F

und

fact

sheet

38

Equity Funds

As on 31

st

January, 2017

Source for entire data stated above is ICRA Online Ltd. (For Disclaimer of ICRA Online Ltd, refer

)

Note: Return figures for all schemes are absolute for <= 1 year and compounded annualised for > 1 year. Past returns cannot be taken as an indicator of future performance.

*If redeemed before 1 year. # If redeemed before 12 months. $If redeemed before 365 Days

~ If redeemed between 0 Month to 6 Month; Exit Load is 1%If redeemed between 6 Month to 12 Month; Exit Load is 0.5%

^ If units purchased or switched in are redeemed or switched out upto 10% of units within 1 Year from the date of allotment - Nil.If units purchased or switched in are redeemed or switched out more than 10% of units within 1 Year

from the date of allotment - 1% of applicable Net Asset Value (NAV).If units purchased or switched in are redeemed or switched out after 1 Year from the date of allotment - Nil.

All the NAVs and return calculation are for the Growth Oriented Plans, unless mentioned otherwise.

As per SEBI circular dated September 13, 2012, fresh subscriptions/switch-ins will be accepted only under a single plan for all the schemes w.e.f from 1st October 2012.

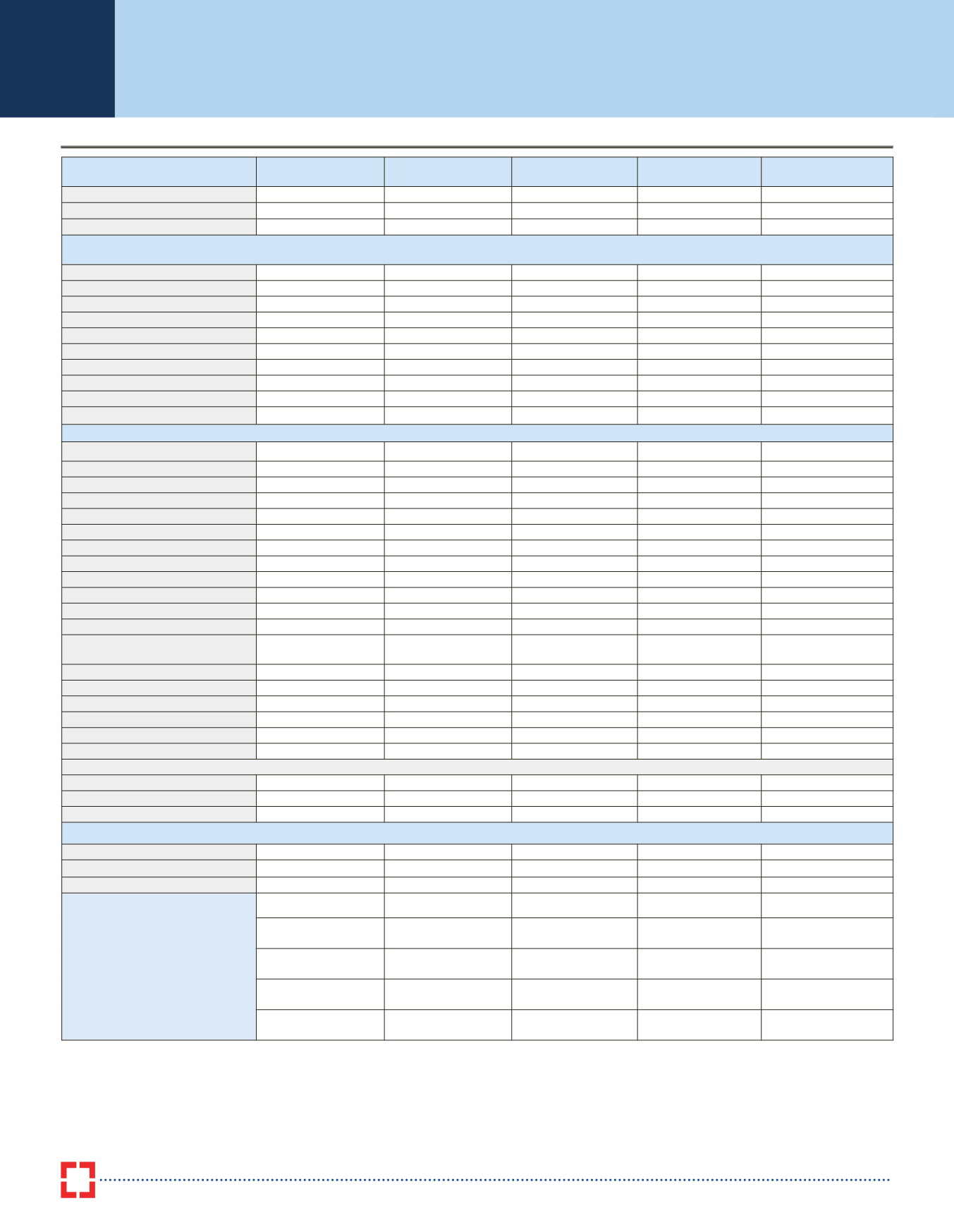

Name of Fund

Birla Sun Life Equity

Fund

DSP BlackRock

Opportunities Fund

SBI Magnum Multi

Cap Fund

Franklin India Prima

Plus Fund

ICICI Prudential

Dynamic Plan

Inception Date

27-Aug-98

16-May-00

29-Sep-05

29-Sep-94

31-Oct-02

Corpus (in

R

Cr)

3770.47

1478.27

1546.60

9930.34

6076.67

NAV (

R

)

586.74

177.51

37.29

481.22

216.52

Returns

S&P BSE Sensex Index

1 Month 3.75%

6.70%

7.34%

4.72%

5.00%

5.28%

3 Months - 0.97%

-1.33%

-0.60%

-3.00%

-2.23%

3.70%

6 Months -1.40%

8.00%

4.40%

-0.34%

0.08%

8.41%

1 Year 11.11%

30.33%

26.04%

17.42%

15.45%

24.25%

3 Years 10.46%

27.14%

23.86%

25.42%

23.11%

18.19%

5 Years 9.96%

20.80%

18.24%

19.56%

18.01%

16.38%

Since Inception --

24.70%

18.77%

12.30%

18.92%

24.06%

Exit Load

1%$

1%#

1% ~

1%*

1% ^

Dividend Pay-out (Latest)

