INSURANCE INSIGHTS

|

JULY 2017

8

9

JULY 2017 |

INSURANCE INSIGHTS

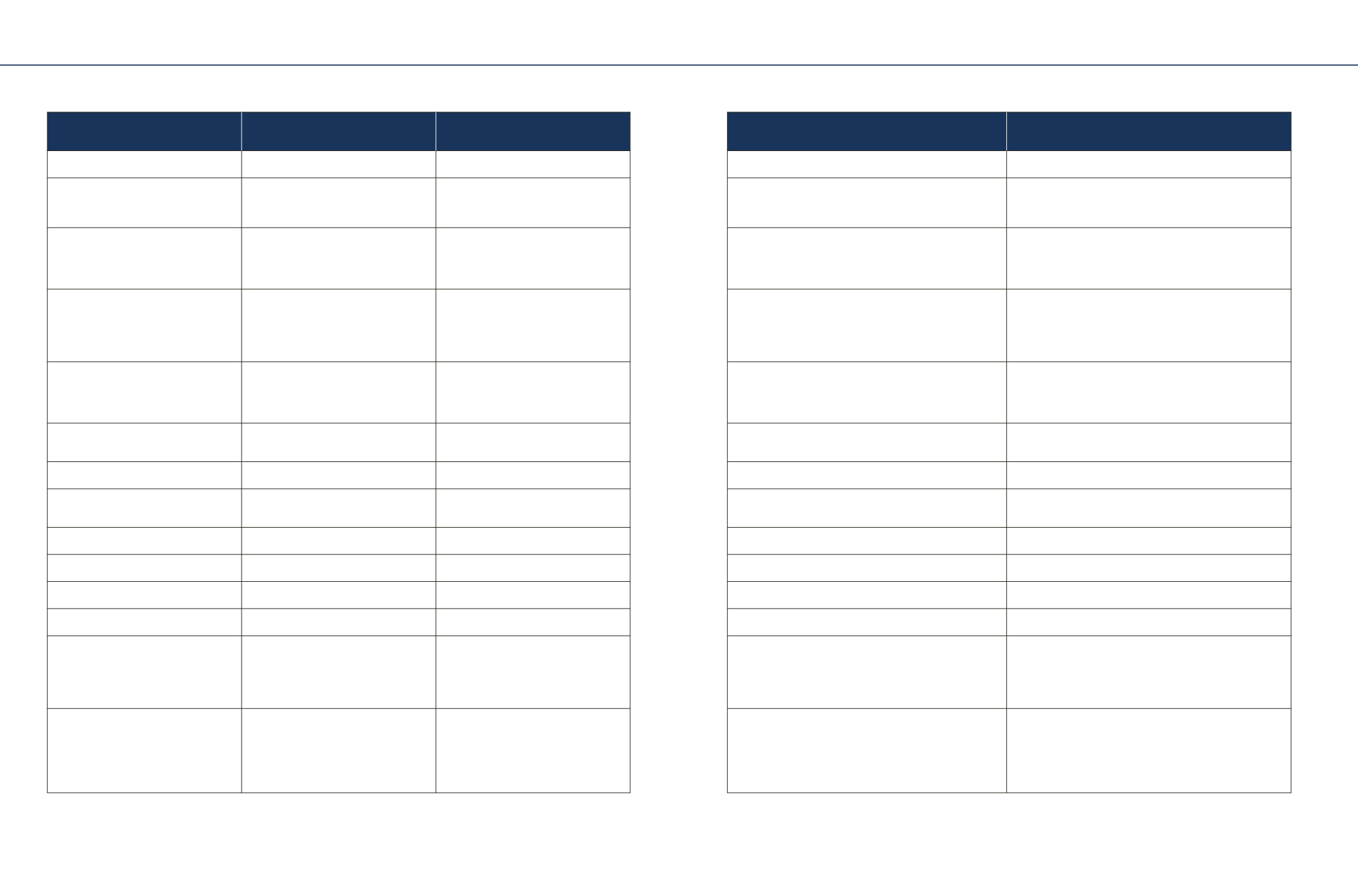

Insurer Name

HDFC Standard Life Insurance

Company Ltd.

HDFC Standard Life Insurance

Company Ltd.

HDFC Standard Life Insurance Company Ltd.

Birla Sun Life Insurance Company Ltd.

