INSURANCE INSIGHTS

|

JULY 2017

20

21

JULY 2017 |

INSURANCE INSIGHTS

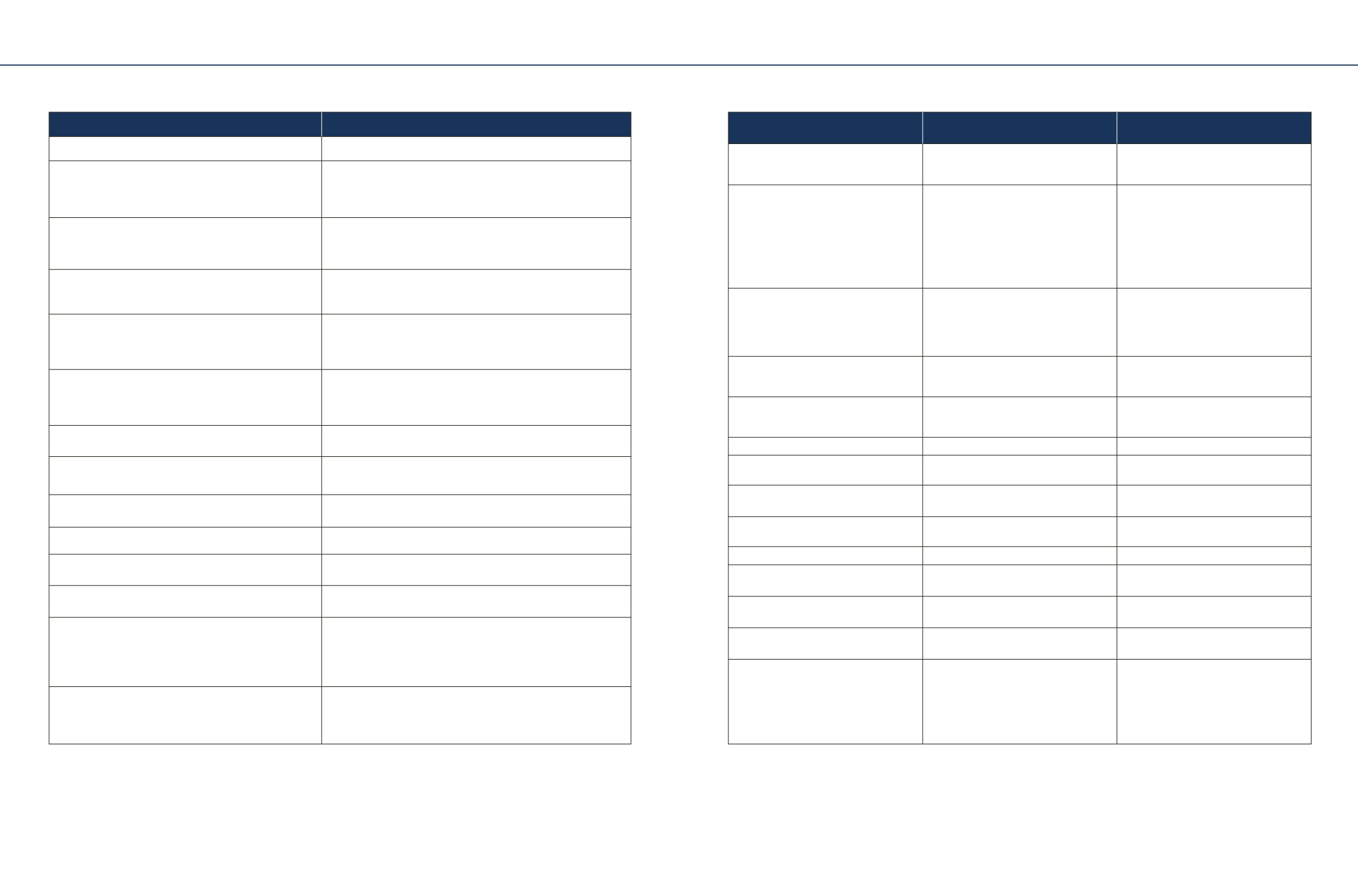

Insurer Name

HDFC Standard Life Insurance Company Ltd.

