INSURANCE INSIGHTS

|

JULY 2017

26

27

JULY 2017 |

INSURANCE INSIGHTS

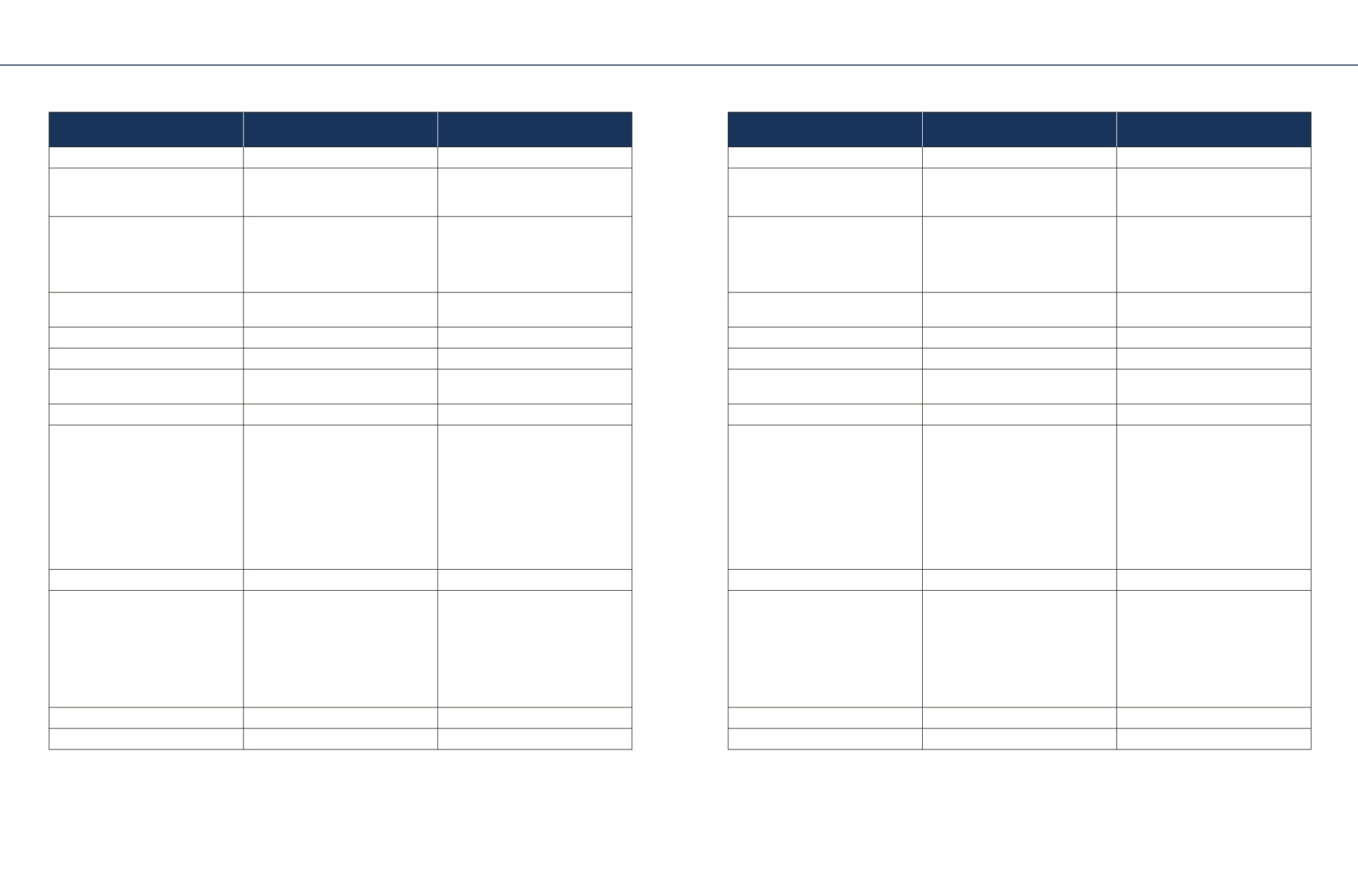

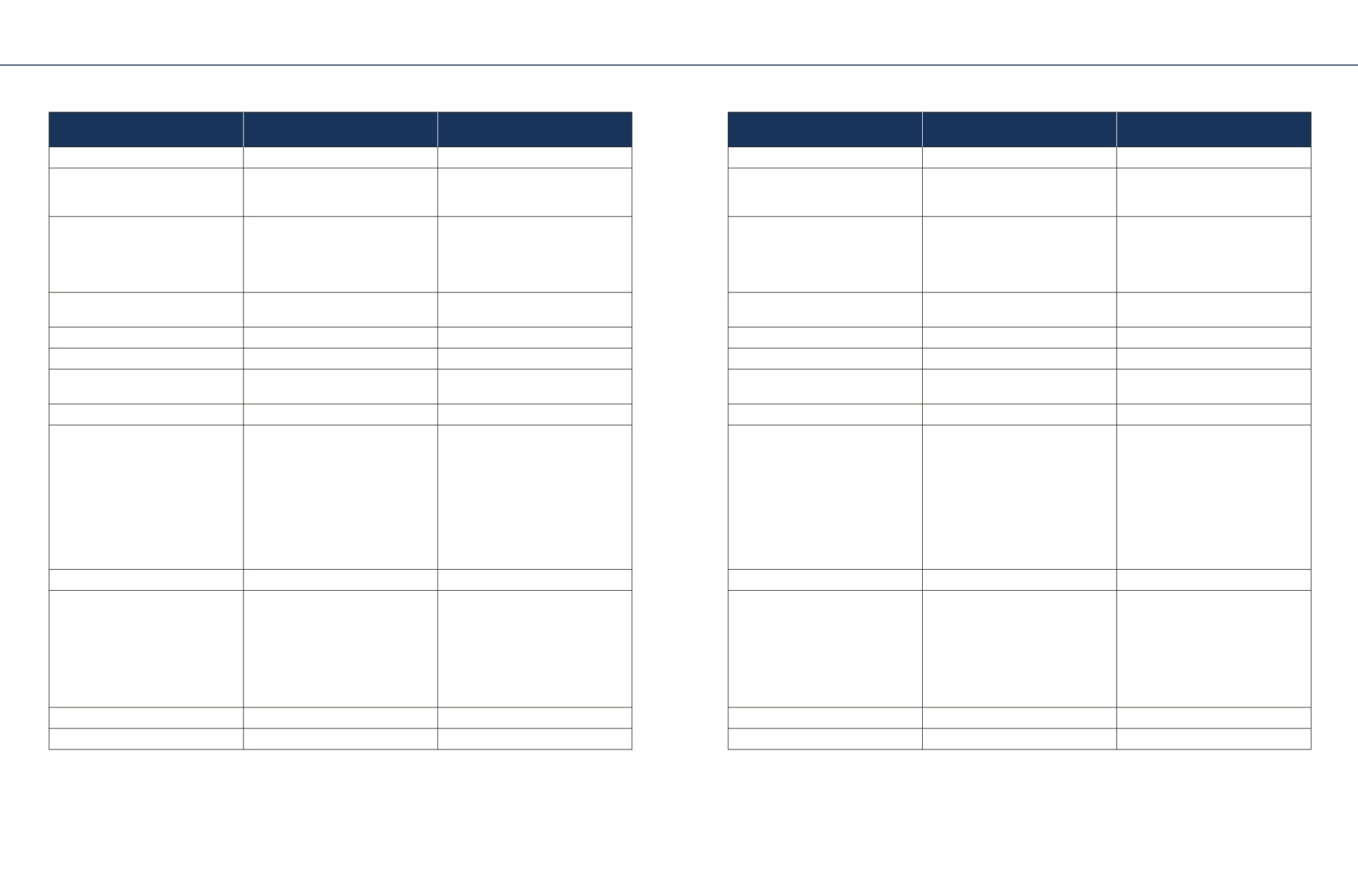

Insurer Name

HDFC Standard Life Insurance

Company Ltd.

Birla Sun Life Insurance Company

Ltd.

Tata AIA Life Insurance Company

Ltd.

Birla Sun Life Insurance Company

Ltd.

HDFC Standard Life Insurance

Company Ltd.

