INSURANCE INSIGHTS

|

JULY 2017

10

11

JULY 2017 |

INSURANCE INSIGHTS

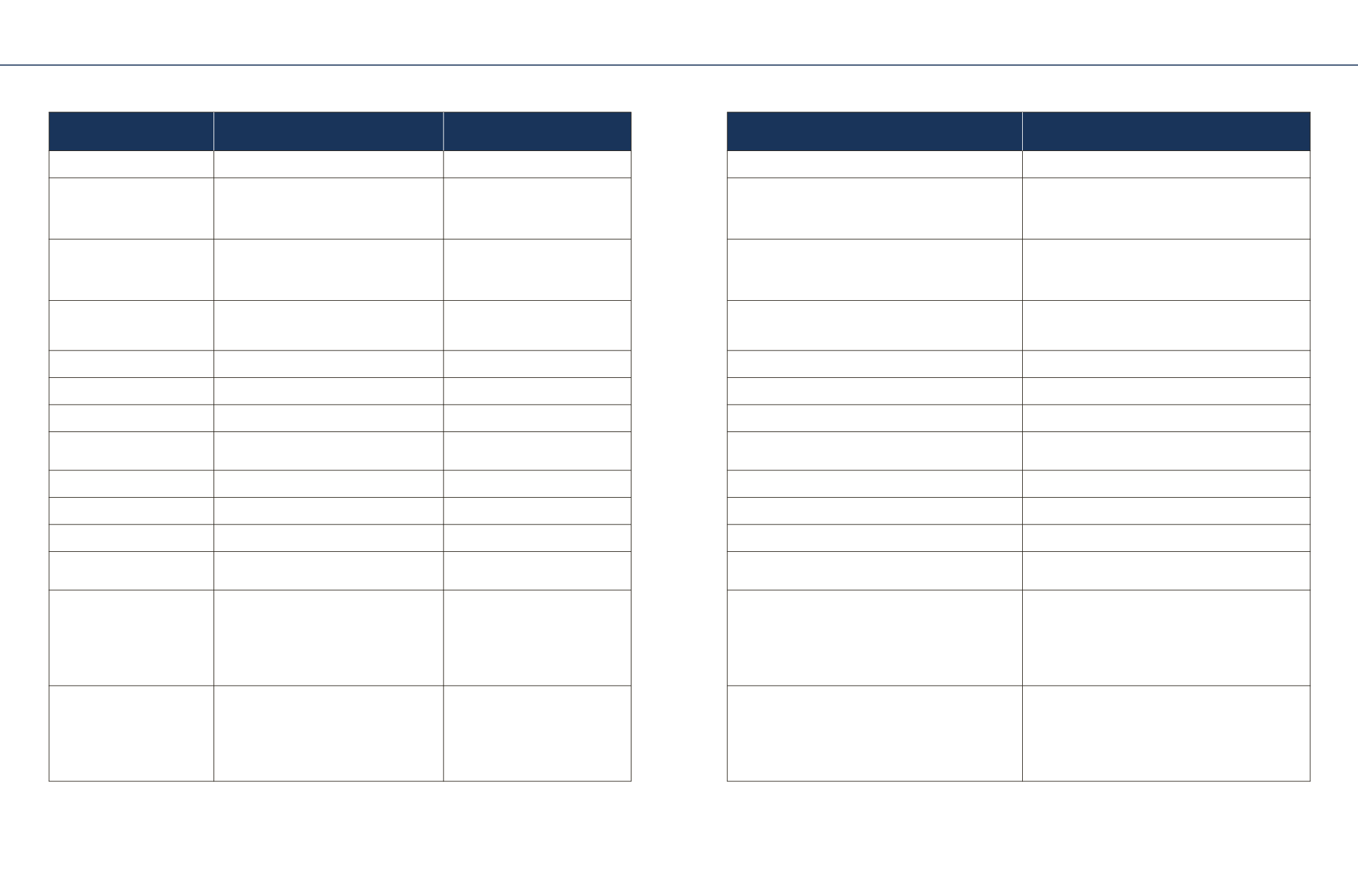

Insurer Name

Birla Sun Life Insurance Company Ltd.

TATA AIA Life Insurance Company

Ltd.

TATA AIA Life Insurance Company Ltd.

HDFC Standard Life Insurance Company Ltd.

