36

Birla Sun Life Debt Funds : Strategy & View

According to the fund house, in the monetary policy, the monetary policy committee (MPC)

surprised markets by not only keeping the interst rates unchanged but also shifting its stance from

accommodative to neutral. This made market participants to believe that the rate easing cycle is

close to conclusion. The fund house feels that this move happened while the RBI accepted that FY17

and FY18 GVA growth is weaker versus their previous forecasts and average CPI inflation for Q4FY17

and FY18 is estimated to be within RBI’s inflation target. In this backdrop, the shift in stance seems

more likely governed by global uncertainty and more optimistic expectation of local growth recovery.

As per the fund house, the impact of US President Trump’s policies in the US and its implications on

global growth, inflation and bond yields would have been the key reasons driving the shift in stance.

The fund house feels that RBI has overestimated the reflationary impact of remonetisation, budget

spending and soft MCLRs on local growth. The fund house also believes that by announcing to be

neutral, RBI has made further transmission more challenging. The fund house awaits more clarity

before firmly changing its view. In Birla Sun Life Treasury Optimizer Plan, the average maturity of the

portfolio stood at 6.12 years as of January 2017 compared with 6.32 years as of December 2016.

The G-sec exposure in the fund stood at around 46% in January 2017 as against 47% in December

2016, while the exposure in Corporate Debt securities was around 44% in January 2017 compared

with 46% in the previous month. The YTM of the fund stood at 7.35% as of January 2017. In Birla Sun

Life Dynamic Bond Fund, the average maturity of the portfolio stood at 18.21 years as of January

2017 compared with 18.24 years as of December 2016. The G-sec exposure in the fund remained

unchanged from the previous month at around 68% in January 2017. The YTM of the fund stood at

7.61% as of January 2017.

ICICI Prudential Debt Funds : Strategy & View

According to the fund house, against the market expectations of a 25 bps cut, the Monetary

Policy Committee (MPC) kept policy rates unchanged; and more surprisingly, the MPC shifted

its stance from ‘accommodative’ to ‘neutral’. The fund house feels that RBI has acted hawkish

by changing its stance from accommodative to neutral amidst adverse global conditions – US

Rate hike cycle and risk of exchange rate volatility. As per the fund house, RBI’s change in policy

stance was unwarranted at this point in time in the backdrop of improving fiscal deficit, effects of

demonetization seen on consumption and growth, lower inflation levels and muted credit growth.

It also believes that inflation may continue to undershoot RBI’s target and growth recovery may be

slower than expected. This may provide room for RBI to turn accommodative again in the medium

term, though in the near term, the fund house does not expect any rate cut. The fund house feels

that bond yields will be range bound till the time RBI maintains a neutral stance. Given the liquidity

backdrop and the still incomplete transmission of earlier rate cuts, the fund house maintains a

downward bias on short-end yields. Based on the above factors and sharp spike in yields across

the curve, the fund house holds a moderately bullish view on yields. In ICICI Prudential Short Term

Fund, the average maturity of the portfolio stood at 3.29 years as of January 2017 compared with

3.68 years as of December 2016. The fund’s G-sec exposure stood at around 31% in January

2017 as against 30% in December 2016. The Corporate Debt exposure in the fund was around

62% in January 2017 compared with 65% in the previous month. The YTM of the fund was 7.34%

as of January 2017. In ICICI Prudential Long Term Plan, the average maturity of the portfolio stood

at 8.44 years in January 2017 as against 9.25 years in December 2016. The fund’s exposure in

G-secs was around 44% in January 2017 as against 45% in December 2016. The portfolio YTM

was 7.32% as of January 2017.

SBI Debt Funds : Strategy & View

Accordingly to the fund house, the monetary policy committee (MPC) maintained status quo on Repo

rate, belying the market expectation of a 25bps rate cut. Markedly, the central bank also shifted its

accommodative stance to neutral. As per the fund house, the RBI marked down its growth forecast for

FY17 to 6.9% and expects growth to rebound sharply to 7.4% in FY18. The inflation target has decidedly

shifted to achieving 4% on a durable and calibrated basis. The fund house feels that significant

consideration underpinning the shift in monetary stance is the persistence of core inflation, which could

provide further downward inflexibility in movement of headline inflation. The fund house expects that

upside pressures to inflation are likely from GST, 7th Pay Commission and global developments. The

fund house expects the central bank to closely monitor the growth impact of the currency cancellation

to determine any persistence in the same. The fund house still believes that the policy rate moves

would be data dependent but the adoption of neutral stance is likely to lend bearishness to the bond

market in the near term. The fund house remains constructive, but with a slightly longer term approach.

