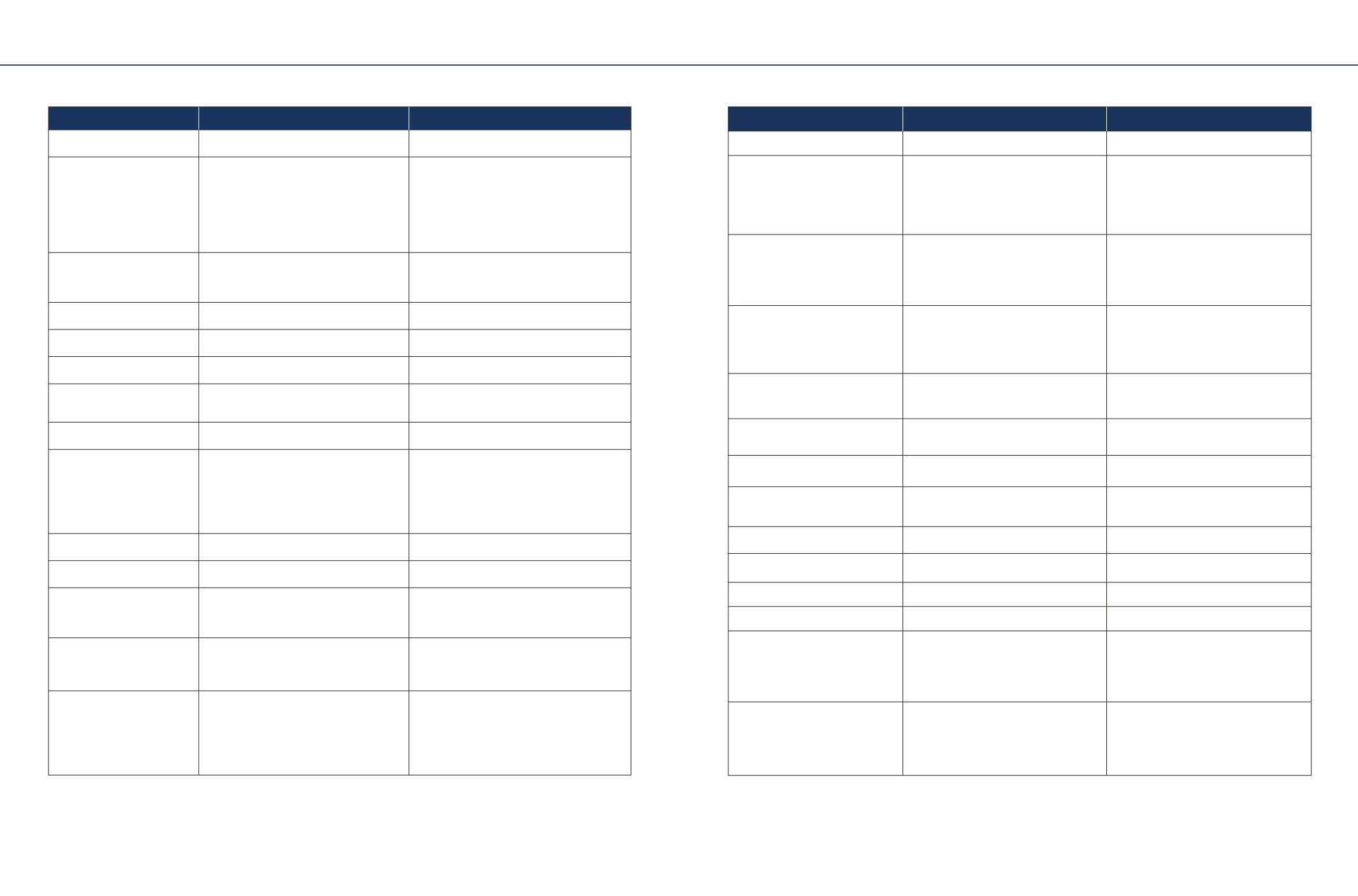

Insurer Name

TATA AIA Life Insurance Company Ltd.

Birla Sun Life Insurance Company Ltd

Product name

TATA AIA Life Insurance Good Kid

BSLI Vision Star Plan

Premium p.a. (for a 35 year old

Male, non-smoker, for SA of Rs.

5 Lakh)

(Excluding taxes, surcharge &

cess)

R

38,095

PPT - 15 years, PT - 20 years

R

41,710

PPT - 10 years, PT - 21 years, Option A

Illustrative Maturity Benefit at

4% and 8% return for above

premium and Sum Assured (as

per insurer's illustration)

R

7,02,448 (at 4%)/

R

11,42,678 (at 8%)

R

5,84,000 (at 4%)/

R

9,83,000 (at 8%)

Key Plan Features

Lump sum death benefit on death of

Insured, waiver of future premiums and

payment of scheduled benefits to take

care of the child's needs.

Flexibility to choose between two Assured

Payout Options.

Entry Age(Min/Max)

25/45 years (Life Assured)

30 days/17 years (Nominee (child))

18/55 years

Maturity Age(Min/Max)

37/70 years

39/75 years

Premium paying options

Limited Pay

Limited Pay

Premium Paying Term(PPT)/

Policy Term(PT)

Policy Term less 5 years/12 to 25 years

5 to 12 years/Option A: 16 to 23 years,

Option B: 14 to 21 years

Premium mode

Annual, Half-yearly, Monthly

Annual, Half-yearly, Quarterly, Monthly

Sum assured (Min/Max)

R

2,50,000/No Limit

R

1,00,000/No Limit

Minimum Annual Premium

R

13,548

1

R

19,095

2

Plan options

Not Available

Option A, Option B

Maturity Benefit*

55% of Basic Sum Assured + Compound

Reversionary bonus + Terminal Bonus (if

any)

Survival Benefit - Available.

1) Accrued bonuses till date; plus

2) Terminal bonus (if any)

Death Benefit*

Sum Assured on Death + All future

outstanding premiums will be waived off +

Other benefits

Sum Assured on Death + No premiums

are required to be paid in future + As-

sured Payouts on the scheduled dates +

Bonuses, if any

CHILD PLANS (TRADITIONAL)

*Please refer to the Product Brochure for more details.

Option 1 - Aspiration, Option 2 - Academia, Option 3 - Career

1

Depends on the Basic Sum Assured selected. Currently taken for 25 year old female, Minimum Sum Assured -

R

2,50,000

2

Depends upon the age, Sum Assured and plan option chosen, Here Male, Age – 18 years, Sum Assured –

R

1 Lakh, PPT – 5 years, PT – 14 years

3

Considered for Age 30 days, Aspiration, Classic option, PPT – 7 years, PT – 18 years, Minimum Premium –

R

24,000