32

Birla Sun Life Equity Fund : Strategy & View

Fund Manager:

Anil Shah

The fund is a flexi cap equity fund that looks for opportunities without any sector or market cap bias

with an aim to provide long term growth of capital. To construct the portfolio, the fund manager

applies mix of top-down and bottom-up investment approach and aims to maintain diversification

across various sectors and market capitalization. The fund manager uses top-down investment

approach to evaluate global and Indian macro-economic condition and accordingly overweight or

underweight sectoral positions are taken. The bottom-up investment approach is used to select

stocks within the selected sectors and invest in companies which have strong fundamentals,

potential to generate free cash flows, low leveraged balance sheet and are available at reasonable

valuations. The fund manager also looks at parameters like competitive advantage, entry barriers

in business and companies which have enough installed capacity to meet the growing demand.

As per the fund manager, the Union Budget for FY18 was a prudent budget as it emphasized on

investment while sticking to fiscal consolidation. The government has targeted the fiscal deficit

at 3.2% of GDP (Gross Domestic Product) for FY18 and 3% of GDP for FY19. The budget mainly

focused on growth in rural economy, support to MSME (Micro, Small and Medium Enterprises),

affordable housing, digitization and infrastructure development to boost the economic growth. As

per the fund manager, government is working in right direction to bring transparency, improve

tax compliance and curb the black economy with the help of various measures. Reforms like

demonetization and implementation of Goods & Services Tax (GST) Bill is likely to integrate the

parallel economy into mainline economy and bring more number of people in the tax net. As per

the fund manager, market may remain volatile in the near term due to state elections in domestic

market and policy measures by developed economies. However, the fund manager expects the

market to deliver better returns over the medium term on back of revival in earnings growth led by

expected improvement in consumption demand. The fund manager is positive on Private Sector

Banks with more focus on retail oriented Banks and has highest exposure in Banking sector. The

other top sectoral holdings are Pharma, Oil & Gas, FMCG, and Auto & Auto Ancillaries. Currently,

the fund has around 76% exposure in large cap stocks, around 12% exposure in mid & small cap

stocks and close to 12% exposure in debt & cash. The portfolio of the fund is diversified across

65-70 stocks. Currently, the top 10 stocks comprises of around 33% of the portfolio. The fund is

recommended for moderate & aggressive investors with an investment horizon of 2-3 years.

SBI Magnum Multi Cap Fund : Strategy & View

Fund Manager:

Anup Upadhyay

The fund is a flexi cap equity fund and can be classified as analysts’ portfolio, as the fund is being

managed by the fund manager with higher involvement of a team of analysts. These analysts are

experts in their respective sectors and select high conviction stocks with bottom up investment

approach. The fund manager primarily looks at overall risk management and portfolio construction.

The fund can take overweight/underweight position in sector with a deviation of 2.5% to sectoral

weightage in benchmark index. As a stock selection process, fund manager invests in companies

which follow good corporate governance, have less leveraged balance sheets and are able to generate

regular cash flows. Indian equity markets closed on a positive note in the month of January 2017

with S&P BSE Sensex rising by around 4%. As per the fund manager, up-move in the market was

mainly on back of factors like buying by DIIs in Indian equity market during the month, anticipation

over the positive announcements in the Union Budget for FY18 and better than expected corporate

earnings growth in Q3FY17. As per the fund manager, Union Budget for FY18 indicated government’s

commitment towards fiscal consolidation while allocating resources to infrastructure development,

affordable housing and growth of rural economy. The budget also focused on insurance for agricultural

activities, digitization, better road connectivity, rural electrification, direct transfer of benefits and

employment generation (via MGNREGA) programme which are likely to boost the growth of rural

economy. As per the fund manager, market may remain volatile in the near term due to factors like

corporate earnings growth trajectory, execution of the proposed budget, outcome of state elections,

development over the implementation of Goods & Services Tax (GST) Bill and policy measures by

the US government. However, the fund manager is of the view that India is relatively better placed

compared to other emerging markets to handle such situation given its healthy macro-economic

parameters. Further, low interest rate scenario, simplified taxation structure with the help of GST

reform and increased government revenues on sustainable basis are likely to boost the economic

growth over long term. The fund manager is positive on Banking sector and has highest exposure

in it. The other top sectoral holdings are FMCG, Oil & Gas, IT and Auto & Auto Ancillaries. The fund

also maintains the diversification across market capitalization. Currently, the fund has around 71%

exposure in large cap stocks, around 18% exposure in mid cap stocks and around 7% exposure in