Product name

HDFC Life Classic Assure Plus

HDFC Life Super Income Plan

HDFC Life Super Savings Plan

BSLI Vision Money Back Plus Plan

Premium p.a. (for a 35 year old Male,

non-smoker, for SA of Rs. 8 Lakh)

(Excluding taxes, surcharge & cess)

Premium -

R

1,03,296

PPT - 10 years, PT - 15 years

R

1,07,536

PPT - 10 years, PT - 20 years

R

61,104

PPT 15 years, PT - 15 years

R

84,976

PPT - 10 years, PT - 20 years

Illustrative Maturity Benefit at 4%

and 8% return for above premium

and Sum Assured (as per insurer's

illustration)

R

11,56,000 (at 4%)/

R

16,72,000 (at

8%)

R

12,72,005 (at 4%)/

R

20,16,000

(at 8%)

R

10,12,560 (at 4%)/

R

13,13,361 (at 8%)

R

9,60,000 (at 4%)/

R

15,20,000 (at 8%)

Key Plan Features

Participating Limited Pay Endowment

plan with minimum guaranteed rever-

sionary bonus during premium paying

term

Participating Limited Pay moneyback

plan that offers guaranteed income for

a period of 8 to 15 years after the Pre-

mium payment term as per the selected

Plan option.

Participating Regular Pay Endowment plan with Inbuilt

Accidental Death

Participating life insurance plan with regular payouts as a

pre-specified percentage of sum assured at the end of every

fourth or fifth policy year throughout the policy term and

survival benefit available.

Entry Age(Min/Max)

8/55 years (PT-10 years), 3/60 years

(PT-15 years)

30 Days/55 years (PT-20 years)

2/59 (PT-16 years), 30 days/57 (PT-18

years), 55 (PT-20 years), 53 (PT-22

years), 51 (PT-24 years), 48 years (PT-

27 years)

30 Days/60 years

13/45 years

Maturity Age(Min/Max)

18/65(PT-10), 18/75(PT-15),20/75

years(PT-20)

30/75 years

18/75 years

33/70 years

Premium paying options

Limited Pay

Limited Pay

Regular Pay

Regular Pay

Premium Paying Term(PPT)/Policy

Term(PT)

7/10, 7/15, 10/15, 10/20 years

8/16, 8/18, 10/20, 10/22, 12/24,

12/27 years

15 to 30 years

10/20, 12/24, 12/25 years

Premium mode

Annual, Half-yearly, Quarterly, Monthly

Annual, Half-yearly, Quarterly, Monthly

Annual, Half-yearly, Quarterly, Monthly

Annual, Half-yearly, Quarterly, Monthly

Sum assured (Min/Max)

R

49,447 (10 year PT)

