34

HDFC Prudence Fund : Strategy & View

Fund Manager:

Prashant Jain

The fund is a balanced fund that endeavours to provide capital appreciation over a long period of time

from a judicious mix of equity and debt investments. Under normal circumstances, the fund invests

in the range of 40%-75% of its corpus in equity & equity-related instruments and 25%-60% in debt &

moneymarket instruments. Asset allocation between equity and debt largely depends upon valuations,

growth outlook and prevailing interest rate scenario. The equity part of the portfolio is managed as

flexi cap strategy, comprising of large, mid and small cap stocks. The fund manager invests in quality

companies with superior growth prospects and are available at reasonable valuations. The debt part

of the portfolio is actively managed based on the interest rate outlook over the next 2-3 years period.

Securities are selected after assessing credit, interest rate and liquidity risk. The fund invests in

debt instruments such as government securities, securitized debt, corporate debentures and bonds,

quasi-government bonds and money market instruments. As per the fund manager, the Union Budget

for FY18 was fiscally prudent as it targeted to maintain the fiscal deficit without compromising on

investment requirements. The budget mainly emphasized to curb the informal economy, improve tax

compliance and widening of tax base, infrastructure development, higher rural income and digitization

to boost the structural economic growth over long term. Further, the impact of higher infra allocation

and several measures taken by the government over the last two years is expected to be seen from

FY18 onwards. The fund manager believes that lower interest rates, improving growth prospects

of the economy and signs of improving corporate profitability creates positive outlook for equity

markets. Hence any volatility in Indian equities induced by global events at a time when the Indian

economy is improving on nearly all parameters will be a good opportunity for investors with long term

perspective. The fund manager is bullish on Banks & Financial Services and has highest exposure in

it. Apart from Banking, the other top sectoral holdings are Construction, Oil & Gas, IT and Auto & Auto

Ancillaries. Currently, the fund has around 74% exposure in equity and around 26% exposure in debt

& cash. Within equity, the fund has around 53% exposure in large cap stocks and 22% exposure in

mid & small cap stocks. The debt portfolio of the fund has an average maturity of 11.93 years. The

fund is recommended for moderate & aggressive investors with an investment horizon of 2-3 years.

ICICI Prudential Balanced Fund : Strategy & View

Fund Manager:

S Naren, Manish Banthia and Atul Patel

The fund is a balanced fund that aims to provide capital appreciation to the investors by using

equity and fixed income instruments. The fund uses an in-house model of Price to Book Value

(P/BV) in which current market levels are compared to the fair value range to determine under

or over valuations of the market. The fund endeavours to maintain an equity allocation in the

range of 65% to 80% based on prevailing market valuations. A lower price to book value than

the fair value range triggers an increase in equity levels and vice versa. The equity part of the

portfolio is maintained as flexi cap strategy and invests into large and mid cap stocks, depending

upon the prevailing market scenarios. The debt portion of portfolio is actively managed and

invests in securities which offer reasonable accrual with credit rating of AA and above. The

fund also takes tactical allocation to longer maturity papers depending upon prevailing interest

rate scenario. As per the fund manager, the government has taken balanced approach in the

Union Budget for FY18 by focusing on need for higher infrastructure spending while maintaining

the fiscal consolidation. The fiscal deficit has been budgeted at 3.2% of GDP (Gross Domestic

Product) in FY18 with a target of achieving 3% of GDP in FY19. Further, the government also

emphasized to bring transparency in the economy, converge informal economy to mainstream

economy, improve tax compliance, rural income and digitization. The fund manager is of the

view that corporate earnings are likely to revive on the back of rise in consumption demand and

improvement in capacity utilization which, in turn, would contribute to increase in profitability.

This would also help the corporates to deleverage their balance sheet and reduce the interest

cost. The fund manager believes that savings are likely to move from physical assets to financial

assets in the backdrop of muted performances by gold and real estate asset classes and due

to lower interest rates on deposits. This is likely to support the equity market growth over the

medium to long term. The fund has highest exposure in Banks & Finance. Apart from Banking,

the other top sectoral holdings are IT, Oil & Gas, Pharma and Telecom. Currently, the fund has

around 66% exposure in equity and around 34% exposure in debt & cash. Within equity, the

fund has around 59% exposure in large cap stocks and around 7% exposure in mid & small

cap stocks. The debt portfolio of the fund has an average maturity of 4.95 years. The fund is

recommended for moderate & aggressive investors with an investment horizon of 2-3 years.

