INSURANCE INSIGHTS

|

JULY 2017

4

5

JULY 2017 |

INSURANCE INSIGHTS

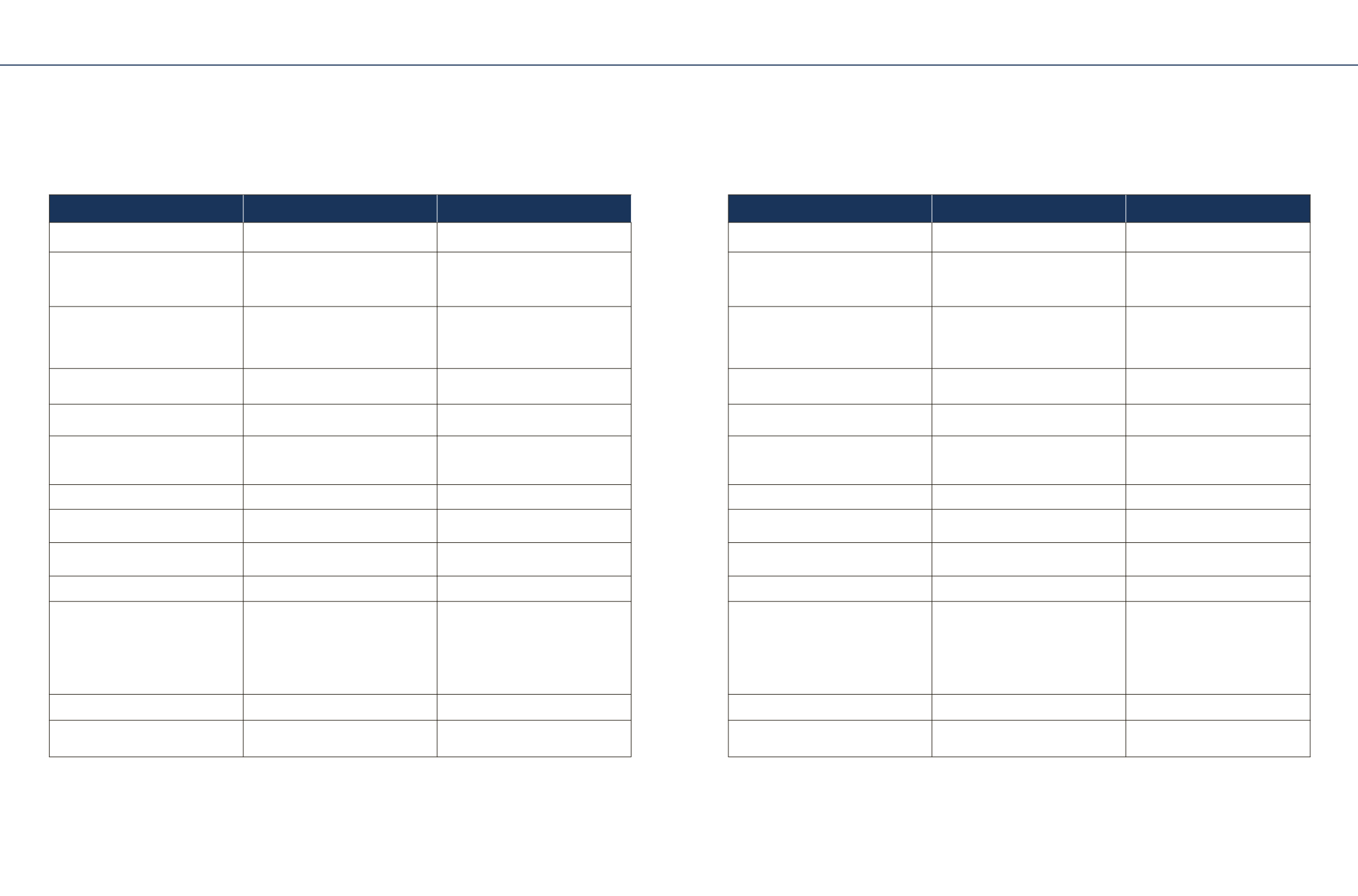

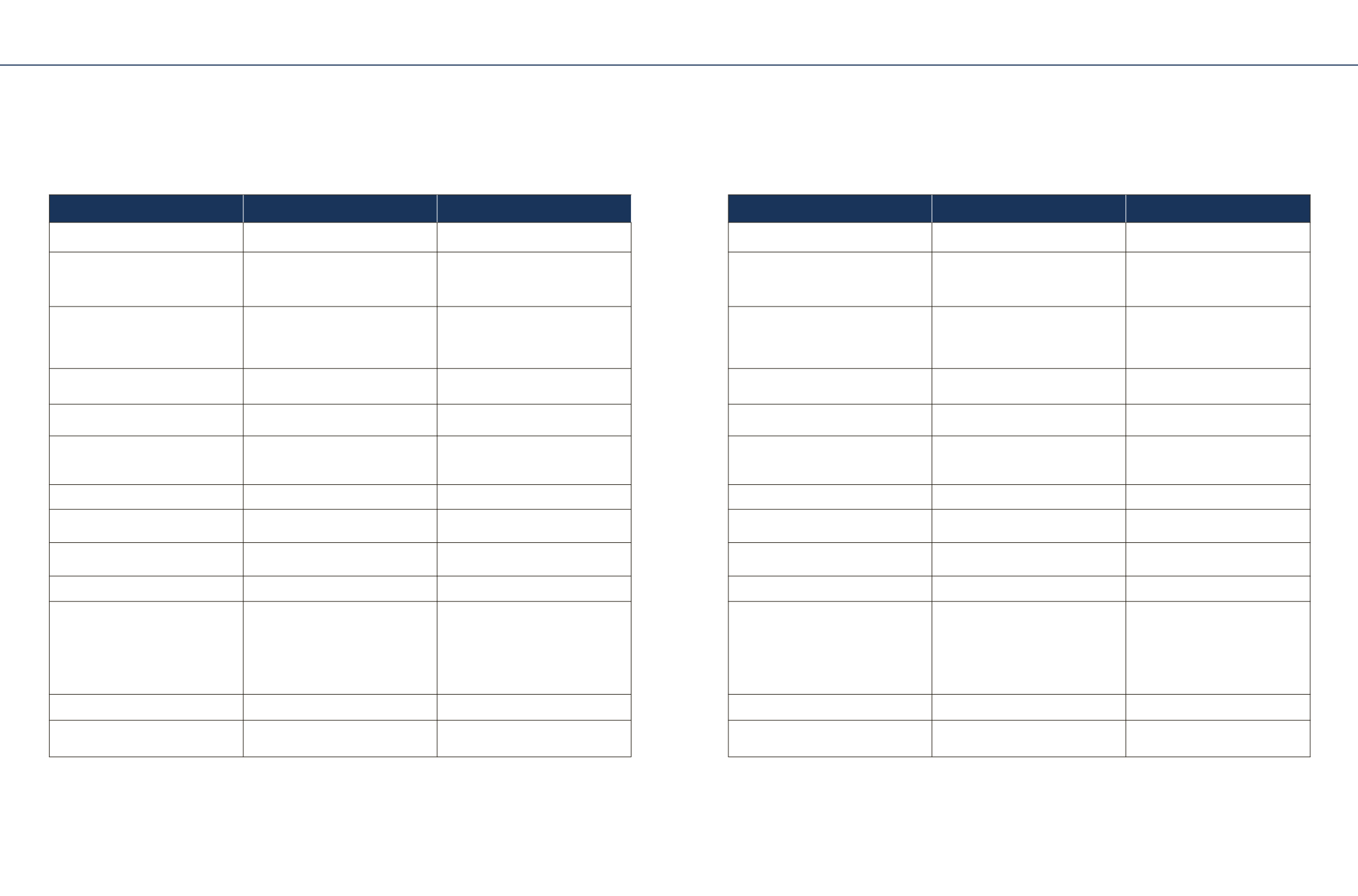

Insurer Name

TATA AIA Life Insurance Company Ltd.

Birla Sun Life Insurance Company Ltd.

HDFC Standard Life Insurance Company Ltd. TATA AIA Life Insurance Company Ltd.

Birla Sun Life Insurance Company Ltd.

Product name

TATA AIA Life Insurance Sampoorna Raksha

BSLI Protect@Ease Plan

HDFC Life Click 2 Protect 3D Plus

TATA AIA Life Insurance Sampoorna

Raksha+

BSLI Protector Plus Plan

Premium p.a. (for a 35 year old Male, non-

smoker, for Life Cover -

R

1 crore, PPT - 30

years, PT - 30 years)

(Excluding taxes, surcharge & cess)

R

10,000

R

12,195

R

13,168

R

17,900

R

20,080

Key Plan Features

Provides 4 death benefit options to choose from.