In SBI Short Term Debt Fund, the average maturity of the portfolio stood at 2.33 years as of January

2017 compared with 2.15 years as of December 2016. The fund’s G-sec exposure stood at around

26% in January 2017 as against 23% in December 2016. The Corporate Debt exposure in the fund was

around 48% in January 2017 compared with 51% in the previous month. The YTM of the fund was

6.95% as of January 2017. In SBI Dynamic Bond Fund, the average maturity of the portfolio stood at

8.63 years in December 2016 as against 6.66 years in December 2016. The fund’s exposure in G-secs

was around 62% in January 2017 as against 60% in December 2016. The portfolio YTM was 6.39% as

of January 2017.

Recommended Funds

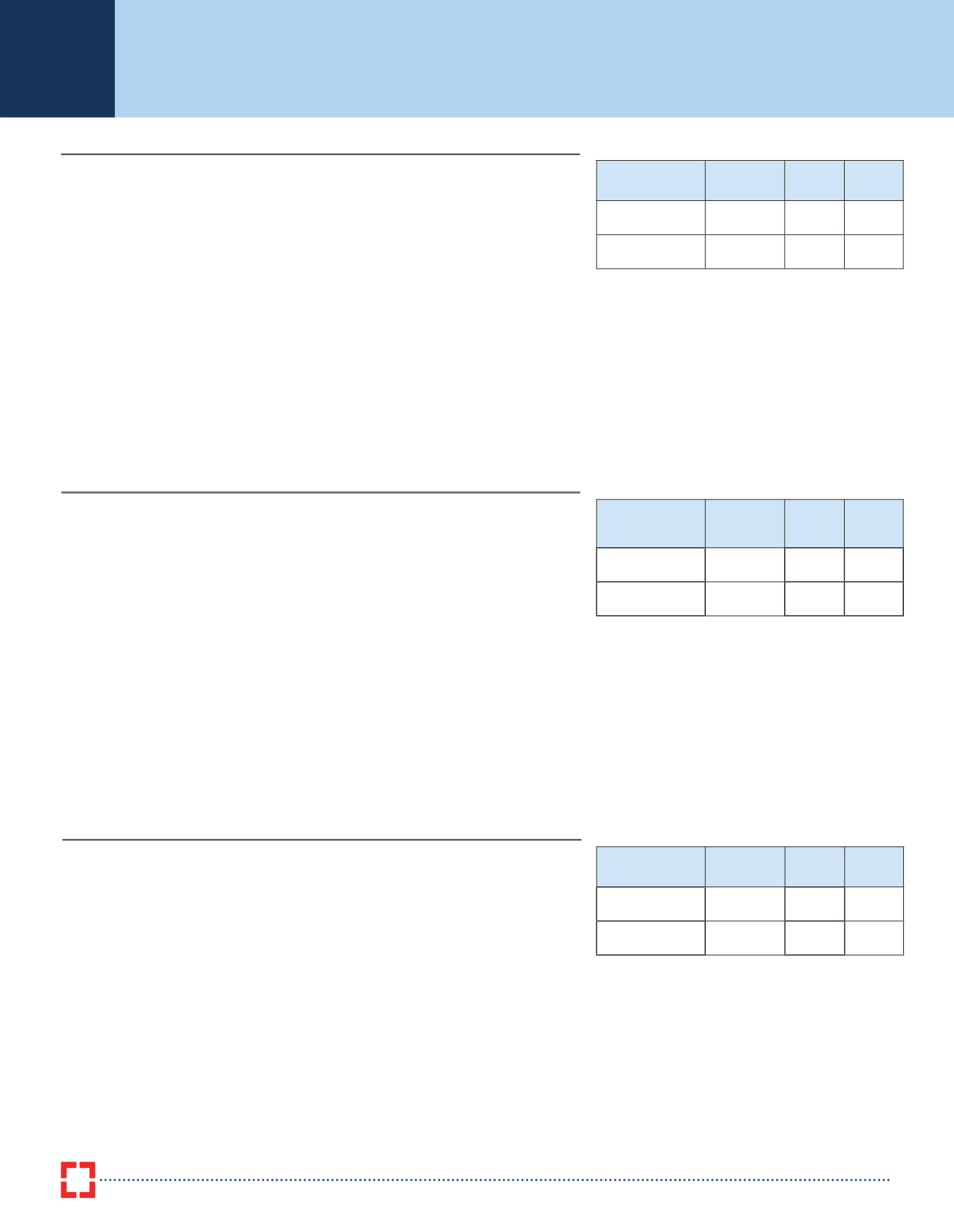

of Birla Sun Life MF Fund Manager Average

Maturity

Investment

Horizon

Birla Sun Life Treasury

Optimizer Plan