Product name

BSLI Vision Life Secure Plan

TATA AIA Life Insurance MahaLife Gold

TATA AIA Life Insurance MahaLife Gold Plus

HDFC Life Sampoorn Samridhi Plus

Premium p.a. (for a 35 year

old Male, non-smoker, for SA

of

R

8 Lakh) (Excluding taxes,

surcharge & cess)

R

69,681

PPT - 15 years, PT - 15 years

R

1,08,640

PPT- 15 years. PT - 50 years

R

1,12,168

PPT - 15 years, PT - 50 years

R

1,14,592

PPT - 10 years, PT - 15 years, Yearly Whole Life Option

Illustrative Maturity Benefit at

4% and 8% return for above

premium and Sum Assured (as

per insurer's illustration)

R

8,36,000 (at 4 %)/

R

13,52,000 (at 8%)

R

29,64,000 (at 4%)/

R

43,32,000(at

8%)

R

25,08,000 (at 4%)/

R

43,68,000(at 8%)

R

11,14,324 (at 4%)/

R

17,48,004 (at 8%)

Key Plan Features

Participating whole life insurance plan - Enhance

your savings with regular bonuses throughout

the policy term starting from the first policy year.

Regular Income till Age 85 and Lump

Sum on Maturity to leave a legacy to

plan for 3 generations.

Regular Income for 30 years with Lump Sum on Maturity and

added benefit of enhancement of protection by way of an

Inflation Protection Cover during the policy term.

Participating Endowment Plan with Whole of Life Option and

Guaranteed Additions from 3% to 5% of Sum Assured on

Maturity in the 1st 5 Policy Years.

Entry Age(Min/Max)

1/60 years

30 days/55 years

30 days/55 years

30 days/60 years

Maturity Age(Min/Max)

18/75 years

85 years

85 years

18/75 years

Premium paying options

Regular Pay

Limited Pay

Limited Pay

Limited Pay

Premium Paying Term(PPT)/

Policy Term(PT)

15 to 35 years

15 years

15 years

PT less 5 years /15 to 40 years

Premium mode

Annual, Half-yearly, Quarterly, Monthly

Annual, Half-yearly, Monthly

Annual, Half-yearly, Monthly

Annual, Half-yearly, Quarterly, Monthly

Sum assured (Min/Max)

