33

Franklin India Prima Plus Fund : Strategy & View

Fund Manager:

Anand Radhakrishnan , R Janakiraman and Srikesh Nair

The fund seeks to invest mainly in large cap companies and can also take upto 30% exposure

in mid & small cap stocks. As a stock selection process, the fund manager applies bottom up

investment approach and invests in companies that are expected to grow at high rate, enjoys

competitive advantage in their respective business segment and generates high Return on Capital

(ROC). The fund manager invests with medium to long term investment horizon and books profit

once the valuation objectives are achieved. The Indian equity markets closed on a positive note

in the month of January 2017 with Nifty 50 index rising by around 5%. As per the fund manager,

rise in the market was mainly on back positive sentiment led by better than expected corporate

earnings growth in Q3FY17, optimism ahead of Union Budget for FY18 and signs of improvement

in some of the macro economic data points. As per the fund manager, the budget mainly focused

on social spending, capital expenditure, infrastructure development, digitization, support to small

and medium enterprises and various reforms to curb the black money in the economy. The budget

also emphasized on affordable housing, measures to improve farm income by enhancing credit

limit for agriculture and increased crop insurance coverage and employment generation schemes

to improve the rural income. As per the fund manager, demonetization by the government has

impacted the overall business activities, however, the adverse impact of the same has been lower

than market expectations. The fund manager is of the view that benign inflation, lower interest

rates, return of normalcy in new currency notes in circulation and gradual rise in wage levels

creates favourable condition for recovery in aggregate consumption demand in FY18. As per the

fund manager, the market may remain volatile in the near term due to factors like development over

the implementation of Goods & Services Tax (GST) Bill, movement in crude oil prices and policy

measures by the US government. However, the fund manager is of the view that benign fiscal

situation, increase in public spending by government, simplification of tax structure along with

various reforms pertaining to land, labour, infrastructure sector and modification in FDI policy are

likely to support sustainable economic growth over the medium to long term. Currently, the fund

has highest exposure to Banking & Finance sector. The other top sectoral holdings are Auto & Auto

Ancillaries, FMCG, IT and Pharma. The fund has around 83% exposure to large cap stocks, around

12% exposure to mid & small cap stocks and close to 5% exposure into debt & cash. The fund is

recommended for moderate & conservative investors with an investment horizon of 2-3 years.

Kotak Select Focus Fund : Strategy & View

Fund Manager:

Harsha Upadhyaya

The fund is a flexi cap equity fund with large cap bias that aims to invest into few selected sectors.

The fund manager uses top-down investment approach to identify sectors that are likely to do well

over the medium term and takes significant exposure in these sectors. The fund generally maintains

concentrated exposure in 4-9 sectors in its portfolio. There is no restriction on the type of sectors

that the fund can take exposure in and the portfolio is generally diversified at stock level. The Indian

equity markets closed on a positive note in the month of January 2017 with Nifty 50 index rising

by around 5%. As per the fund manager, the rise in the market was mainly on back of buying by

DIIs in domestic equity markets during the month and better than expected corporate earnings

growth of some of the companies in Q3FY17. Also, improvement in asset quality and credit growth

of some of the private and retail oriented banks accentuated the market performance. As per the

fund manager, the Union Budget FY18 mainly highlighted the government’s commitment to focus

on balancing the fiscal prudence and economic growth. The budget also emphasized on boosting

the consumption demand, higher tax revenues to the government through better tax compliance,

more resources for capex, maintaining path of fiscal prudence and supporting the infrastructure

growth. The government also prioritized rural welfare and agriculture as its key growth agenda in the

budget by increasing allocation towards various schemes like Fasal Bima Yojna, Soil Health cards,

combined spot and derivatives markets for commodities and Electronic market place (E –NAM)

etc. As per the fund manager, the market may remain volatile in the near term mainly due to the

corporate earnings growth trajectory, outcome of the state elections and monetary policy action by

the developed economies. However, the fund manager expects the equity market to deliver better

returns in the medium term on back of revival in earnings growth led by expected improvement in

consumption demand. The fund manager believes that consumption demand is likely to improve

on back of higher government spending towards development in rural area, affordable housing and

various infrastructure projects. The fund manager is positive on Private Sector Banks and select PSU

Banks and has highest exposure in Banking sector. The other top sectoral holdings are Oil & Gas,

Energy, Auto & Auto Ancillaries, Cement and FMCG. Currently, the fund has around 75% exposure to

the top five sectors in the portfolio, while top five stocks constitute around 22% of the portfolio. The

fund manager maintains higher allocation towards large cap stocks and has around 88% exposure

to it. The fund can be considered by moderate & conservative investors looking to invest with an

investment horizon of 2-3 years.

