INSURANCE INSIGHTS

|

JULY 2017

38

39

JULY 2017 |

INSURANCE INSIGHTS

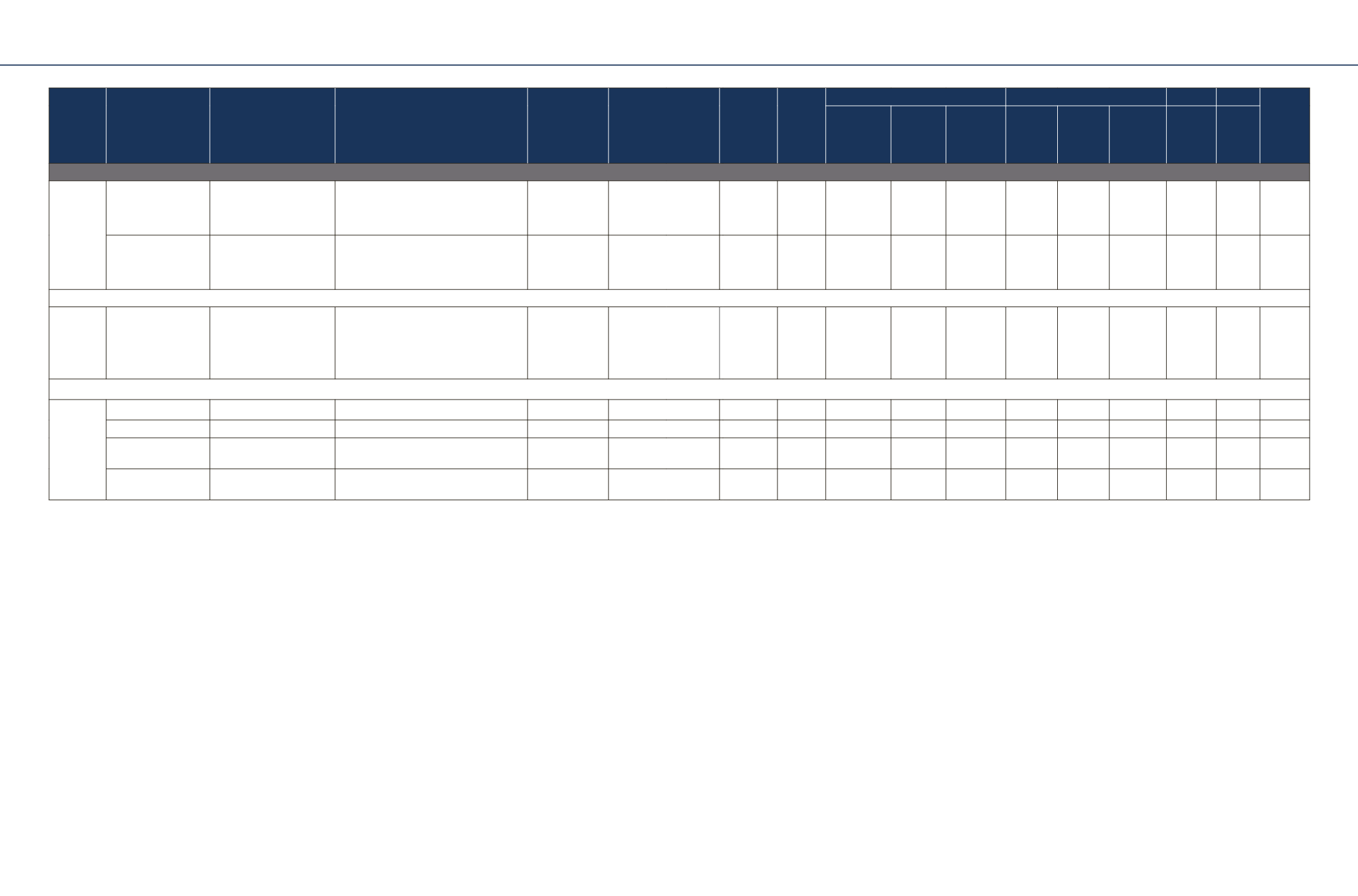

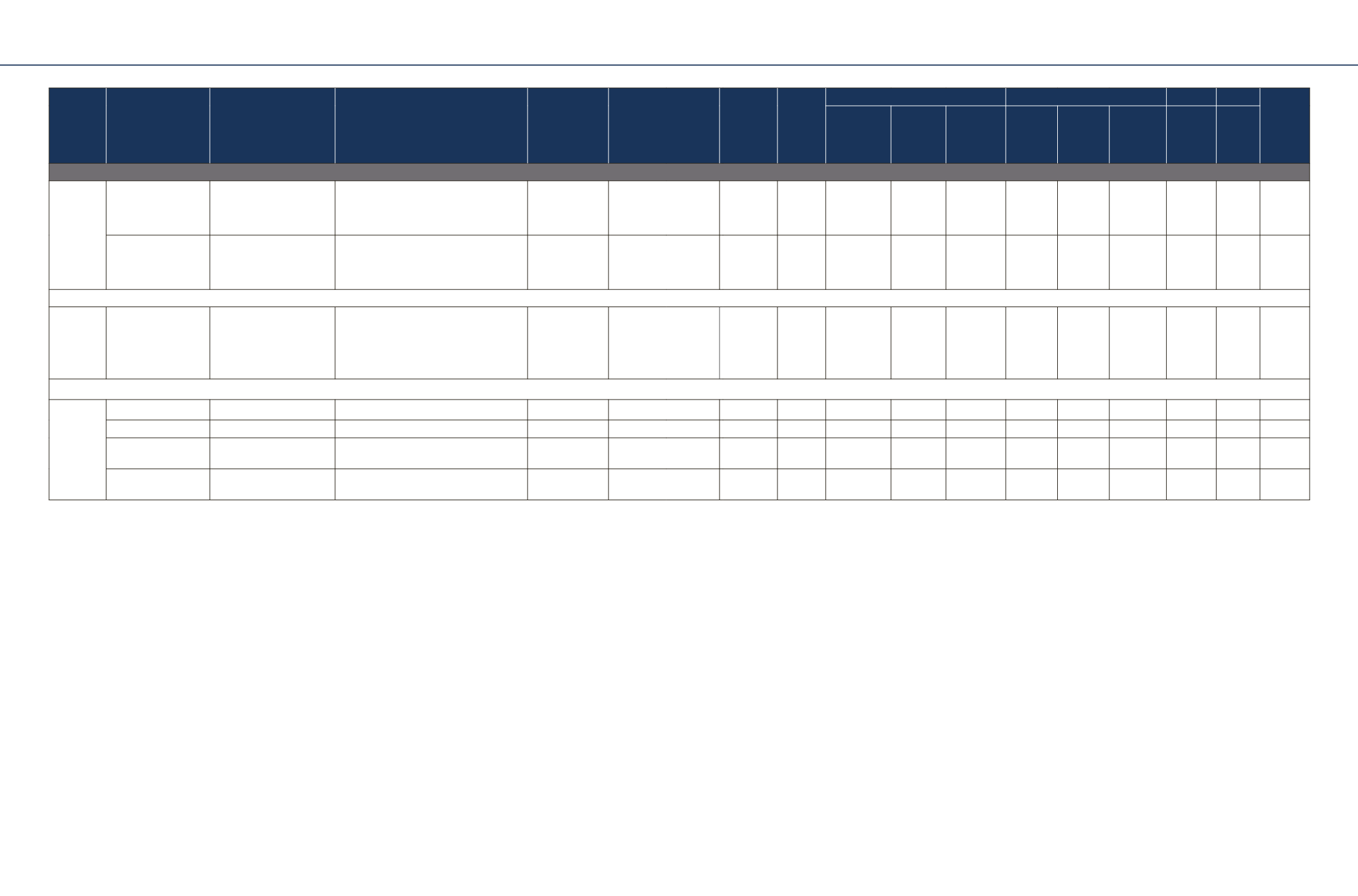

Insurer/

Classifica-

tion

Fund

Category

SFIN

Inception Date

YTM

Average

Maturity

(Years)

AUM

(Rs in

Cr.)

% Allocation

CAGR Returns as on 31st Mar 17

Since

Inception

Debt

Public

Deposits

and Money

Market

Equity

3M 6M

1 Yr

3 Yr

5 Yr

Debt Fund

HDFC Stan-

dard Life

Insurance

Company

Ltd.

Bond Fund

ULIF05601/08/13Bond Funds101 23-Jun-14

7.16%

8.81

10.03 40%-100% 0%-60% 0% -0.39% 3.13% 9.83% NA

NA 9.75%

Income Fund

ULIF03401/01/10IncomeFund101 5-Jan-10

7.30%

8.08

1,957.62 80%-100% 0%-20% 0% 0.07% 2.59% 10.69% 10.38% 9.16% 8.67%

Tata

AIA Life

Insurance

Company

Ltd.

Whole Life Income

Fund

ULIF 012 04/01/07 WLI 110

08-Jan-07

7.53%

9.36