R

2,00,000/No Limit

R

1,00,000/No Limit

5

R

2,00,000/No Limit

5

R

65,463/No Limit

Minimum Annual Premium

R

12,000

R

14,000

R

12,733

R

12,000

Plan options

Not Available

Not Available

Not Available

Endowment

Endowment with Whole Life

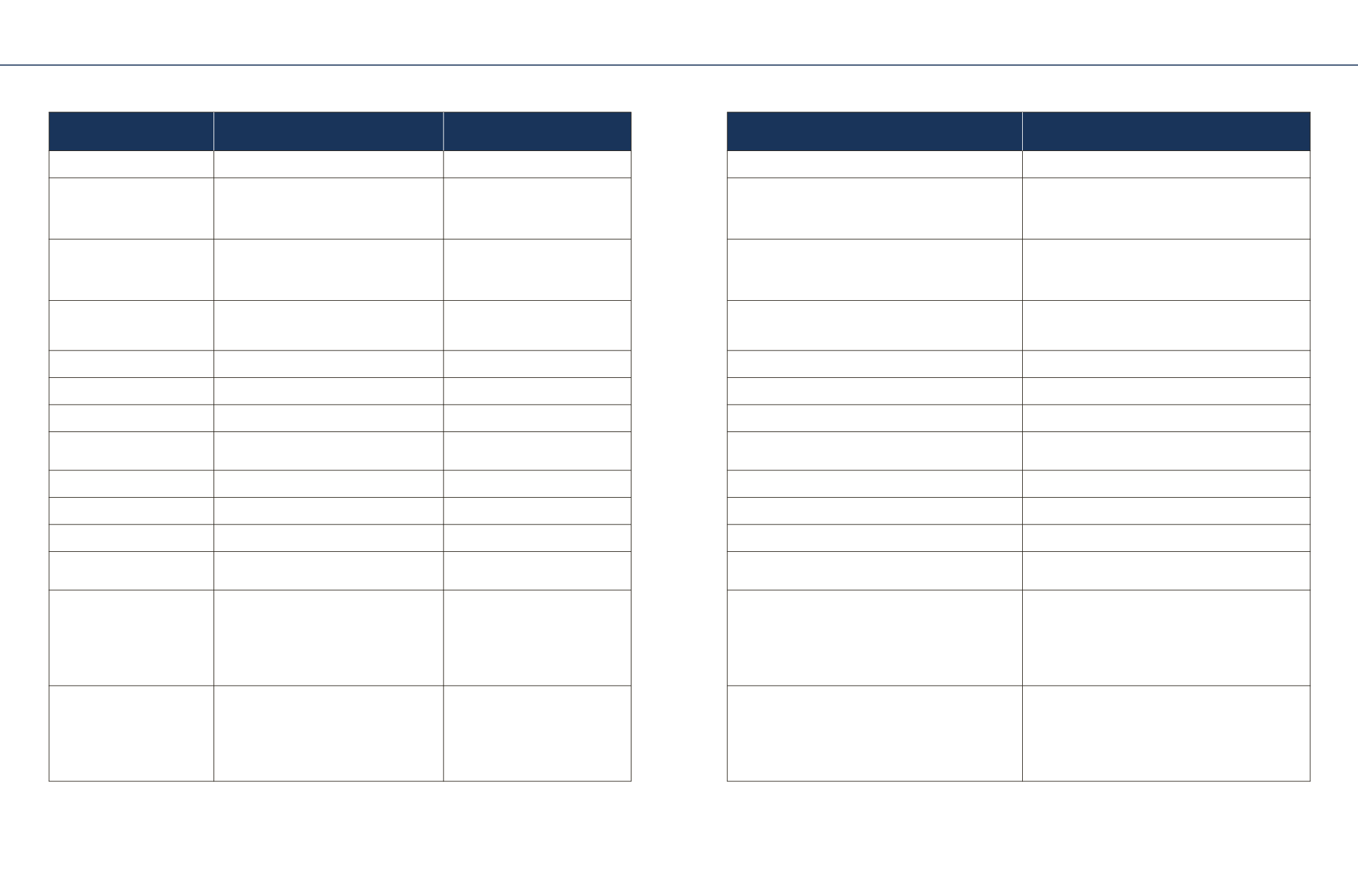

Maturity Benefit*

- Sum Assured; plus

- Accrued regular bonus; plus

- Terminal Bonus (if any)

Basic Sum Assured + last Guaranteed

Cash Coupon + Last Non-Guaranteed

Cash dividend

Survival Benefit - Available

Minimum Guaranteed Sum Assured on Maturity + last Non-

Guaranteed Cash Dividend

Survival Benefit - Available

Aggregate of:

- Sum Assured on Maturity

- Accrued Guaranteed Additions

- Accrued Reversionary bonuses

- Interim bonus (if any)

- Terminal bonus (if any)

plus additional benefit for Endowment with Whole Life Option

Death Benefit*

Death Benefit

^

during Policy Term:

- Guaranteed Death Benefit plus

- Accrued regular bonus as on date of death plus

- Terminal Bonus (if any)

Death Benefit^ after Policy Term till age 100 or

on survival till age 100:

Guaranteed Death Benefit

^

Sum Assured on Death

^*”

Sum Assured on Death” plus additional % of Basic Sum

Assured*

Highest of:

-Sum Assured on Death + Accrued Guaranteed Additions

+ Accrued Reversionary Bonuses + Interim bonus (if any) +

Terminal bonus (if any)

-105% of premiums paid till date

*Please refer to the Product Brochure for more details.

SP - Single Pay, RP - Regular Pay, LP - Limited Pay, AP - Annualised Premium

^The minimum death benefit will be at least 105% of the premiums paid,

#

Different for other PT - Please refer product brochure.

1

Here, Sum Assured is

R

8,03,000,

2

Here, Sum Assured is

R

8,07,360,

3

For a 8 year old Male, Sum Assured –

R

1 lakh, PPT - 10 years, PT - 20 years,

4

For a 14 year old Male, Sum Assured –

R

1 lakh, PPT - 12 years PT - 25 years,

5

subject to underwriting policy

SAVINGS PLANS (TRADITIONAL)

SAVINGS PLANS (TRADITIONAL)