Product name

HDFC Life YoungStar Udaan

Premium p.a. (for a 35 year old Male, non-smoker,

for SA of Rs. 5 Lakh)

(Excluding taxes, surcharge & cess)

R

46,334

PPT - 15 years, PT - 20 years, Aspiration option

Illustrative Maturity Benefit at 4% and 8% return for

above premium and Sum Assured (as per insurer's

illustration)

R

8,71,154 (at 4%)/

R

13,44,997 (at 8%)

Key Plan Features

Participating Child Plan with 3 Plan options of Money back and

Endowment and Guaranteed additions in the 1st 5 Policy years.

Entry Age(Min/Max)

30 days/60 years (Classic: Option 1), 8/60 years (Classic: Option

2&3),

18/55 years (Classic Waiver)

Maturity Age(Min/Max)

18/75 years (Classic: Option 1), 23/75 years (Classic: Option

2&3),

33/75 years (Classic Waiver)

Premium paying options

Limited Pay

Premium Paying Term(PPT)/Policy Term(PT)

7, 10 or PT minus 5 years/15 to 25 years

Premium mode

Annual, Half-yearly, Quarterly or Monthly

Sum assured (Min/Max)

R

1,57,224

3

/No Limit

Minimum Annual Premium

R

24,000

Plan options

Classic, Classic Waiver

Maturity Benefit*

A. Last guaranteed payout for Moneyback Options OR ‘Sum As-

sured on Maturity’ for Endowment Option.

B. Accrued Guaranteed Additions (if applicable)

C. Reversionary bonus, interim bonus and terminal bonus, if any.

Death Benefit*

Classic - Basic Death Benefit + Accrued Guaranteed Additions +

Accrued Bonuses, if any

Classic Waiver - Basic Death Benefit + Premium Waiver

CHILD PLANS (TRADITIONAL)

*Please refer to the Product Brochure for more details.

Option 1 - Aspiration, Option 2 - Academia, Option 3 - Career

1

Depends on the Basic Sum Assured selected. Currently taken for 25 year old female, Minimum Sum Assured -

R

2,50,000

2

Depends upon the age, Sum Assured and plan option chosen, Here Male, Age – 18 years, Sum Assured –

R

1 Lakh, PPT – 5 years, PT – 14 years

3

Considered for Age 30 days, Aspiration, Classic option, PPT – 7 years, PT – 18 years, Minimum Premium –