280.2

70.98% 29.02% 0% 0.29% 2.62% 11.50% 11.53% 10.07% 8.27%

Birla

Sun Life

Insurance

Company

Ltd.

BSLI Liquid Plus

ULIF02807/10/11BSLLIQPLUS109 9-Mar-12

7.06%

0.34

96.37 10%-100 % 0%-90 % 0% 1.68% 3.42% 7.32% 7.74% 7.91% 7.83%

BSLI Assure

ULIF01008/07/05BSLIASSURE109 12-Sep-05

7.47%

2.06

171.27 10%-100 % 0%-90 % 0% 1.61% 3.28% 8.04% 8.39% 8.85% 9.07%

BSLI Income Advan-

tage

ULIF01507/08/08BSLIINCADV109

22-Aug-08

7.65%

10.24

631.01 60%-100 % 0%-40 % 0% -0.24% 1.66% 10.20% 10.47% 9.37% 10.48%

BSLI Income Advan-

tage Guaranteed

ULIF03127/08/13BSLIINADGT109

1-Jan-14

7.55%

7.99

113.58 60%-100 % 0%-40 % 0% 0.44% 2.17% 9.36% 9.96% -

9.94%

Note: Money Market includes Current Assets - Tata AIA Life Insurance Co. Ltd.

*only for current funds available. Past performance is not indicative of future performance.