small cap stocks. The fund is recommended for moderate & conservative investors, with a 2-3 years

investment horizon

M

utual

F

und

S

ynopsis

- E

quity

F

unds

as

on

31

st

J

anuary

, 2017

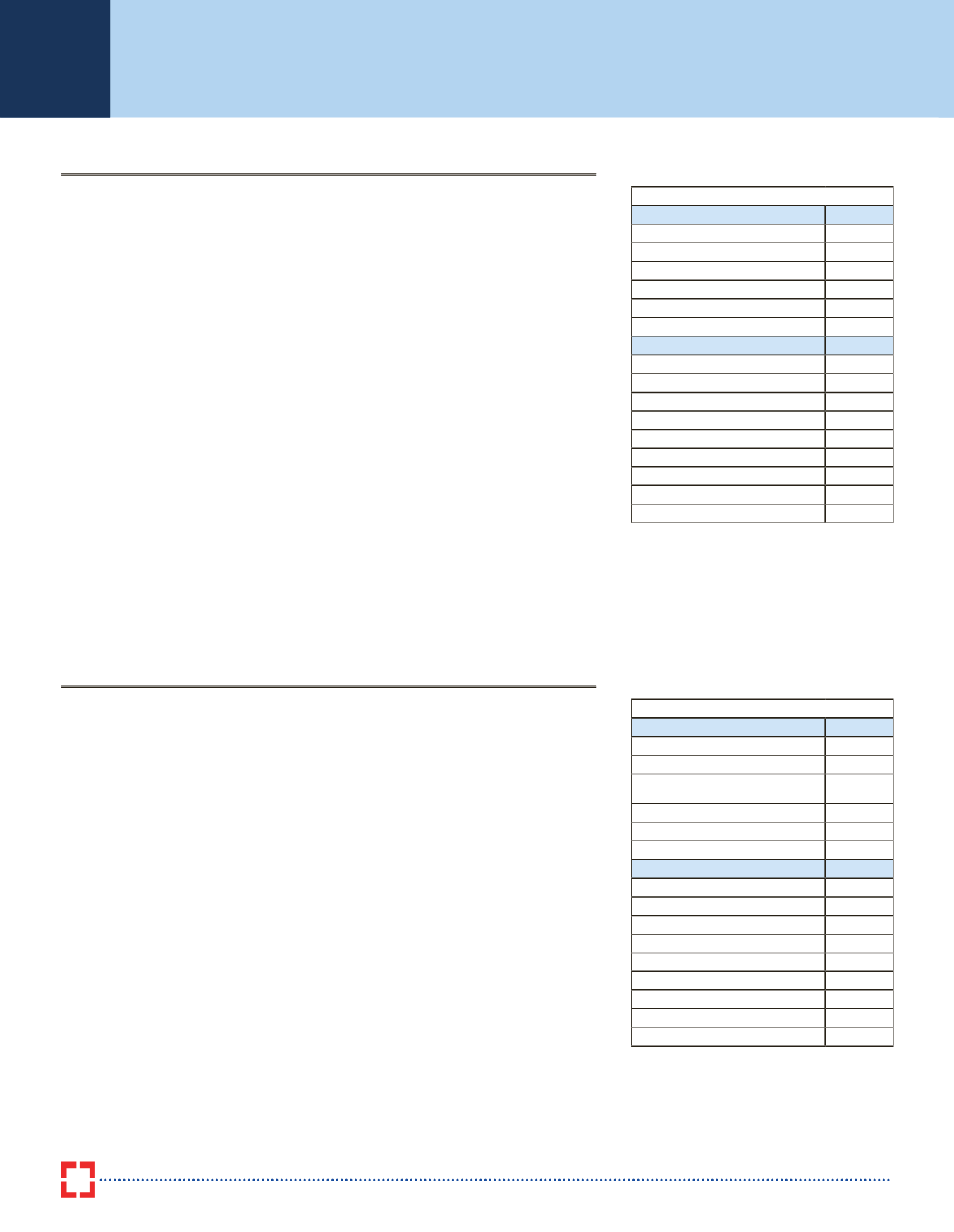

Top Holdings as on 31st January 2017

Company

%

HDFC Bank Ltd.

5.12

Cairn India Ltd.

3.84

Tata Chemicals Ltd.

3.83

Maruti Suzuki India Ltd.

3.26

Dr Reddys Laboratories Ltd.