M

utual

F

und

S

ynopsis

- E

quity

F

unds

as

on

31

st

J

anuary

, 2017

Source for entire data stated above is ICRA Online Ltd. (For Disclaimer of ICRA Online Ltd, refer

)

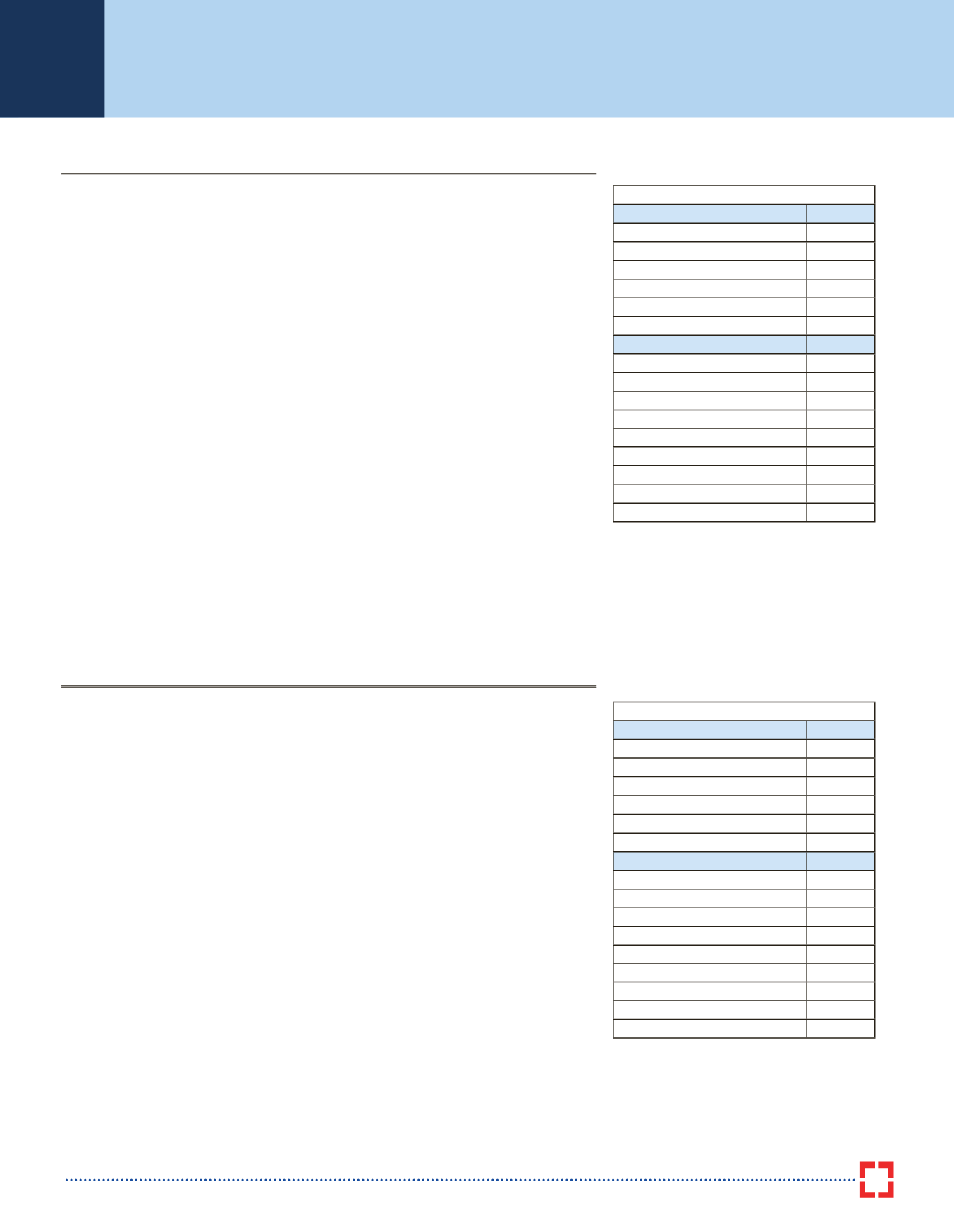

Top Holdings as on 31st January 2017

Company

%

HDFC Bank Ltd.

7.84

ICICI Bank Ltd.

4.09

Bharti Airtel Ltd.

3.96

IndusInd Bank Ltd.

3.78

Yes Bank Ltd.