Product name

HDFC Life Easy Health

BSLI Hospital Plus Plan

TATA AIA Life Insurance Vital Care Pro BSLI Cancer Shield Plan

HDFC Life Cancer Care

Premium p.a. (for a 35 year old Male,

non-smoker)

(Excluding taxes, surcharge & cess)

R

3,191

Sum Insured -

R

5 Lakh, PPT - 5 years,

PT - 5 years, Option A

R

8,080

Sum Insured -

R

5,62,500, Option D,

PPT - 5 years, PT - 5 years

R

4,722

Sum Insured -

R

20.01 Lakh, PPT - 10

years, PT - 10 years, Option - Pro Care

R

870

Sum Insured -

R

10 Lakh, PT - 10 years,

PPT - 10 years, Option - Level SA

R

8,81

Sum Insured -

R

10 Lakh, PT - 10 years,

PPT - 10 years, Option - Silver

Key Plan Features

Fixed Benefit Health Insurance Plan

that provides Lump sum Payout on

Diagnosis of Critical Illness OR upon

undergoing surgical procedures OR

hospitalization.

Flexibility of choosing from 4 Benefit

Options to suit your needs along with an

additional benefit in case of

hospitalization due to an accident.

Protection against 15 critical illnesses

and income for 10 years.

Fixed Benefit Health Insurance

Plan that pays Lump sum payout on

diagnosis of major and early stage

cancer.

Fixed Benefit Health Insurance

Plan that pays Lump sum payout on

diagnosis of major and early stage

cancer.

Entry Age(Min/Max)

18/65 years

Adult: 18/65 years

Child: 3 months/17 years

18/65 years

18/65 years

18/65 years

Maturity Age(Min/Max)

23/70 years

23/95 years*

0/85 years

23/75 years

28/75 years

Premium paying options

Single Pay, Regular Pay

Regular Pay

Regular Pay

Regular Pay

Regular Pay

Premium Paying Term(PPT)/Policy

Term(PT)

5 years

5 years

10/15/20/25/30 years

5 to 20 years

10 to 20 years

Premium mode

Single, Annual

Annual and Monthly (ECS only)

Annual, Half-yearly, Quarterly, Monthly

Annual, Half-yearly, Quarterly, Monthly

Annual, Half-yearly, Quarterly, Monthly

Sum assured (Min/Max)

Option 1 :

R

25,000,

Option 2 :

R

50,000,

Option 3 :

R

75,000,

Option 4 :

R

1,00,000,

Option 5 :

R

1,50,000,

Option 6 :

R

2,00,000,

Option 7 :

R

2,50,000,

Option 8 :

R

3,00,000,

Option 9 :

R

4,00,000,

Option 10 :

R

5,00,000

Option A:

R

75,000,

Option B:

R

2,25,000,

Option C:

R

3,75,000,

Option D:

R

5,62,500

R

20.01 Lakh/

R

60 Lakh

R

10 Lakh/

R

50 Lakh

R

10 Lakh/

R

40 Lakh

Minimum Annual Premium

R

6,76 (RP)

R

1,225

#

R

3,600

R

390

^

R

427

Plan options

A: Daily Hospital Cash Benefit (DHCB)

B: Surgical Benefit (SB)

C: Critical Illness Benefit (CIB)

D: DHCB + SB

E: SB + CIB

F: DHCB + CIB

G: DHCB + SB + CIB

Benefit Option A, B, C, D

Single Life:

i. Pro Care - Lump sum Benefit

ii. Pro Care Plus - Lump sum Benefit

with Income Loss Benefit

Joint Life:

i. Duo Care - Lump sum Benefit

ii. Duo Care Plus - Lump sum Benefit

with Income Loss Benefit

Level Sum Assured

Increasing Sum Assured

Silver, Gold, Platinum

Maturity Benefit*

NA

NA

NA

NA

NA

Death Benefit*

NA

NA

NA

NA

NA

HEALTH PLANS (TRADITIONAL)

HEALTH PLANS (TRADITIONAL)

*Please refer to the Product Brochure for more details.

RP - Regular Pay

#

basis age and plan option,

^Male aged 18 at entry, 5-year term,

R

10 Lakh sum assured, Option A, without income benefit