77.00%

26.00%

19.00%

25.00%

22.50%

Dividend Date

30-Nov-16

6-Jan-17

29-Dec-16

26-Feb-16

21-Oct-16

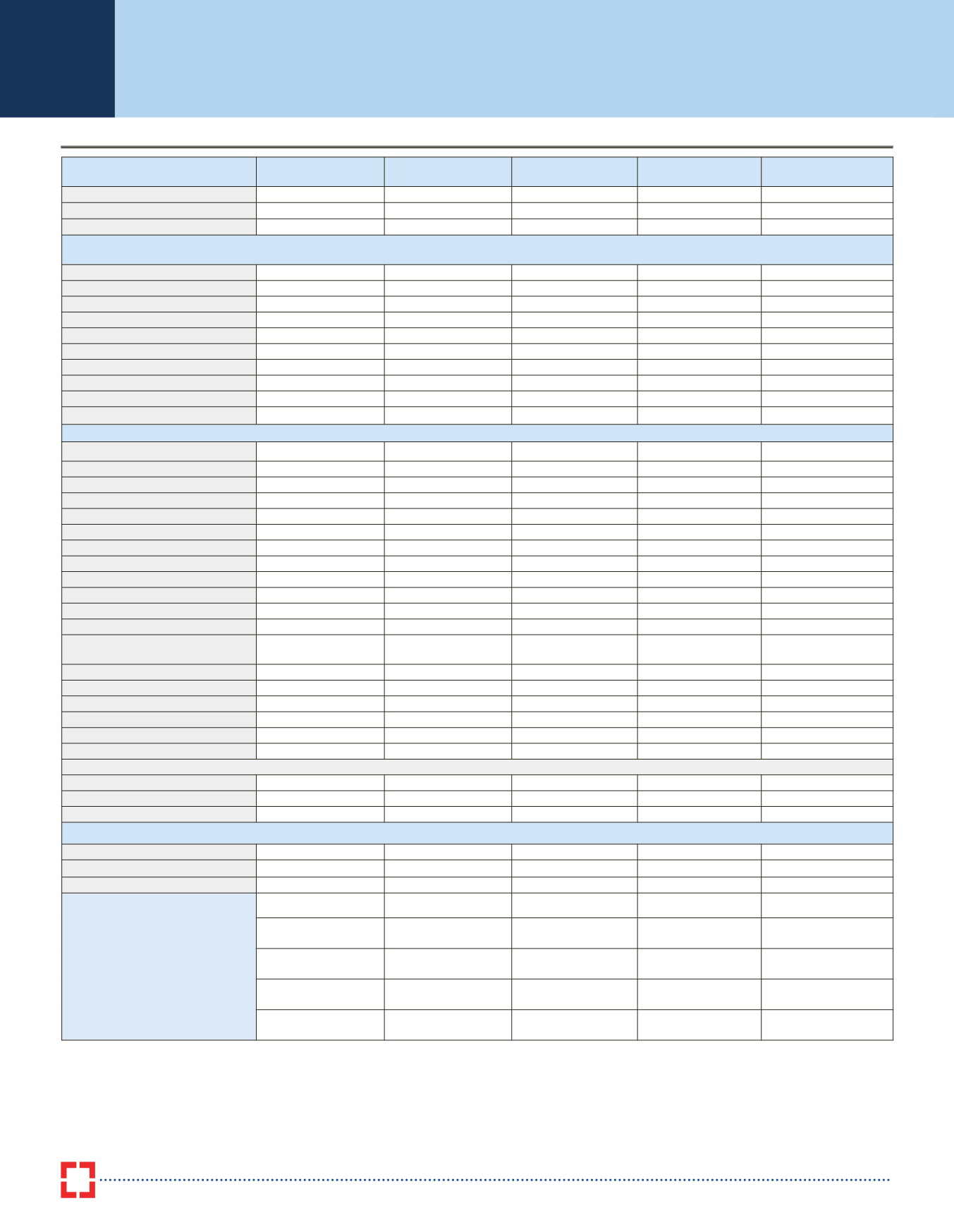

Portfolio Composition Sectors

Auto & Auto Ancillaries

7.24%

6.47%

9.22%

10.88%

6.50%

Banks & Finance

25.70%

27.60%

26.04%

28.79%

12.25%

Capital Goods

1.39%

2.83%

1.54%

2.91%

0.13%

Cement

5.59%

3.73%

3.19%

5.08%

0.12%

Chemicals & Fertilizers

4.40%

0.68%

2.26%

0.31%

6.65%

Housing & Construction

0.00%

7.60%

6.28%

4.52%

2.05%

IT

6.24%

6.64%

9.32%

10.24%

9.41%

Media

1.89%

0.57%

1.79%

1.11%

0.51%

Metals

3.42%

7.81%

2.49%

1.09%

6.84%

Oil & Gas, Energy

9.27%

14.71%

10.08%

3.06%

7.21%

Telecom

3.70%

0.00%

1.66%

5.62%

9.18%

Textiles

0.31%

1.25%

2.51%

1.56%

2.65%

Transport & Shipping , Logistics &

Services

0.80%

0.53%

1.63%

1.35%

5.06%

Defensive

17.97%

14.47%

18.12%

18.49%

14.06%

FMCG

8.11%

7.52%

11.24%

10.62%

6.10%

Pharma

9.86%

6.95%

6.88%

