INSURANCE INSIGHTS

|

JULY 2017

40

41

JULY 2017 |

INSURANCE INSIGHTS

DISCLAIMER

HDFC Bank Limited (“HDFC Bank”) is registered with Insurance Regulatory & Development Authority of India (IRDAI) as a Com-

posite Corporate Agent, IRDAI Registration No. CA0010 for distribution of Insurance Products. HDFC Bank currently has arrange-

ment with six insurance companies viz HDFC Life Insurance Co. Ltd, TATA AIA Life Insurance Co. Ltd. and Birla Sun Life Insurance

Co. Ltd for distribution of Life Insurance products, HDFC ERGO General Insurance Co. Ltd and Bharti AXA General Insurance Co

Ltd for distribution of General Insurance products and Aditya Birla Health Insurance Co. Ltd. for distribution of Health Insurance

products. HDFC Bank does not underwrite the risk or act as an insurer. The insurance is underwritten by respective Insurance

Companies. The contract of insurance is between the Insurance Company and the insured only, and not between HDFC Bank and

the insured. HDFC Bank is not responsible or liable for performance of any obligations under the contract of insurance. Insurance

is sold as a stand-alone product and not linked to any of the Banking products. Participation in Insurance is purely on a voluntary

basis. Purchase of Insurance is not a pre-condition of availing any of the banking products / services. Details related to product

features and fund performance published in this magazine are based on the input received from insurance companies. HDFC Bank

is not responsible or liable for any omission or commission in the information shared. For more details on risk factors, product details,

terms and conditions and exclusions please read the relevant product brochure carefully before conclusion of sale.

COMMISSION

Under corporate agency guidelines, HDFC Bank earns commission for distribution of Insurance products. The commission varies

depending upon the product in each category, tenure, amount of premium and premium paying term. A brief snapshot of the com-

missions earned by the Bank across varied product categories is given below.

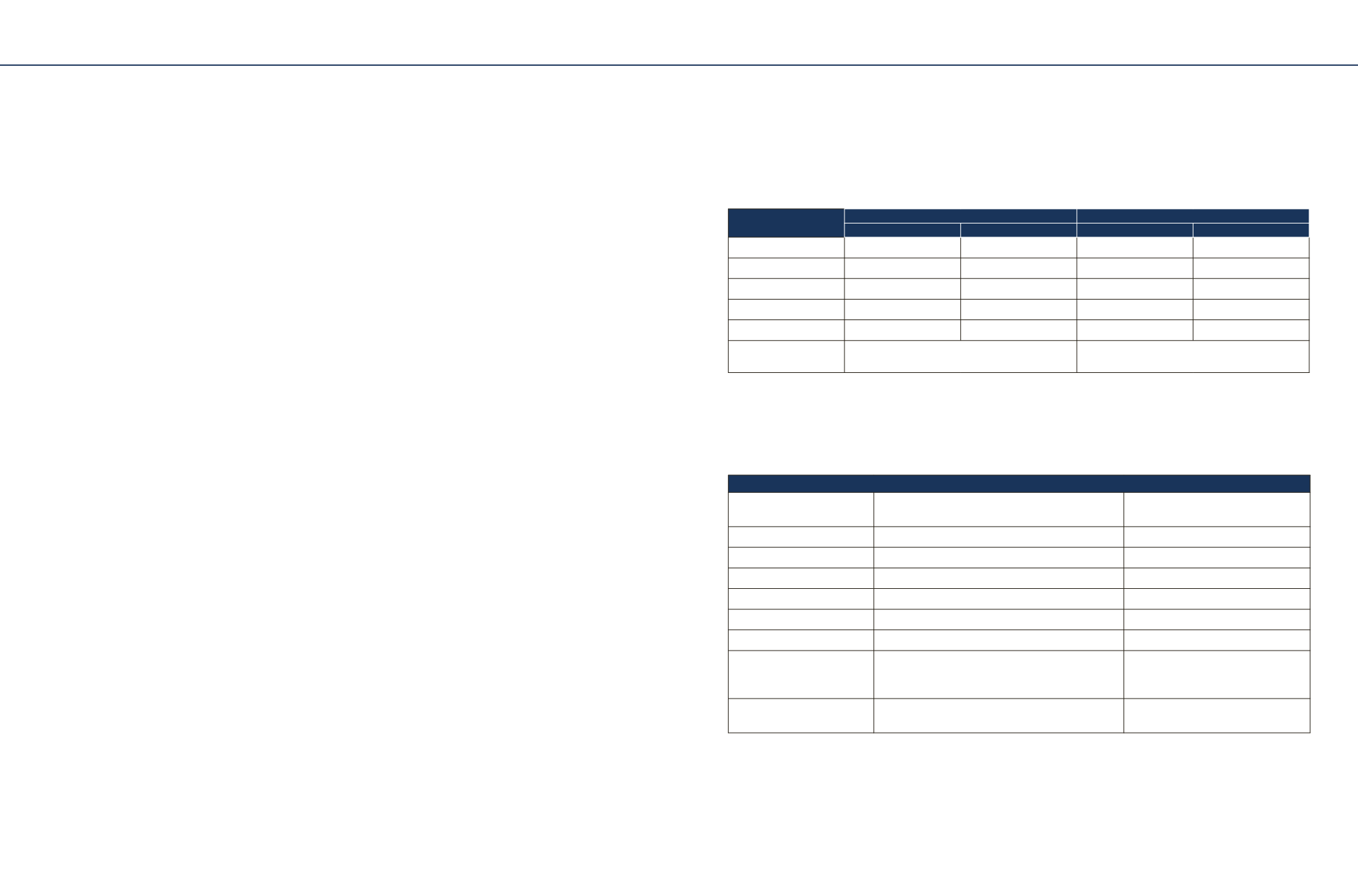

Commission Range for Life Insurance

Category

First Year Commission

2nd year Renewal Commission

Min

Max

Min

Max

Health

2%

25%

0%

7.50%

Protection

2%

40%

0%

10%

Pension

2%

7.50%

0%

2%

Saving & Investment

2%

35%

0%

7.50%

Group Product

0%

2%

0%

0%

Govt Sponsored

Schemes

As per Govt Notification

As per Govt Notification

*For Group Products commission payable is 2% of the premium with a ceiling on the maximum payout as defined by Insur-

ance Regulatory and Development Authority of India (IRDAI) from time to time.