#

/No Limit

R

1,28,337/No Limit

R

2,45,155/No Limit

R

1,00,000/No limit

Minimum Annual Premium

R

12,000

R

24,000

R

24,000

R

9,539

4

Plan options

Not Available

Not Available

Not Available

Not Available

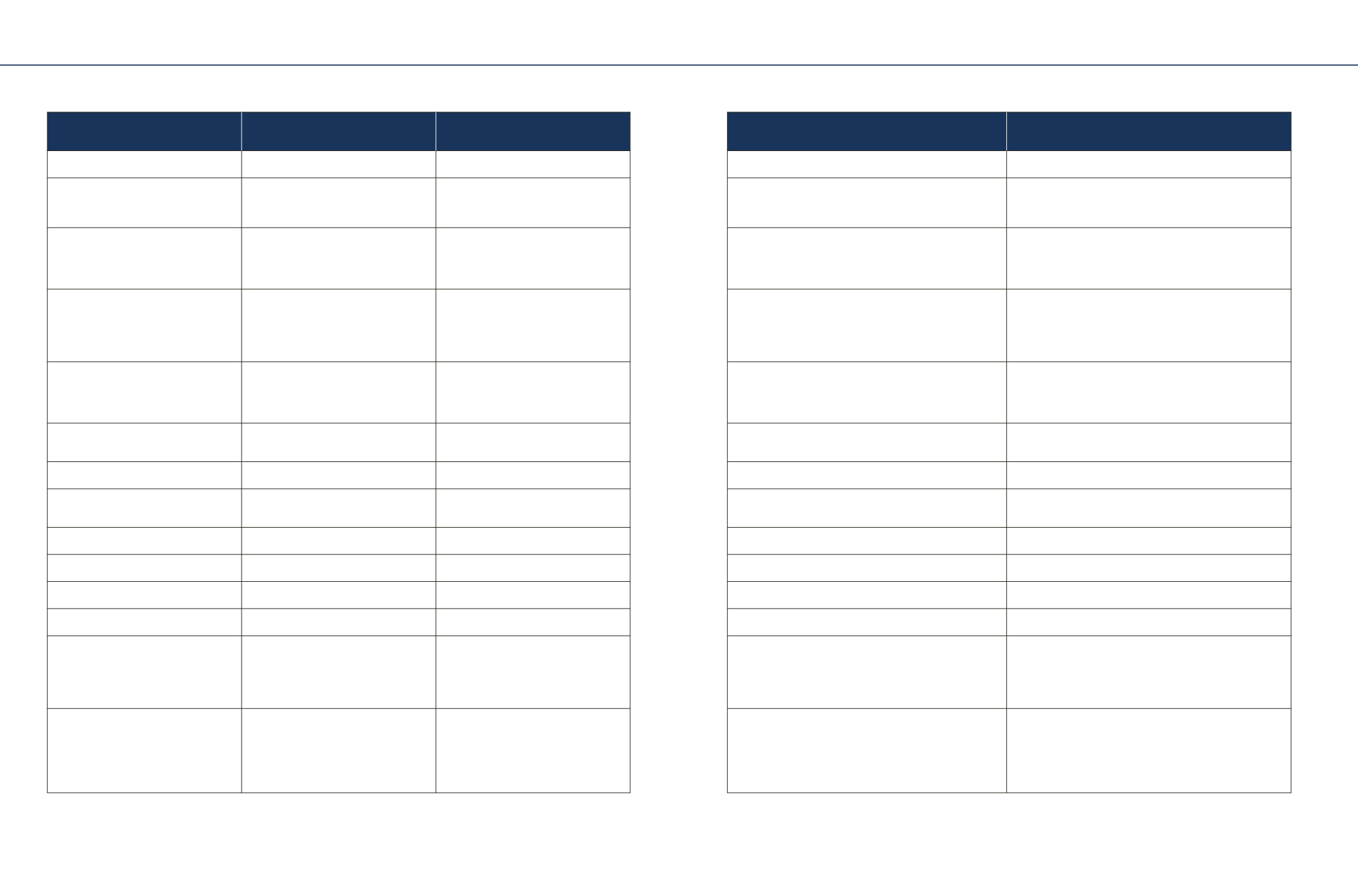

Maturity Benefit*

Sum Assured plus accrued bonuses

Aggregate of -

- Last Survival Benefit payout

- Accrued Reversionary Bonuses

- Interim Bonus, if any

- Terminal bonus, if any

Sum Assured plus accrued simple reversionary bonuses plus

interim bonus plus terminal bonus, if any.

- Accrued Bonus till date plus

- Terminal Bonus (if any)

Death Benefit*

Highest of:

- Sum Assured

- 10 times annualised premium

- 105% of the premiums paid

plus accrued bonuses

Highest of:

- Sum Assured on Death + Accrued

Reversionary Bonuses + Interim Bonus

(if any) + Terminal Bonus (if any)

-105% of premiums paid till date

Higher of:

-10 x annualised premium

-Sum Assured

-105% of all premiums paid till date

plus, accrued simple reversionary bonus, interim bonus,

terminal bonus, if any.

Sum Assured on Death

^

Plus Accrued Bonus as on date of

Death plus Terminal Bonus (if any).

*Please refer to the Product Brochure for more details.

SP - Single Pay, RP - Regular Pay, LP - Limited Pay, AP - Annualised Premium

^The minimum death benefit will be at least 105% of the premiums paid,

#

Different for other PT - Please refer product brochure.

1

Here, Sum Assured is

R

8,03,000,

2

Here, Sum Assured is

R

8,07,360,

3

For a 8 year old Male, Sum Assured –

R

1 lakh, PPT - 10 years, PT - 20 years,

4

For a 14 year old Male, Sum Assured –

R

1 lakh, PPT - 12 years PT - 25 years,

5

Subject to underwriting policy

SAVINGS PLANS (TRADITIONAL)

SAVINGS PLANS (TRADITIONAL)