Kaustubh Gupta,

Prasad Dhonde 6.12 years 15 Months

& above

Birla Sun Life Dynamic

Bond Fund

Maneesh Dangi 18.21 Years 24 Months

& above

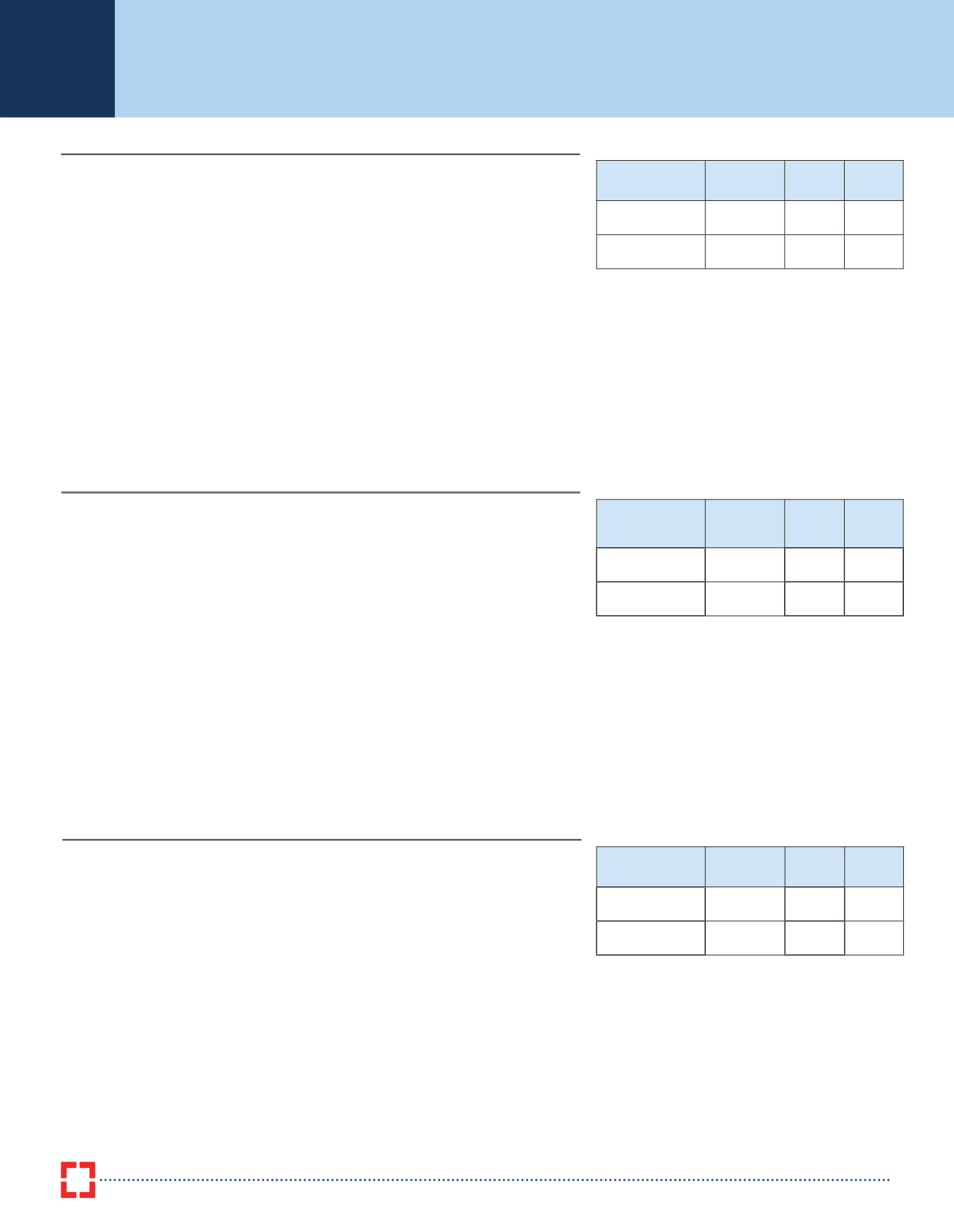

Recommended Funds

of ICICI Prudential MF Fund Manager

Average

Maturity

Investment

Horizon

ICICI Prudential Short

Term Plan

Manish Banthia 3.29 years 12 Months

& above

ICICI Prudential Long

Term Plan

Manish Banthia,

Anuj Tagra 8.44 years 24 Months

& above

Recommended Funds

of SBI MF

Fund Manager Average

Maturity

Investment

Horizon

SBI Short Term Debt

Fund

Rajiv

Radhakrishnan 2.33 years 12 Months

& above

SBI Dynamic Bond

Fund

Dinesh Ahuja 8.63 years 24 Months

& above

M

utual

F

und

S

ynopsis

:

D

ebt

O

riented

F

unds

as

on

31

st

J

anuary

2017

Source for entire data stated above is ICRA Online Ltd. (For Disclaimer of ICRA Online Ltd, refer