R

24,000

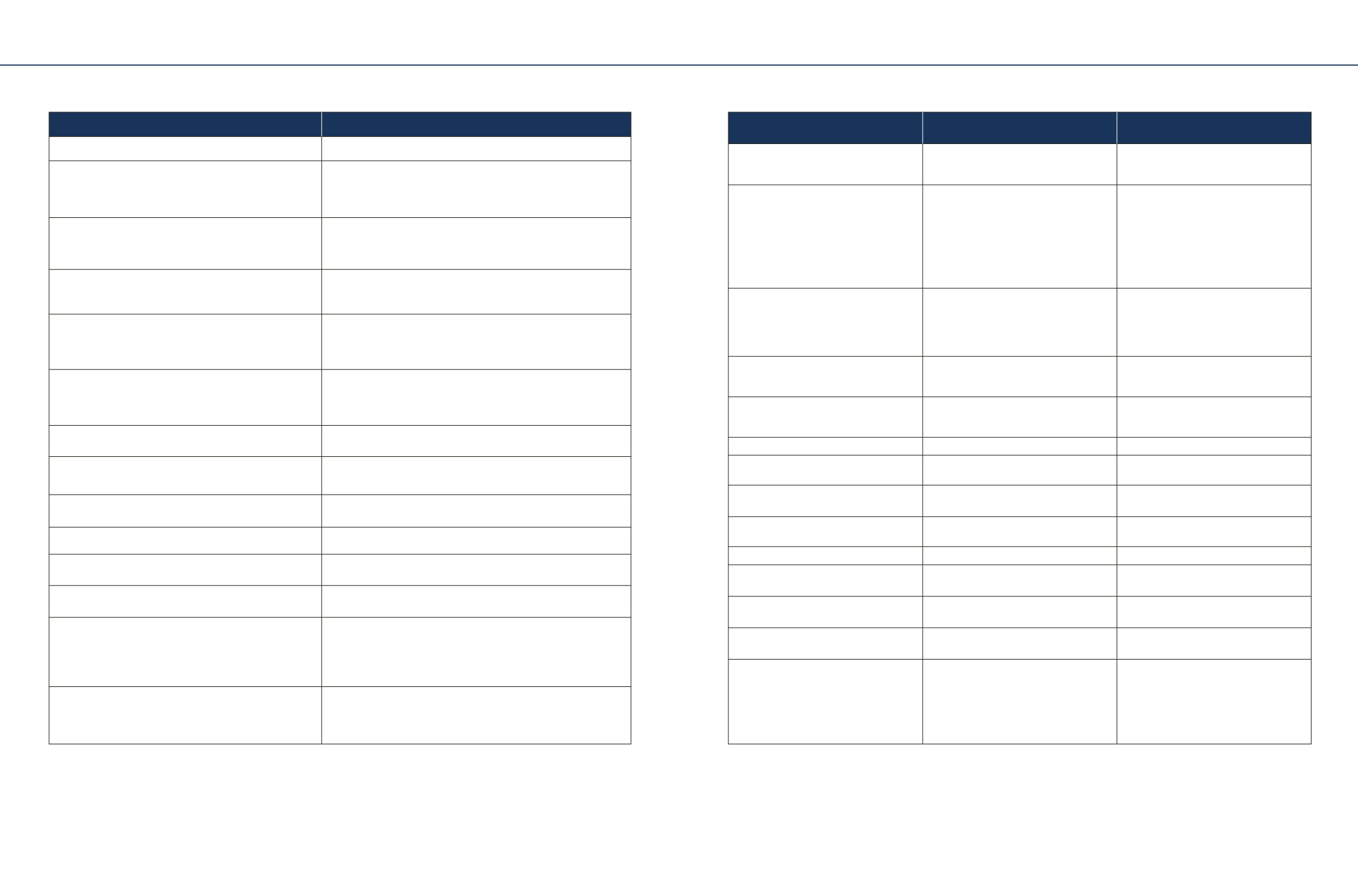

Insurer Name

HDFC Standard Life Insurance

Company Ltd.

Birla Sun Life Insurance Company

Ltd

Product name

HDFC SL YoungStar Super Premium

BSLI Wealth Aspire Plan -Assured

Option

Illustrative Maturity Benefit at 4% and

8% return for Premium Rs. 50,000 p.a.,

PPT - 20 years, PT - 20 years, for a 35

year old Male, non-smoker. (as per

insurer's illustration)

(Premium excluding taxes, surcharge

& cess)

R

11,15,911 (at 4%)

/R

17,53,838 (at 8%)

R

3,23,343 (at 4%)/

R

6,

88,610 (at 8%)

Key Plan Features

Regular Premium Payment Child

Endowment plan with 2 plan options and a

choice of investment in 4 fund options.

Flexibility to add top-ups in case of

additional savings and you are also

rewarded for policy continuance in the

form of additional units.

Entry Age(Min/Max)

18/65 years (Option 1), 55 years

(Option 2)

18/45 (5, 6 & 7 Pay), 50 years (8 Pay

& above)

Maturity Age(Min/Max)

18*/75 years (Option 1), 33/65 years

(Option 2)

28/60 years

Premium paying options

Regular Pay

Limited Pay, Regular Pay

Premium Paying Term(PPT)/Policy

Term(PT)*

10 to 20 years

5,6,7,8 years/5 to 40 years

1

Premium mode

Annual

Annual, Half-yearly,

Quarterly, Monthly

Sum assured (Min/Max)

Age<45 years: 10 x AP/40 x AP

Age>=45 years: 7 x AP/40 x AP

R

3,00,000/No Limit

Minimum Annual Premium

R

15,000

R

30,000

2

Plan options

Life Option, Life and Health Option

BSLI Wealth Aspire Plan - Assured

Option

Premium Allocation Charges

Year1-7 : 4%, Year 8+ : 1%

Year 1/Premium Band

#

1 - 7%, Year

2+/Band

#

1 - 5%

Maturity Benefit*

Fund Value

Fund Value

Settlement Option Available

Death Benefit*

Sum Assured + Premium Waiver depend-

ing upon Save Benefit or Save-n-Gain

option chosen.

On Maturity, fund value to be paid to the

beneficiary.

^

Higher of -

Basic Fund Value or Basic Sum Assured

plus, higher of -

Top-up Fund Value or Top-up Sum As-

sured

CHILD PLANS (ULIP)

*Please refer to the Product Brochure for more details.

Option 1 - Life Option, Option 2 - Life and Health Option, AP – Annualised Premium

^Death benefit payable shall never be less than 105% of total premiums paid to date (including Top-up),

#

Varies as per the premium band chosen. 2% Premium Allocation Charge is levied on any top-up premium when paid,

1

subject to maximum age of 70 on pay term,

2

depends on the premium mode selected