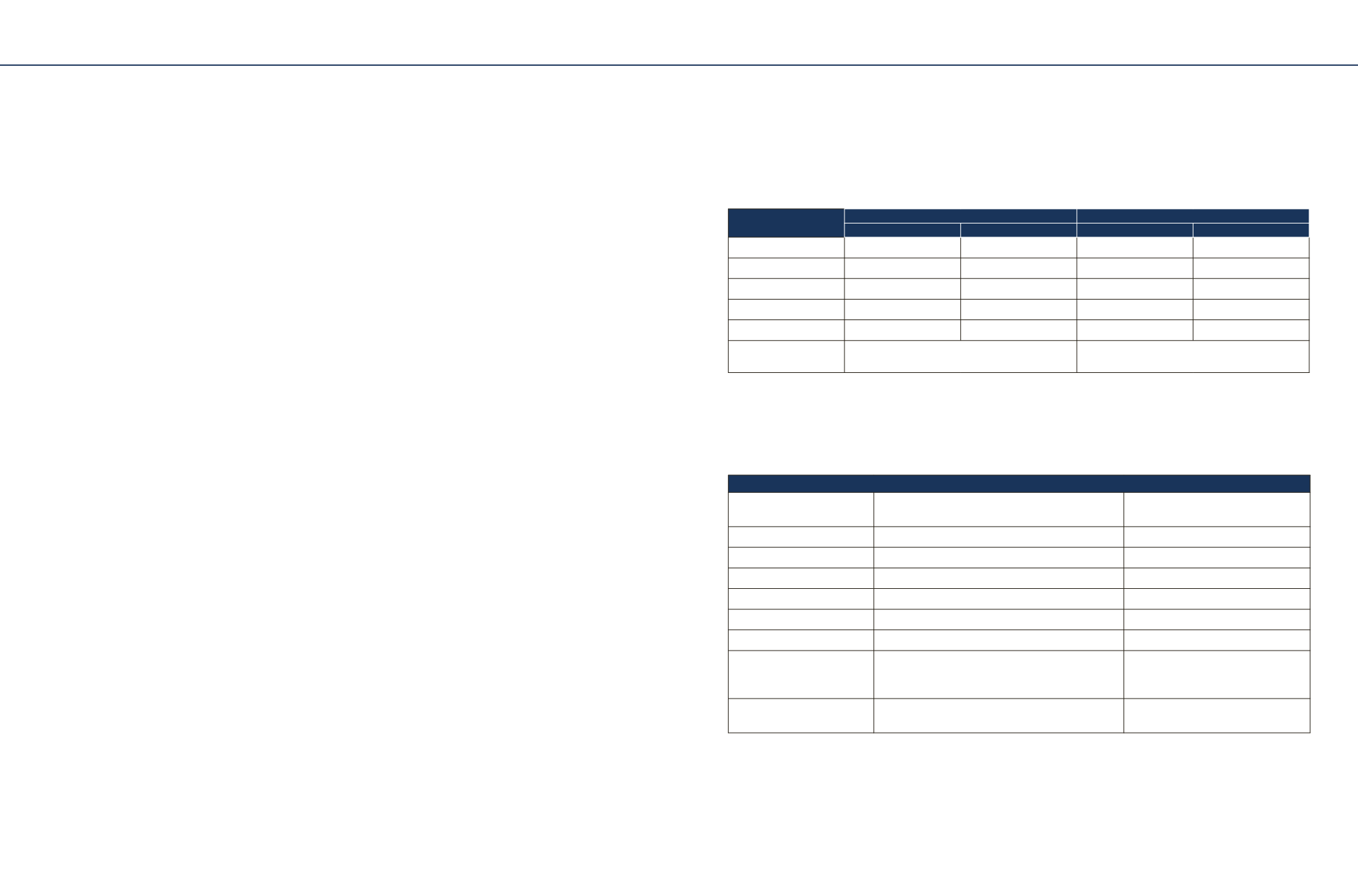

Commission Range for General Insurance

The maximum rate of commission payable is as below -

General Insurance (other than motor)

Sr. No.

Line of business (Other than Motor)

Maximum remuneration payable to

Insurance intermediary

1

Fire-Retail

16.5%

2

Fire-Corporate (Risks with S.I. < Rs 2,500 crs)

11.5%

3

Fire-Corporate (Risks with S.I. > Rs 2,500 crs)

6.25%

4

Marine – Cargo

16.5%

5

Marine – Hull

11.5%

6

Miscellaneous – Retail

16.5%

7

Miscellaneous – Corporate /Group*

(*Commission/ remuneration shall be payable as per

Government Notification.)

12.5%

8

Miscellaneous – Corporate (Engineering Risks with S.I.

> Rs 2,500 crs)

6.25%