INSURANCE INSIGHTS

|

JULY 2017

6

7

JULY 2017 |

INSURANCE INSIGHTS

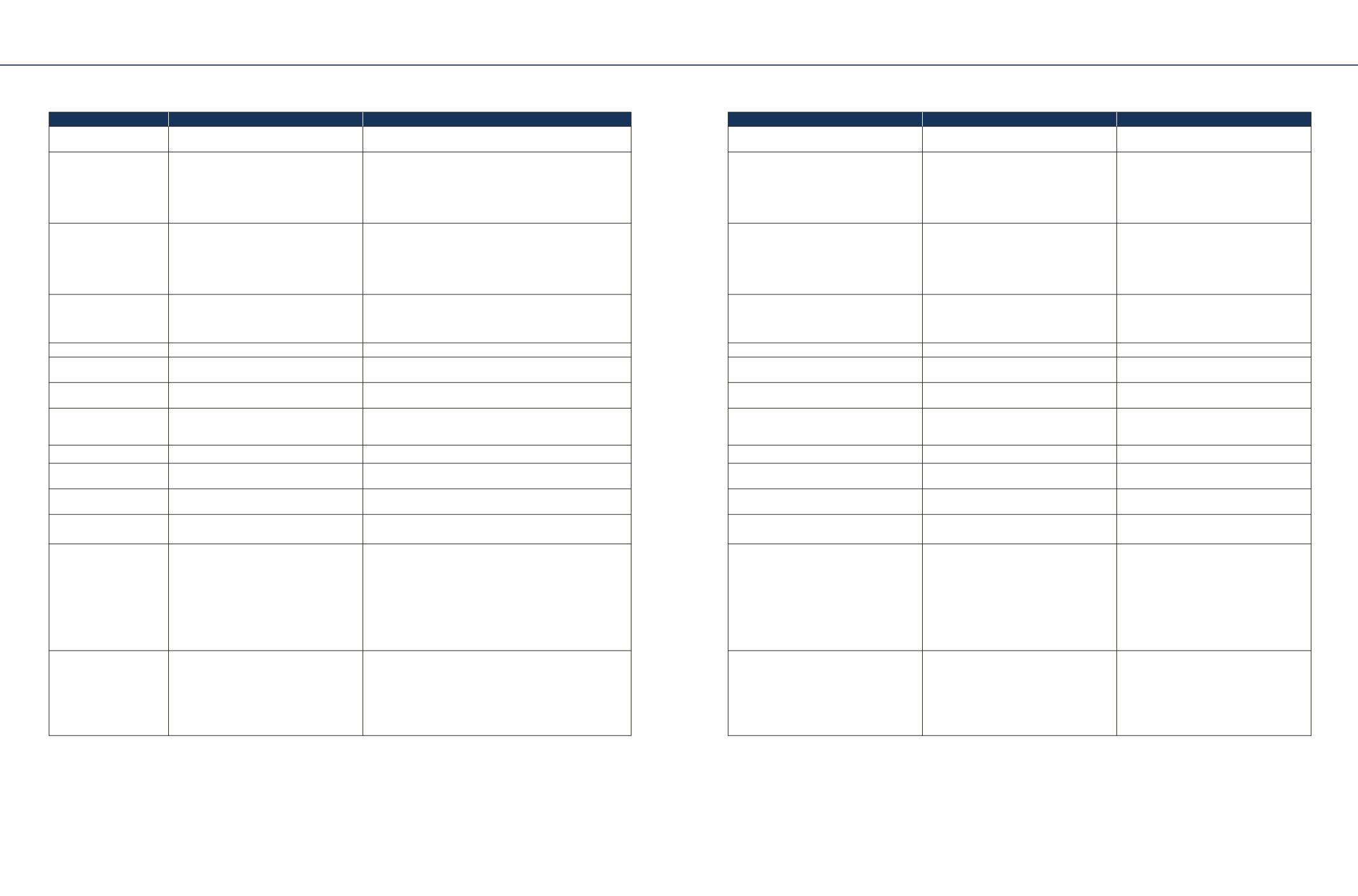

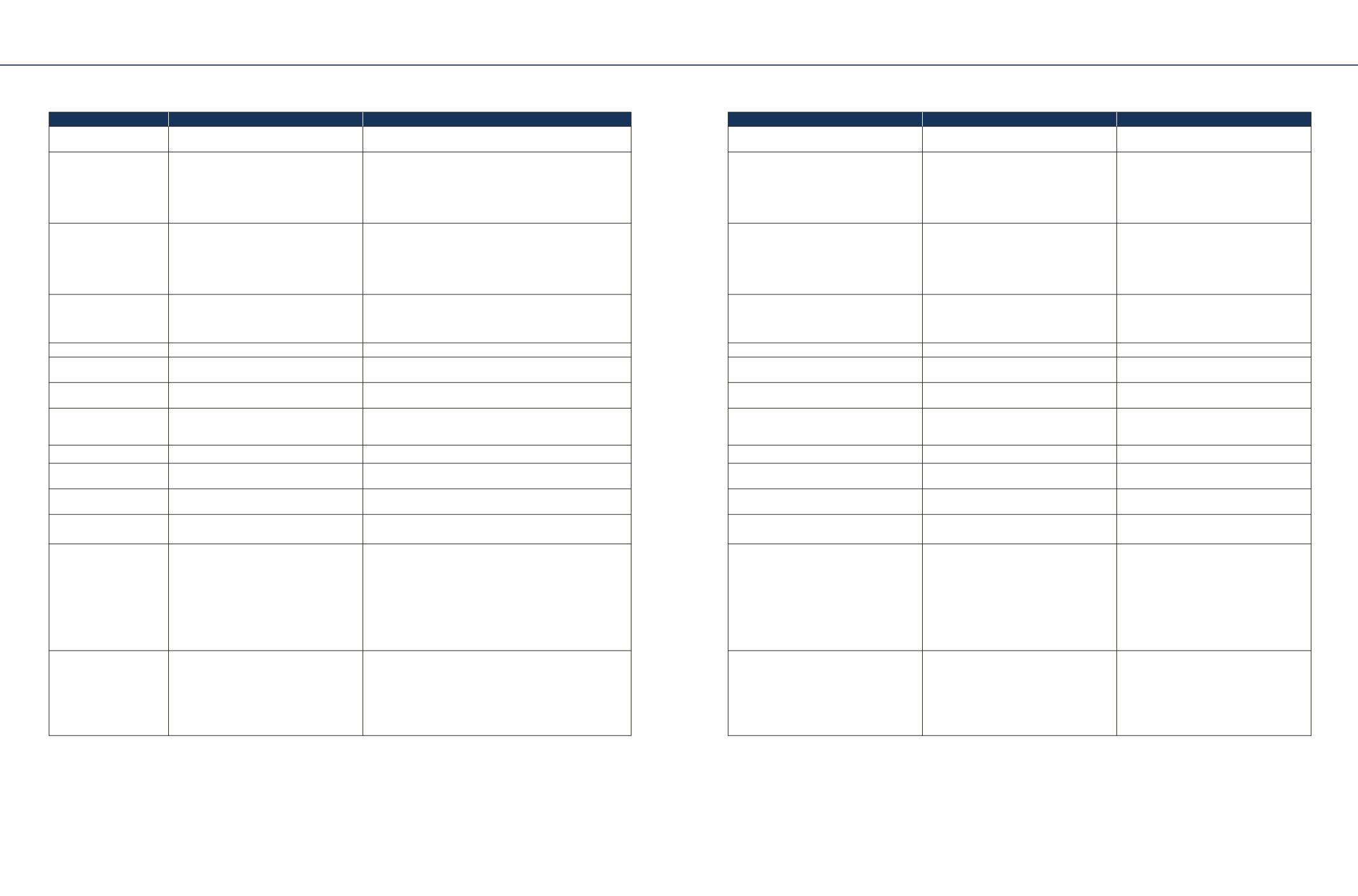

Insurer Name

TATA AIA Life Insurance Company Ltd.

HDFC Standard Life Insurance Company Ltd.

Birla Sun Life Insurance Company Ltd.

TATA AIA Life Insurance Company Ltd.

Birla Sun Life Insurance Company Ltd.

Product name

TATA AIA Life Insurance Smart Income

Plus

HDFC Life Sanchay

BSLI Secure Plus

TATA AIA Life Insurance Gold Income

Plan

BSLI Income Assured Plan

Premium p.a. (for a 35

year old Male, non-

smoker, for SA of Rs. 8

Lakh)

(Excluding taxes, sur-

charge & cess)

R

73,000

PPT - 10 years, PT - 21 years, Regular

Income Option

1

R

1,14,888

PPT - 10 years, PT - 15 years

R

50,000

PPT - 12 years, PT - 13 years, Option B

R

96,000

PPT- 12 years, PT - 15 years

2

R

1,27,221.90

PPT - 10 years, PT - 20 years, Option B

Illustrative Maturity

Benefit at 4% and

8% return for above

premium and Sum

Assured (as per

insurer's illustration)

R

12,48,884

R

17,60,000

R

12,00,000

R

21,14,743

R

24,32,000

Key Plan Features

Non-participating, Endowment Assurance

Plan that offers guaranteed income with an

option to choose from 2 plan options.