3.58

Total

23.26

Sector

%

Banks & Finance

28.79

Auto & Auto Ancillaries

10.88

FMCG

10.62

IT

10.24

Pharma

7.87

Total

68.40

Debt & Cash

4.99

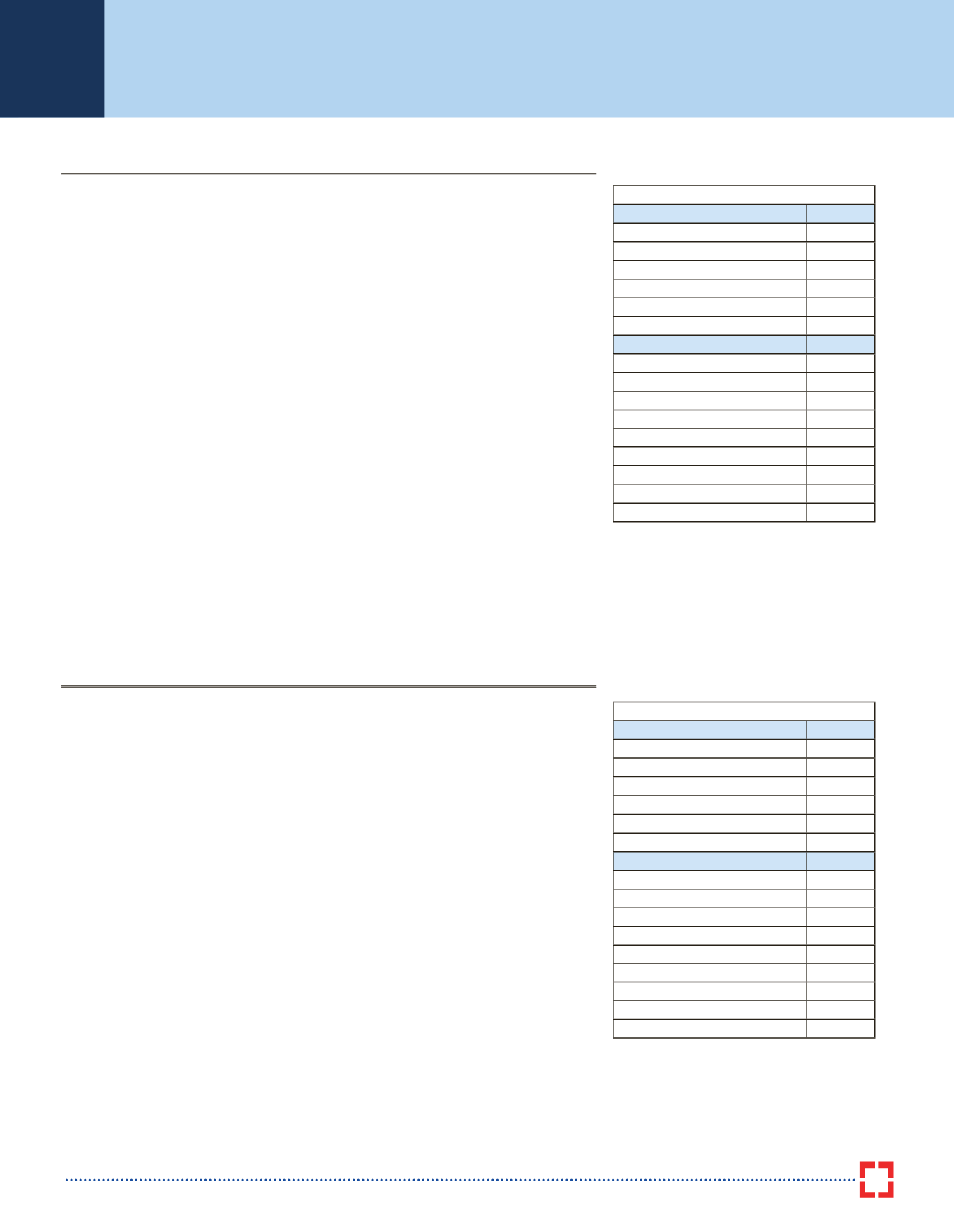

Top Holdings as on 31st January 2017

Company

%

HDFC Bank Ltd.

6.15

Reliance Industries Ltd.

4.14

ITC Ltd.

4.11

Hero MotoCorp Ltd.

3.85

Ultratech Cement Ltd.

3.77

Total

22.02

Sector

%

Banks & Finance

28.04

Oil & Gas, Energy

15.93

Auto & Auto Ancillaries

13.01

Cement

10.55

FMCG

7.78

Total

75.31

Debt & Cash

5.31