44

F

und

fact

sheet

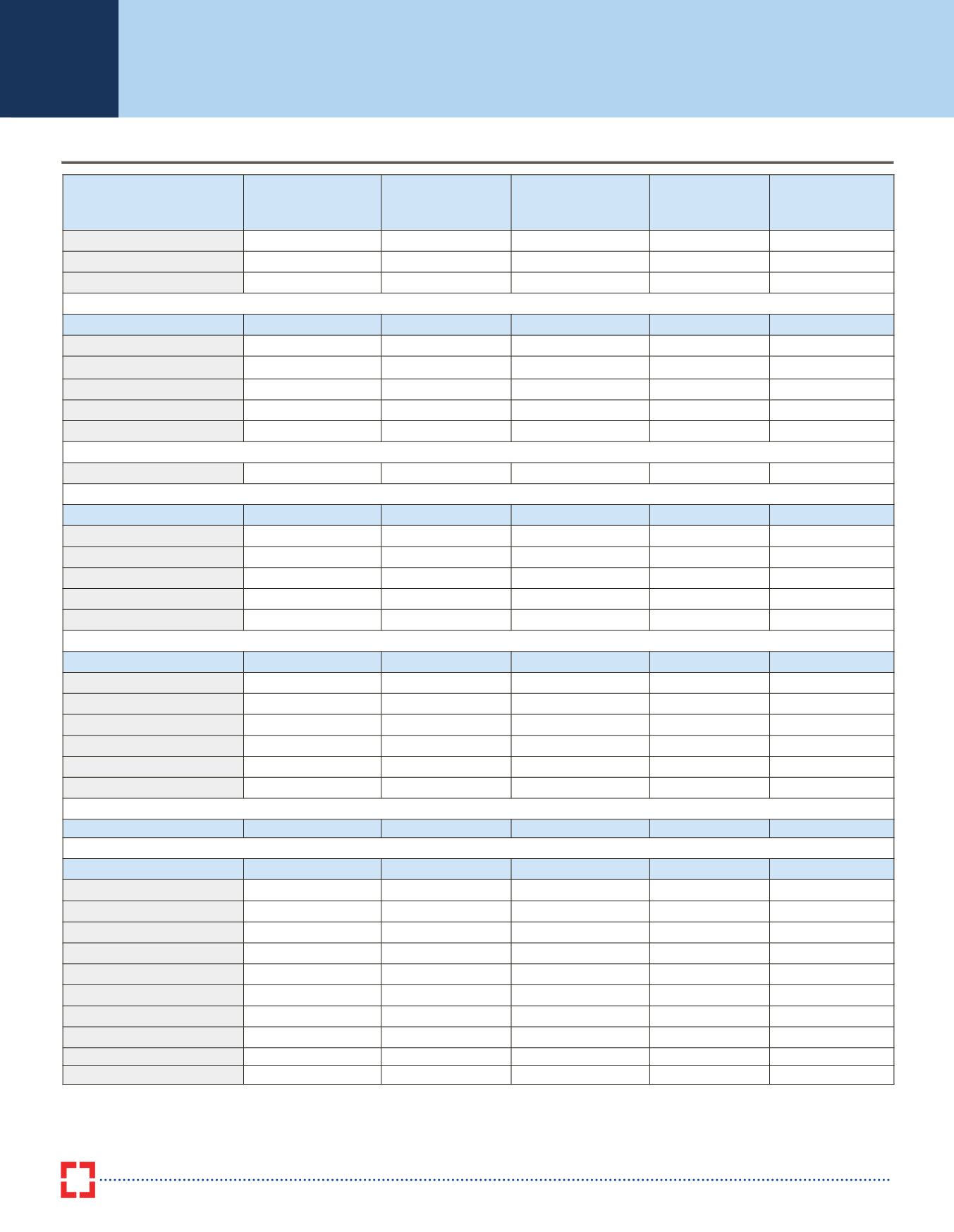

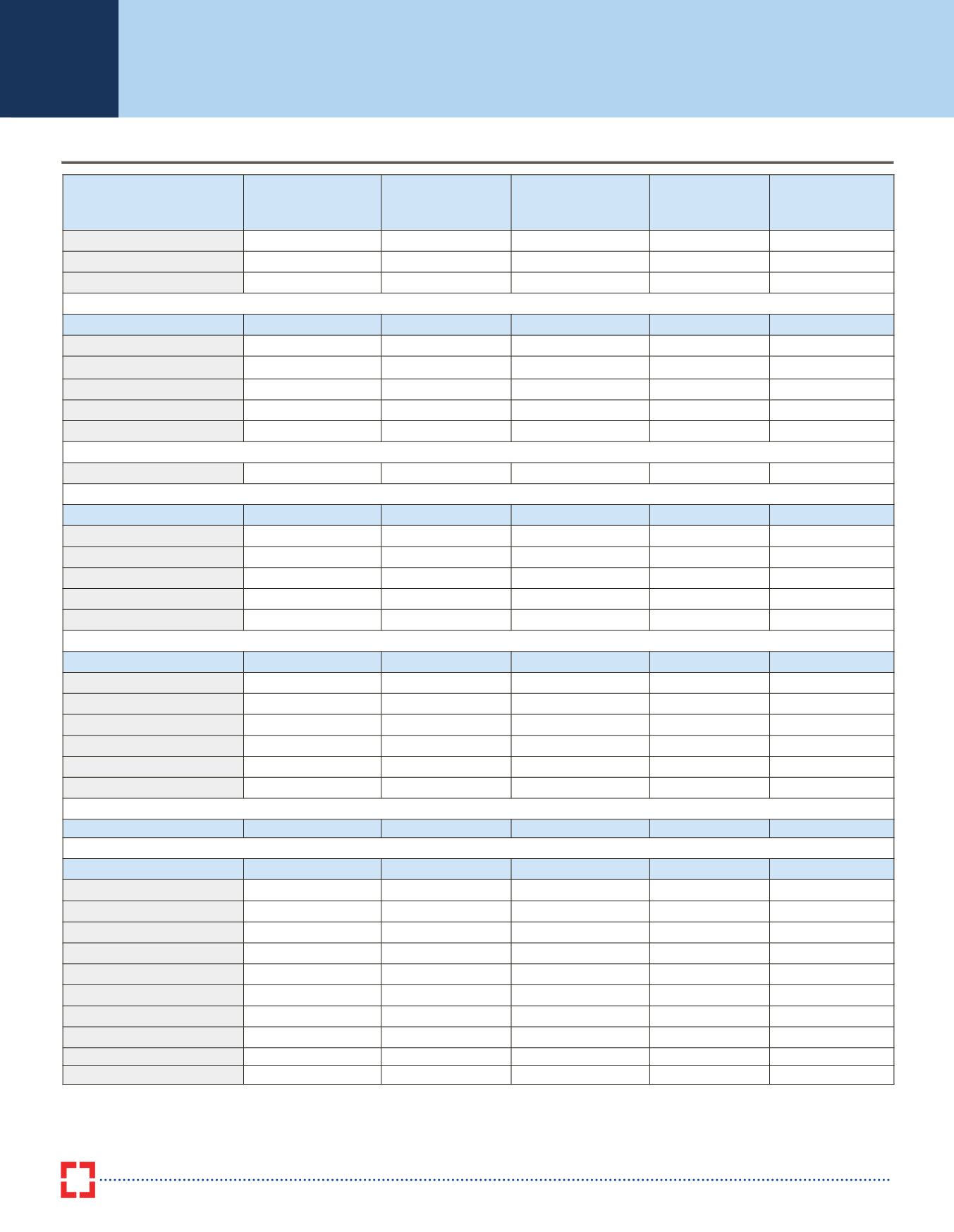

Ultra Short Term Funds

As on 31

st

January, 2017

Name of Fund

Birla Sun Life

Savings Fund

ICICI Prudential

Flexible Income Plan

HDFC Floating Rate

Income Fund - Short

Term Fund

SBI Ultra Short

Term Debt Fund

Axis Treasury

Advantage Fund

Inception Date

15-Apr-03

27-Sep-02

23-Oct-07

27-Jul-07

9-Oct-09

Corpus (in Crs)

18024.67

21040.08

13615.76

10491.39

2755.63

NAV (

R

)

315.92

308.03

28.00

2076.91

1796.92

Returns

Crisil Liquid Fund Index

1 Week 0.11%

0.15%

0.12%

0.15%

0.13%

0.15%

1 Month 0.52%

0.91%

0.84%

0.78%

0.60%

0.72%

3 Months 1.63%

2.12%

2.17%

2.07%

1.84%

1.84%

6 Months 3.35%

4.37%

4.37%

4.24%

3.73%

3.77%

Exit Load

Nil

Nil

Nil

Nil

Nil

Portfolio Composition

Gilts/T-Bills

15.99%

15.16%

2.35%

9.30%

11.01%

CDs/CPs

6.91%

21.05%

19.89%

35.89%

26.53%

Securitised Debt

7.62%

0.69%

9.45%

0.79%

0.00%

Corporate Debt

65.43%

59.31%

65.07%

54.01%

50.61%

Cash & Others

4.06%

3.79%

3.24%

0.01%

11.85%

Sectoral Composition

FI and Bank Papers

8.23%

21.73%

46.45%

39.31%

28.01%

PSU Bonds

19.61%

9.80%

25.67%

15.17%