Non-participating Limited pay Savings Plan that provides

guaranteed Maturity Benefit of 220% to 325% of Sum As-

sured on Maturity as per the selected Plan Option.

Non–participating insurance plan with

flexibility to choose the amount you wish to

pay every year and Inbuilt Accidental Death

Benefit.

Non-participating, Endowment Assurance

Plan that offers Guaranteed increasing

income.

Non-participating insurance plan that

provides Assured income and Guaranteed

Additions.

Entry Age(Min/Max)

3/50 years

30 days/45 years

5/50 years

6/65 (5 Pay), 3/55 years (12 Pay)

8/60 years

Maturity Age(Min/Max)

18/65 years (PT-15 years), 71 (PT-21

years), 75 years (PT-25 years)

18/70 years

18/63 years

18/77 (5 Pay), 18/70 years (12 Pay)

23/75 years

Premium paying

options

Limited Pay

Limited Pay

Regular Pay

Limited Pay

Limited Pay

Premium Paying

Term(PPT)/Policy

Term(PT)

7/15, 10/21, 12/25 years

5, 8,10/15 to 25 years

12/13 years

5/12, 12/15 years

5/15, 7/17, 7/22, 10/20, 10/25 years

Premium mode

Annual, Half-yearly, Quarterly, Monthly

Annual, Half-yearly, Quarterly, Monthly

Annual

Annual, Half-yearly, Quarterly, Monthly

Annual, Half-yearly, Quarterly, Monthly

Sum assured (Min/Max)

R

1,98,000/No Limit (Option 1)

R

3,96,000/No Limit (Option 2)

R

1,05,673/No Limit

R

7,25,000/No Limit

R

1,15,000/No Limit (PT-12 years)

R

87,000/No Limit (PT-15 years)

R

1,00,000/No Limit

Minimum Annual

Premium

R

18,000 (Option 1)

R

30,000

R

50,000

R

50,000 (5 Pay),

R

36,000 (12 Pay)

R

16,338

3

Plan options

Option 1 - Regular Income Plan

Option 2 - Endowment Plan

Not Available

Not Available

Not Available

Not Available

Maturity Benefit*

Guaranteed Maturity Payout plus Additional

Benefits depending on the plan option

chosen.

Survival Benefit - Available

Sum Assured on Maturity plus Accrued Guaranteed

Additions

Commuted value of the Income Benefit as

a lump sum.

100% of Basic Sum Assured as lump sum

+ Guaranteed Income of 12% of Basic

Sum Assured, from end of following year

which increases annually, for 10/15 years

(based on income term chosen).

Income Boosters: Guaranteed increase in

income (5% - 10%) per year basis premium

and PPT.

- Sum Assured plus

- Guaranteed Additions Accrued

- Increased Assured Income is paid if opted.

Death Benefit*

Highest of:

- 11 times Annualised Premium

- 105% of all the premiums paid as on date

of death

- Minimum guaranteed Sum Assured on

Maturity

- Basic Sum Assured

Higher of:

- Sum Assured on Death + Accrued Guaranteed Additions

- 105% of Premiums Paid

Higher of:

- 10 times of the annual premium

- 105% of the total premiums paid as on

the date of death

- Maturity Sum Assured

- Sum Assured

Highest of:

- 11 X Annualised Premium

- 105% of the all the premiums paid,

- Guaranteed Sum Assured on Maturity

- Absolute amount assured to be paid on

death

Sum Assured plus

Guaranteed Additions accrued till date of

death

Increased Assured Income is paid if opted.

*Please refer to the Product Brochure for more details.

SP - Single Pay, RP - Regular Pay, LP - Limited Pay, AP - Annualised Premium

^The minimum death benefit will be at least 105% of the premiums paid, #Different for other PT - Please refer product brochure.

1

Here, Sum Assured is

R

8,03,000,

2

Here, Sum Assured is

R

8,07,360,

3

For a 8 year old Male, Sum Assured –

R

1 lakh, PPT - 10 years, PT - 20 years,

4

For a 14 year old Male, Sum Assured –

R

1 lakh, PPT - 12 years PT - 25 years,

5

Subject to underwriting policy

SAVINGS PLANS (TRADITIONAL)

SAVINGS PLANS (TRADITIONAL)