40

F

und

fact

sheet

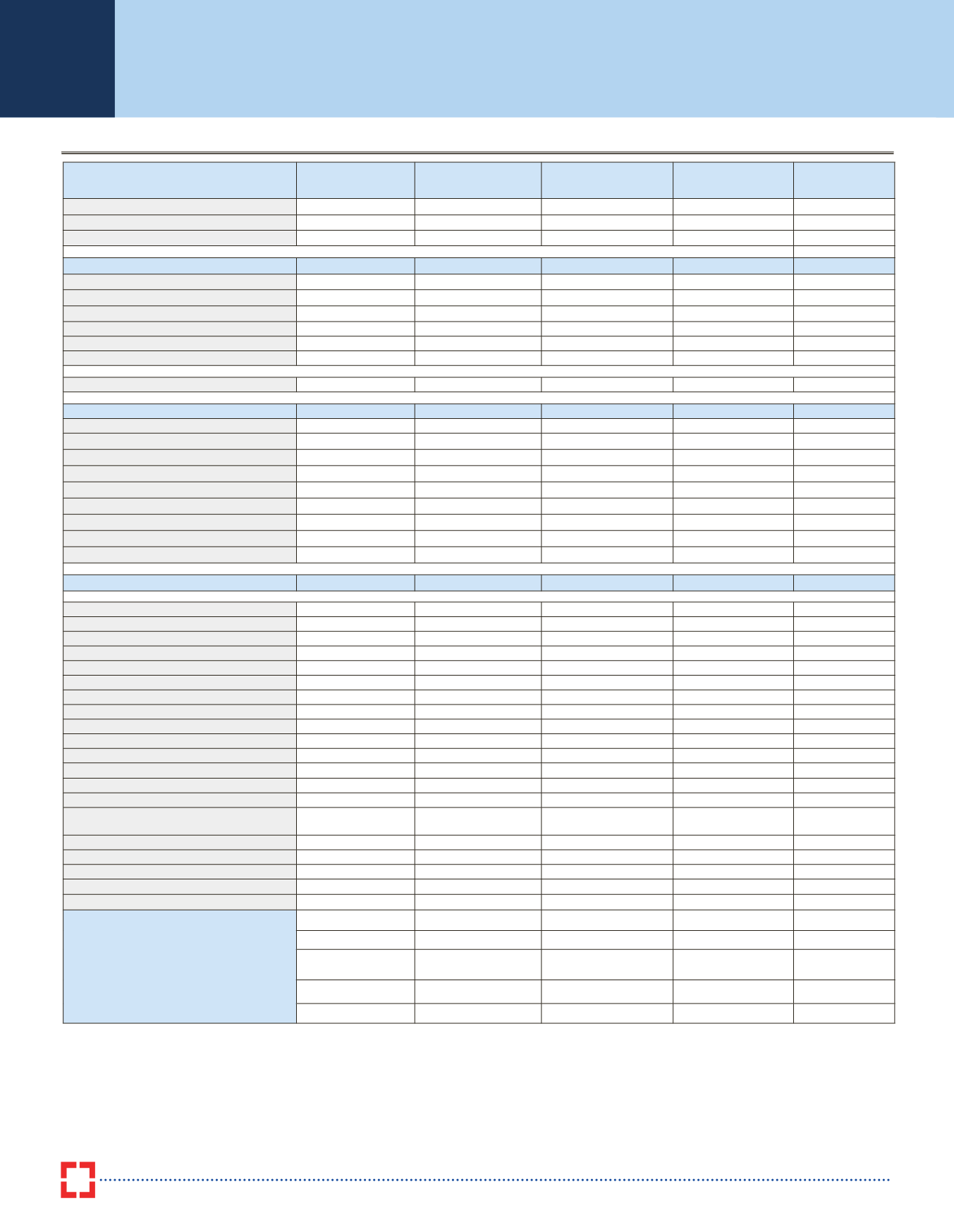

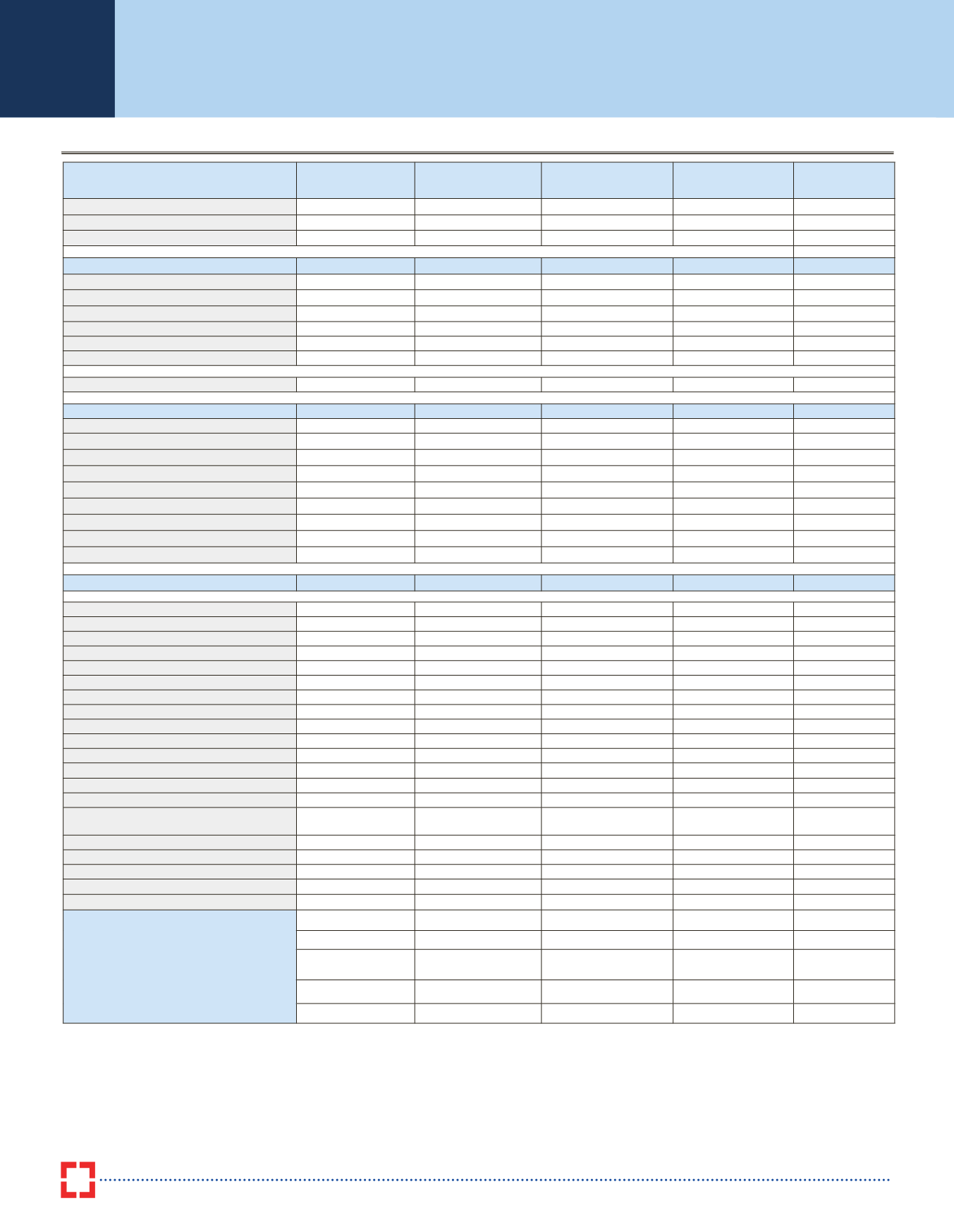

Monthly Income Plans

As on 31

st

January, 2017

Name of Fund

Birla Sun Life MIP

II - Wealth 25

HDFCMonthly Income

Plan - Long Term Plan

Kotak Monthly

Income Plan

Birla Sun Life MIP

II - Savings 5

UTI Monthly

Income Scheme

Inception Date

22-May-04

26-Dec-03

2-Dec-03

1-May-04

12-Sep-02

Corpus (in

R

Crs)

1539.61

3759.27

195.39

292.66

278.09

NAV (

R

)

