43

F

und

fact

sheet

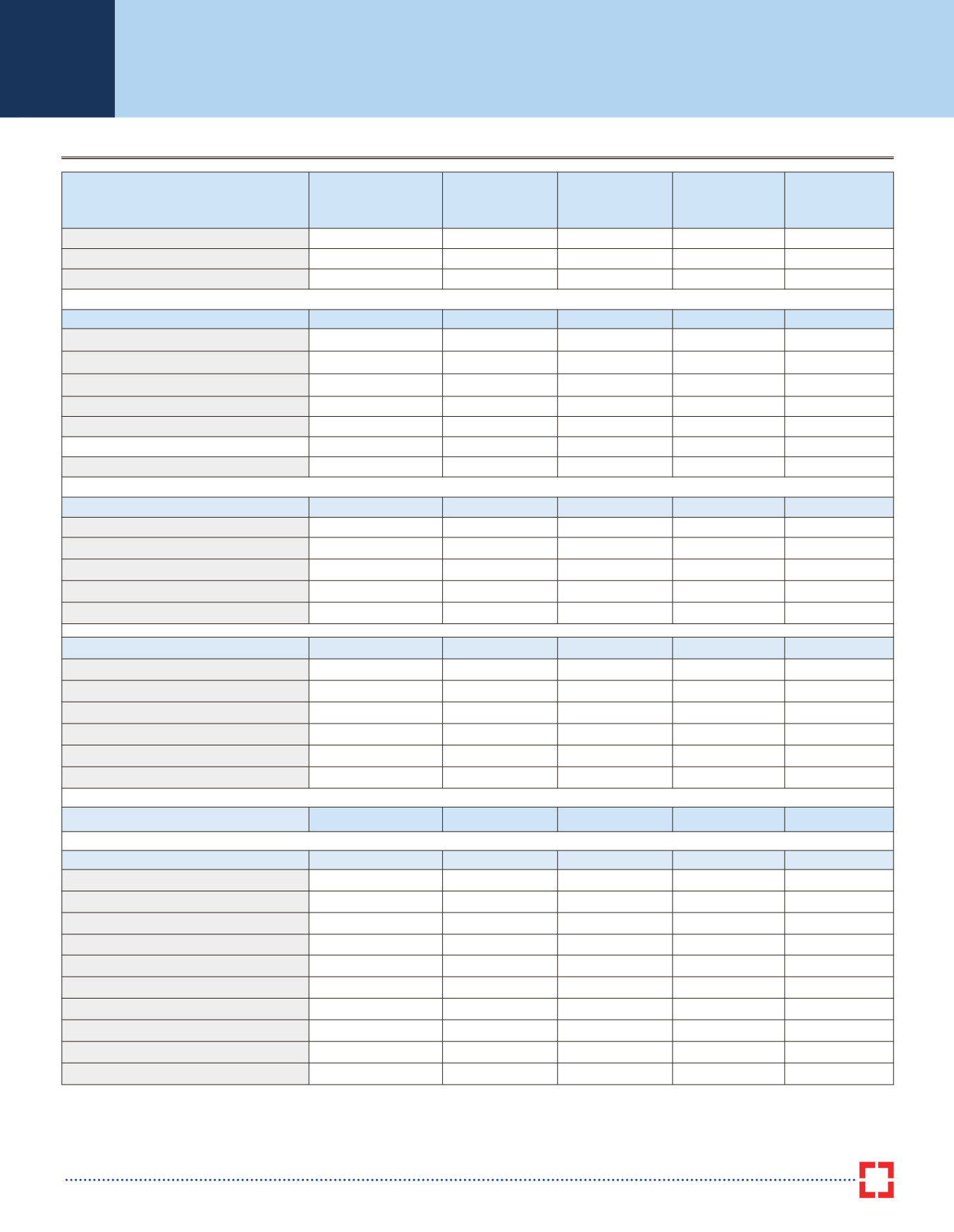

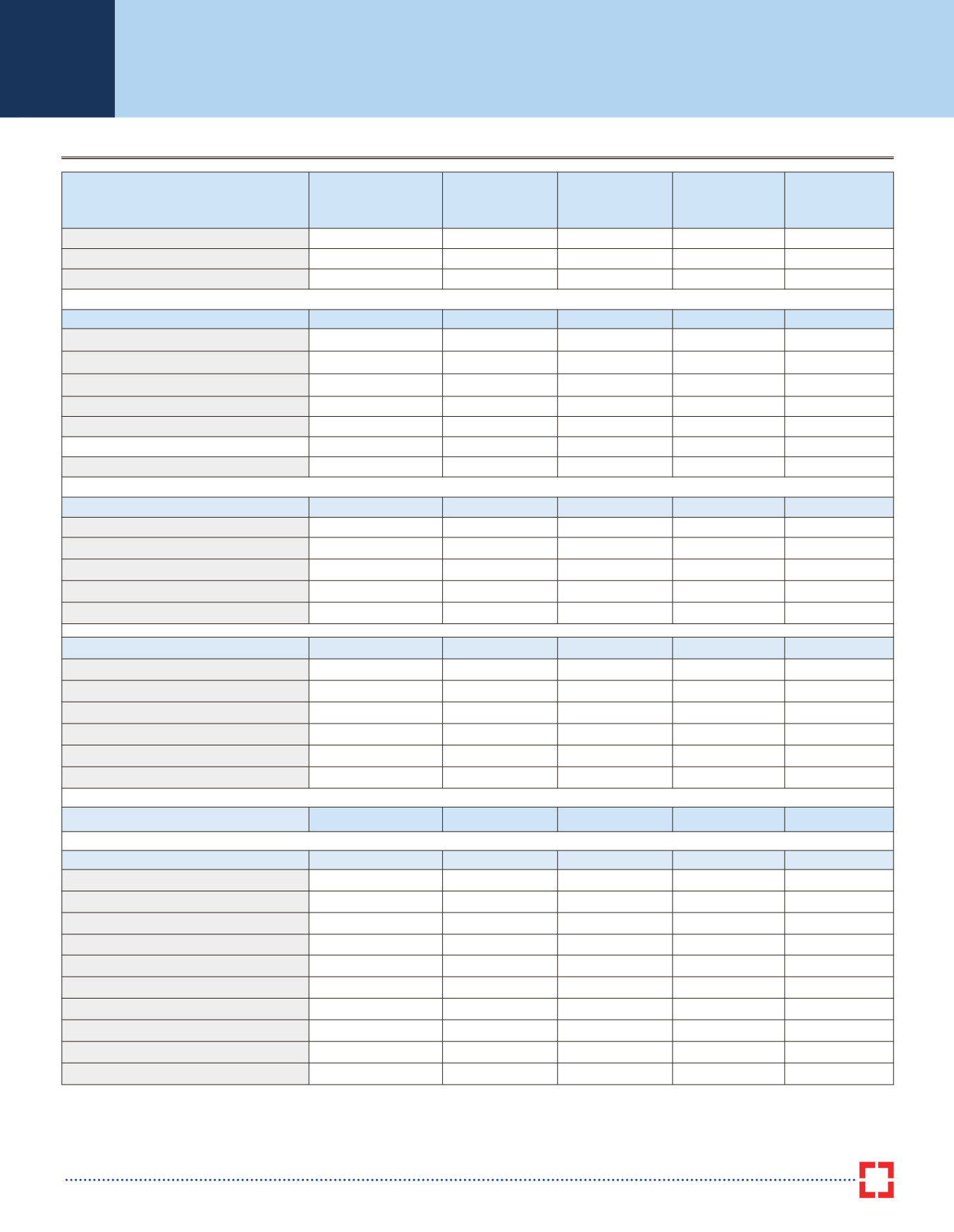

Short Term Plans

As on 31

st

January, 2017

Name of Fund

ICICI Prudential

Banking & PSU Debt

Fund

Birla Sun Life

Treasury

Optimizer Plan

Kotak Flexi Debt

Fund

HDFC Short Term

Opportunities

Fund

Axis Short

Term Fund

Inception Date

1-Jan-10

2-May-08

27-May-08

25-Jun-10

22-Jan-10

Corpus (in Crs)

9217.61

8762.69

1949.91

9315.71

6281.95

NAV (

R

)

18.73

208.77

21.03

17.83

17.69

Returns

Crisil Short-Term Bond Fund Index

3 Months 2.28%

2.83%

2.52%

2.52%

2.17%

2.47%

6 Months 4.69%

5.92%

5.64%

6.27%

4.39%

4.80%

1 Year 10.15%

12.97%

12.78%

13.62%

9.56%

10.09%

Since Inception --

9.26%

8.77%

8.93%

9.15%

8.45%

Exit Load

Nil

Nil

Nil

Nil

Nil

Portfolio Composition

Gilts/T-Bills

40.20%

46.07%

61.29%

11.46%

16.85%

CDs/CPs

0.23%

2.71%

0.00%

3.50%

6.51%

Securitised Debt

0.00%

4.21%

0.00%

7.95%

0.72%

Corporate Debt

51.66%

44.38%

36.41%

74.33%

71.87%

Cash & Others

7.91%

2.63%

2.30%

2.77%

4.06%

Sectoral Composition

FI and Bank Papers

24.82%

1.69%

10.98%

31.29%

21.86%

PSU Bonds

10.32%

9.03%

2.45%

26.04%

21.10%