6.59%

NBFC Papers

27.34%

25.84%

13.81%

26.68%

27.70%

Other Corporate Bonds

24.77%

23.68%

8.48%

9.54%

14.84%

Gilts/T-Bills

15.98%

15.16%

2.35%

9.30%

11.01%

Cash & Others

4.06%

3.79%

3.24%

0.01%

11.85%

Average Maturity (in Days)

635

386

558

201

176

Asset Quality (in %)

AAA/Equivalent

77.53%

81.23%

77.04%

82.07%

85.30%

AAA/P1+/A1+/PR1+

57.49%

62.29%

71.45%

72.76%

62.44%

Call/Cash/FD/G-Secs

20.05%

18.95%

5.59%

9.31%

22.86%

Sub AAA

22.47%

18.77%

22.96%

17.93%

14.70%

AA+

7.79%

3.28%

12.67%

7.82%

9.44%

AA

9.40%

9.50%

6.34%

10.11%

5.26%

Below AA

5.28%

5.98%

3.95%

0.00%

0.00%

Unrated

0.00%

0.00%

0.00%

0.00%

0.00%

Source for entire data stated above is ICRA Online Ltd. (For Disclaimer of ICRA Online Ltd, refer

)

Note: Return of all schemes are absolute for <= 1 year and compounded annualised for > 1 year. Past returns cannot be taken as an indicator of future performance.

As per SEBI circular dated September 13, 2012, fresh subscriptions/switch-ins will be accepted only under a single plan for all the schemes w.e.f from 1st October 2012.

All the NAVs and return calculation are for the Growth Oriented Plans, unless mentioned otherwise.