2.91

Total

18.96

Sector

%

Banks & Finance

25.70

Pharma

9.86

Oil & Gas, Energy

9.27

FMCG

8.11

Auto & Auto Ancillaries

7.24

Total

60.18

Debt & Cash

12.06

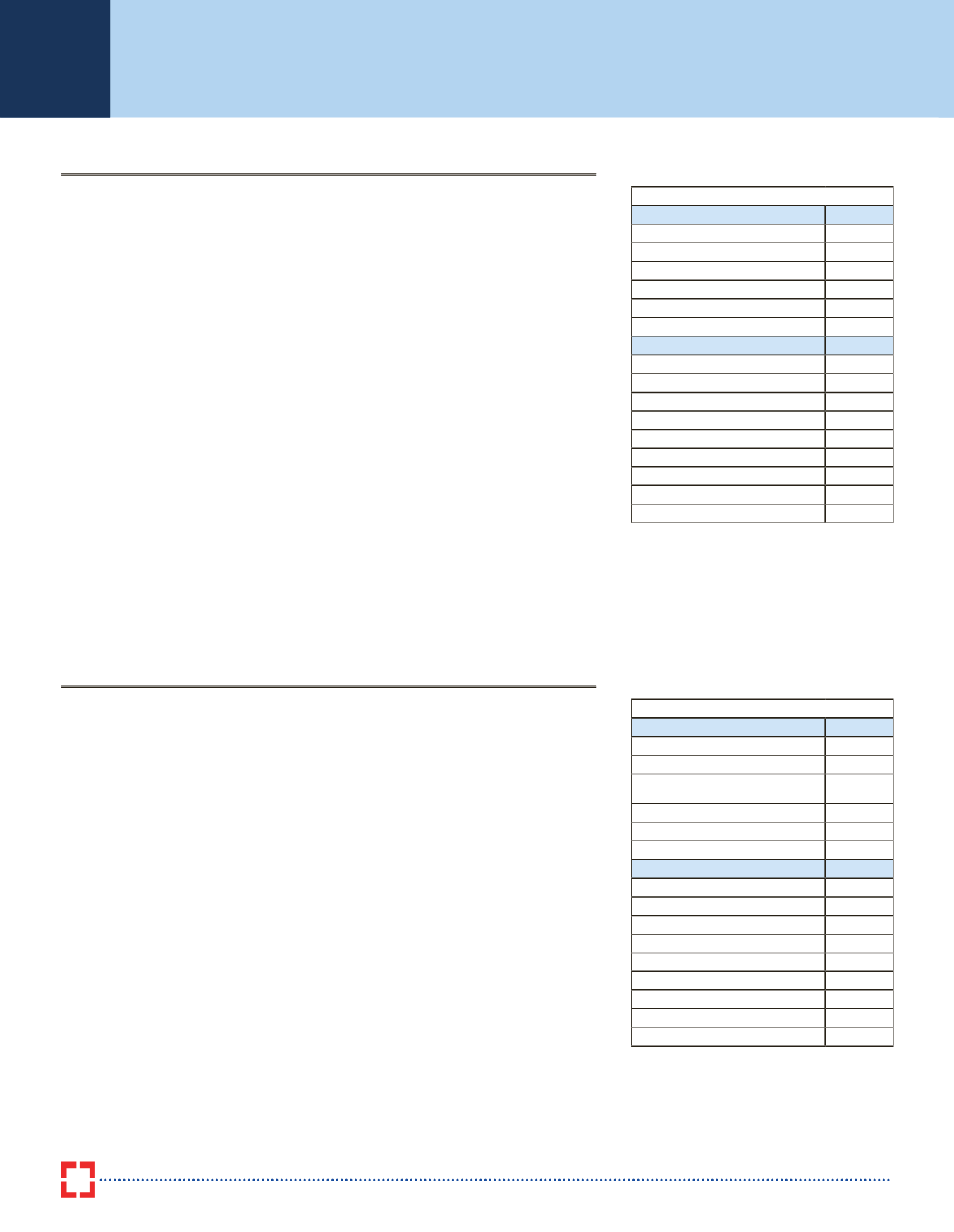

Top Holdings as on 31st January 2017

Company

%

HDFC Bank Ltd.

4.93

State Bank of India

4.17

Mahindra & Mahindra Financial

Services Ltd.

3.82

Equitas Holdings Ltd.

3.61

Infosys Ltd.

3.30

Total

19.83

Sector

%

Banks & Finance

26.04

FMCG

11.24

Oil & Gas, Energy

10.08

IT

9.32

Auto & Auto Ancillaries

9.22

Total

65.91

Debt & Cash

3.87

Source for entire data stated above is ICRA Online Ltd. (For Disclaimer of ICRA Online Ltd, refer