NBFC Papers

6.82%

26.62%

16.91%

18.01%

21.38%

Other Corporate Bonds

9.92%

13.96%

6.07%

10.44%

14.75%

Gilts/T-Bills

40.20%

46.07%

61.29%

11.46%

16.85%

Cash & Others

7.91%

2.63%

2.30%

2.77%

4.06%

Average Maturity (in Years)

4.45

6.12

6.13

1.57

2.80

Asset Quality (in %)

AAA/Equivalent

93.64%

86.73%

89.28%

88.75%

87.96%

AAA/P1+/A1+/PR1+

45.53%

38.03%

25.69%

74.53%

67.06%

Call/Cash/FD/G-Secs

48.11%

48.70%

63.59%

14.22%

20.90%

Sub AAA

6.36%

13.27%

10.72%

11.25%

12.04%

AA+

6.36%

9.19%

5.26%

4.32%

7.30%

AA

0.00%

4.08%

5.46%

4.87%

4.74%

Below AA

0.00%

0.00%

0.00%

2.06%

0.00%

Unrated

0.00%

0.00%

0.00%

0.00%

0.00%

Source for entire data stated above is ICRA Online Ltd. (For Disclaimer of ICRA Online Ltd, refer

)

Note: Return of all schemes are absolute for <= 1 year and compounded annualised for > 1 year. Past returns cannot be taken as an indicator of future performance.

As per SEBI circular dated September 13, 2012, fresh subscriptions/switch-ins will be accepted only under a single plan for all the schemes w.e.f from 1st October 2012.

All the NAVs and return calculation are for the Growth Oriented Plans, unless mentioned otherwise.