7.87%

7.96%

Other Equities

0.00%

0.00%

0.00%

0.00%

0.00%

Fixed Income Investments

7.72%

0.07%

0.00%

0.00%

7.36%

Current Assets

4.35%

5.06%

3.87%

4.99%

10.01%

Market Capitalization (%)

Large Cap

75.86%

79.40%

70.65%

83.11%

62.84%

Mid Cap

9.97%

9.52%

18.40%

10.67%

9.56%

Small Cap

2.11%

5.95%

7.08%

1.23%

10.23%

Concentration of Stocks

% of Assets

Top 5

18.96%

20.81%

19.83%

23.26%

27.50%

Top 10

32.89%

35.81%

34.79%

38.04%

45.32%

Top 5 Stocks

HDFC Bank Ltd

ICICI Bank Ltd

HDFC Bank Ltd

HDFC Bank Ltd

Bharti Airtel Ltd

Cairn India Ltd State Bank of India Ltd State Bank of India Ltd ICICI Bank Ltd Power Grid Corporation

of India Ltd

Tata Chemicals Ltd

HDFC Bank Ltd Mahindra & Mahindra

Financial Services Ltd Bharti Airtel Ltd

Tata Chemicals Ltd

Maruti Suzuki India Ltd

Yes Bank Ltd

Equitas Holdings Ltd IndusInd Bank Ltd

ICICI Bank Ltd

Dr Reddys Laboratories

Ltd

IndusInd Bank Ltd

Infosys Ltd

Yes Bank Ltd

Infosys Ltd