Option to cover your spouse under the same

policy and enhance the cover at certain mile-

stones without medicals.

Non-Participating Pure Protection Plan with 9

Plan Options providing Lump sum payout, Regular

Income or both on Death/Diagnosis of Terminal

Illness.

Provides protection cover throughout the policy

term and Return of Premium on Maturity.

Enhanced protection with inbuilt Total and

Permanent Disability cover and an option to

receive death benefit as Annual Income.

Entry Age(Min/Max)

18/70 years (RP&5 Pay), 65 years (10 Pay)

18/65 years

#

Option 1- 18/65 years, Option 2 - 25/65 years 18/70 years (RP&5 Pay), 65 years (10 Pay)

18/65 years

Maturity Age(Min/Max)

28/80 years

23/80 years

#

Option 1 - 23/75 years

Option 2 - Whole Life

28/80 years

23/70 years

Premium paying options

Regular Pay, Limited Pay

Single Pay, Limited Pay, Regular Pay

#

Option 1 - Single Pay, Regular Pay, Limited Pay

Option 2 - Limited Pay

Regular Pay, Limited Pay

Regular Pay

Premium Paying Term(PPT)/Policy Term(PT)

RP, 5 Pay/10 to 40 years

10 Pay/15 to 40 years

5 to 40 years

#

Option 1 - SP, RP, LP: 5 to 39 years/5 to 40 years

Option 2 – LP: 65 years - Age at Entry/Whole Life

RP, 5 Pay/10 to 30 years

10 Pay/15 to 30 years

5 to 30 years

Premium mode

Annual, Half-yearly, Quarterly, Monthly

Annual, Monthly

Single, Annual, Half-yearly, Quarterly, Monthly

Annual, Half-yearly, Quarterly, Monthly

Annual, Half-yearly, Quarterly, Monthly

Minimum Sum assured

(Max - No Limit)

R

50 Lakh

R

30 Lakh

R

10 Lakh

R

50 Lakh

R

30 Lakh

Minimum Annual Premium

R

3,700 (RP)

R

3,024 (LP/RP)

R

2,234 (LP/RP)

R

6,700(RP)

R

3,024

Plan options

4 Plan Options:

1. Basic Sum Assured payable on Death

2. Basic Sum Assured payable on Death &

Monthly Income thereafter for 10 years

3. Enhanced Sum Assured payable on Death

4. Enhanced Sum Assured payable on Death &

Monthly Income thereafter for 10 years

Level Term Assurance - Sum Assured will remain

constant for entire policy term.

Increasing Term Assurance - Sum Assured

increases by 5% or 10% of original Sum Assured

as chosen without any increase in premium

amount.

9 Plan options:

1) Life Option 2) 3D Life Option 3) Extra Life

Option 4) Income Option 5) Extra Life Income Op-

tion 6) Income Replacement Option 7) Return of

premium Option 8) Life Long Protection Option 9)

3D Life Long Protection Option

2 Plan Options:

1. Basic Sum Assured payable on Death

2. Basic Sum Assured payable on Death &

Monthly Income thereafter for 10 years

Level Sum Assured - Sum Assured will remain

constant for entire policy term. Increasing Sum

Assured - Sum Assured increases by 5% or

10% of original Sum Assured as chosen with-

out any increase in premium amount.

Maturity Benefit

#

NA

NA

Only for return of premium option

Total Premiums Paid

1

NA

Death Benefit

#

Sum Assured on death + Other Benefits de-

pending on plan option chosen

Sum Assured on Death depending on the pre-

mium paying option chosen

Sum Assured on death + Other Benefits depending

on plan option chosen

Sum Assured on death + Other Benefits

depending on plan option chosen

Sum Assured on Death

*Please refer to the product brochure for more details.

#

Option 1 - All Options except Life Long Protection Option & 3D Life Long Protection Option,

Option 2 - Life Long Protection Option & 3D Life Long Protection Option

RP - Regular Pay, LP - Limited Pay, SP - Single Pay

1

excluding the underwriting extra premiums and modal loading

RANGE OF PRODUCTS

Details related to product features mentioned herewith are based on the input received from insurance companies. HDFC Bank is not

responsible or liable for any omission or commission in the information shared. For more details on risk factors, product details, terms and

conditions and exclusions please read the relevant product brochure carefully before conclusion of sale.

LIFE INSURANCE

PROTECTION PLANS (TRADITIONAL)

PROTECTION PLANS (TRADITIONAL)