35.18

40.89

27.73

31.54

32.83

Returns

Crisil MIP Blended Index

1 Month 1.71%

3.89%

2.20%

2.15%

1.73%

1.42%

3 Months 2.45%

0.87%

1.67%

0.79%

1.77%

1.41%

6 Months 5.31%

4.86%

5.76%

5.62%

5.07%

4.24%

1 Year 13.76%

19.88%

17.75%

16.64%

14.68%

12.41%

Since Inception --

10.41%

11.34%

8.05%

9.42%

8.61%

Exit Load

1%*

1%#

1%^

1% @

1%$

Portfolio Composition

Fixed Income Securities

Government Securities

49.74%

39.69%

51.59%

61.32%

26.96%

Call Money/Repos/Cash/FD

12.04%

7.13%

12.98%

11.87%

17.73%

PSU Bonds

1.01%

2.18%

0.05%

7.01%

0.14%

FI and Bank Papers

4.65%

18.89%

15.86%

9.86%

16.21%

NBFC Papers

0.65%

0.00%

0.00%

0.00%

0.19%

Securitised Debt

0.00%

3.71%

0.00%

0.00%

3.64%

Other Corporate bonds

1.62%

3.70%

0.00%

0.00%

20.36%

Total

69.71%

75.30%

80.49%

90.06%

85.23%

Average Maturity (in Years)

11.17

11.27

6.22

12.52

5.88

Equities

Sectors

Auto & Auto ancillaries

4.24%

2.86%

2.53%

1.30%

1.46%

Banks & Finance

9.50%

8.14%

3.29%

3.84%

4.52%

Capital Goods

1.87%

1.73%

0.12%

0.00%

0.00%

Cement

1.56%

0.40%

1.19%

0.16%

0.54%

Chemicals & Fertilizers

1.34%

0.87%

1.04%

0.18%

0.00%

Housing & Construction

0.55%

4.57%

0.00%

0.13%

0.68%

IT

0.35%

1.57%

2.32%

0.16%

0.84%

Media

0.00%

0.09%

0.96%

0.00%

0.00%

Metals

1.93%

1.48%

0.00%

0.70%

0.29%

Oil & Gas, Energy

3.52%

1.43%

0.79%

0.86%

2.90%

Telecom

0.10%

0.00%

0.69%

0.00%

0.24%

Textiles

0.69%

0.00%

0.50%

0.80%

0.00%

Transport & Shipping , Logistics &

Services

0.52%

0.43%

0.00%

0.27%

1.22%

Defensive

4.13%

1.01%

6.08%

1.54%

2.06%

FMCG

2.01%

0.15%

5.96%

0.87%

1.00%

Pharma

2.12%

0.86%

0.11%

0.66%

1.07%

Other Equities

0.00%

0.12%

0.00%

0.00%

0.00%

Total

30.29%

24.70%

19.51%

9.94%

14.77%

Top 5 Equity Stocks

Yes Bank Ltd

ICICI Bank Ltd

ITC Ltd.

Repco Home Finance HDFC Bank Ltd

Eicher Motors Ltd State Bank of India

Tata Motors Ltd.

Eicher Motors Ltd Gail (India) Ltd

Hindustan Petroleum

Corporation Ltd Larsen & Toubro Ltd

Infosys Ltd.

HDFC Bank Ltd

ICICI Bank Ltd

Natco Pharma Ltd

Infosys Ltd

Bata India Ltd.

Hindustan Zinc Ltd Larsen & Toubro

Maruti Suzuki India ITD Cementation India IFB Industries Ltd.

Bajaj Finance Ltd

NTPC Ltd

Source for entire data stated above is ICRA Online Ltd. (For Disclaimer of ICRA Online Ltd, refer

)

Note: Return of all schemes are absolute for <= 1 year and compounded annualised for > 1 year. Past returns cannot be taken as an indicator of future performance.

* Upto 15% of the units may be redeemed / switched-out without any exit load. Any redemption in excess of the above limit shall be subject to the following exit load:For redemption / switch-out of units on or before 365

days from the date of allotment: 1%.

# In respect of each purchase / switch-in of Units, 15% of the units (“the limit”) may be redeemed without any exit load from the date of allotment. Any redemption in excess of the limit shall be subject to the following

exit load: Exit load of 1% is payable if Units are redeemed / switched-out within 1 year from the date of allotment of units.

^ For redemption / switch out of upto 10% of the initial investment amount (limit) purchased or switched in within 1 year from the date of allotment : Nil. If units redeemed or switched out are in excess of the limit within

1 year from the date of allotment : 1%.

$ If redeemed within 365 Days. @ If redeemed within 540 days.

All the NAVs and return calculation are for the Growth Oriented Plans, unless mentioned otherwise.

As per SEBI circular dated September 13, 2012, fresh subscriptions/switch-ins will be accepted only under a single plan for all the schemes w.e.f from 1st October 2012.