M

utual

F

und

S

ynopsis

- E

quity

F

unds

as

on

31

st

J

anuary

, 2017

Source for entire data stated above is ICRA Online Ltd. (For Disclaimer of ICRA Online Ltd, refer

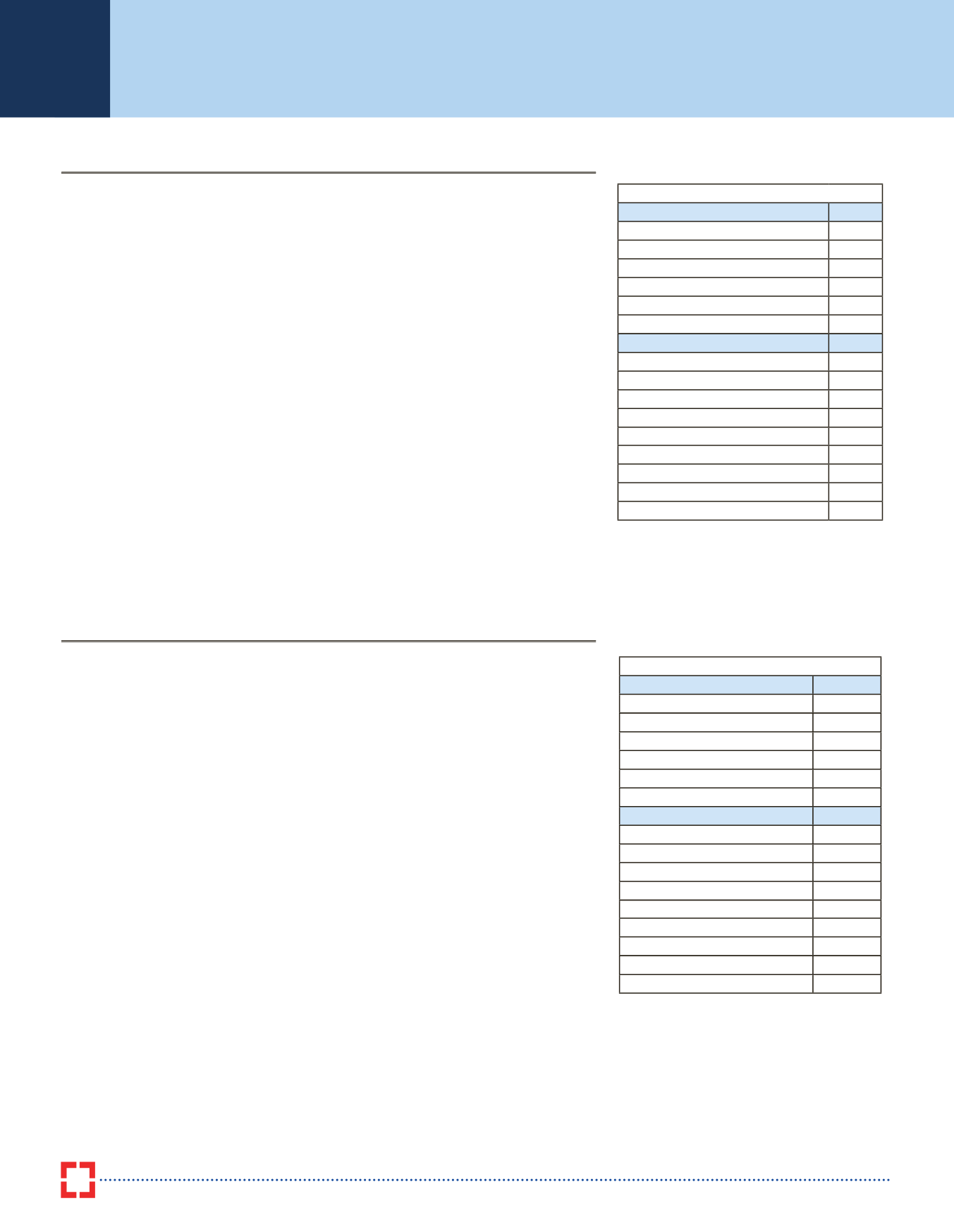

Top Holdings as on 31st January 2017

Company

%

Bharti Airtel Ltd.

5.06

ICICI Bank Ltd.

4.42

Tata Chemicals Ltd.

3.94

Infosys Ltd.

3.81

HDFC Bank Ltd.

3.43

Total

20.66

Sector

%

Banks & Finance

14.17

IT

9.65

Oil & Gas, Energy

9.33

Pharma

6.31

Telecom

5.06

Total

44.52

Debt & Cash

33.61

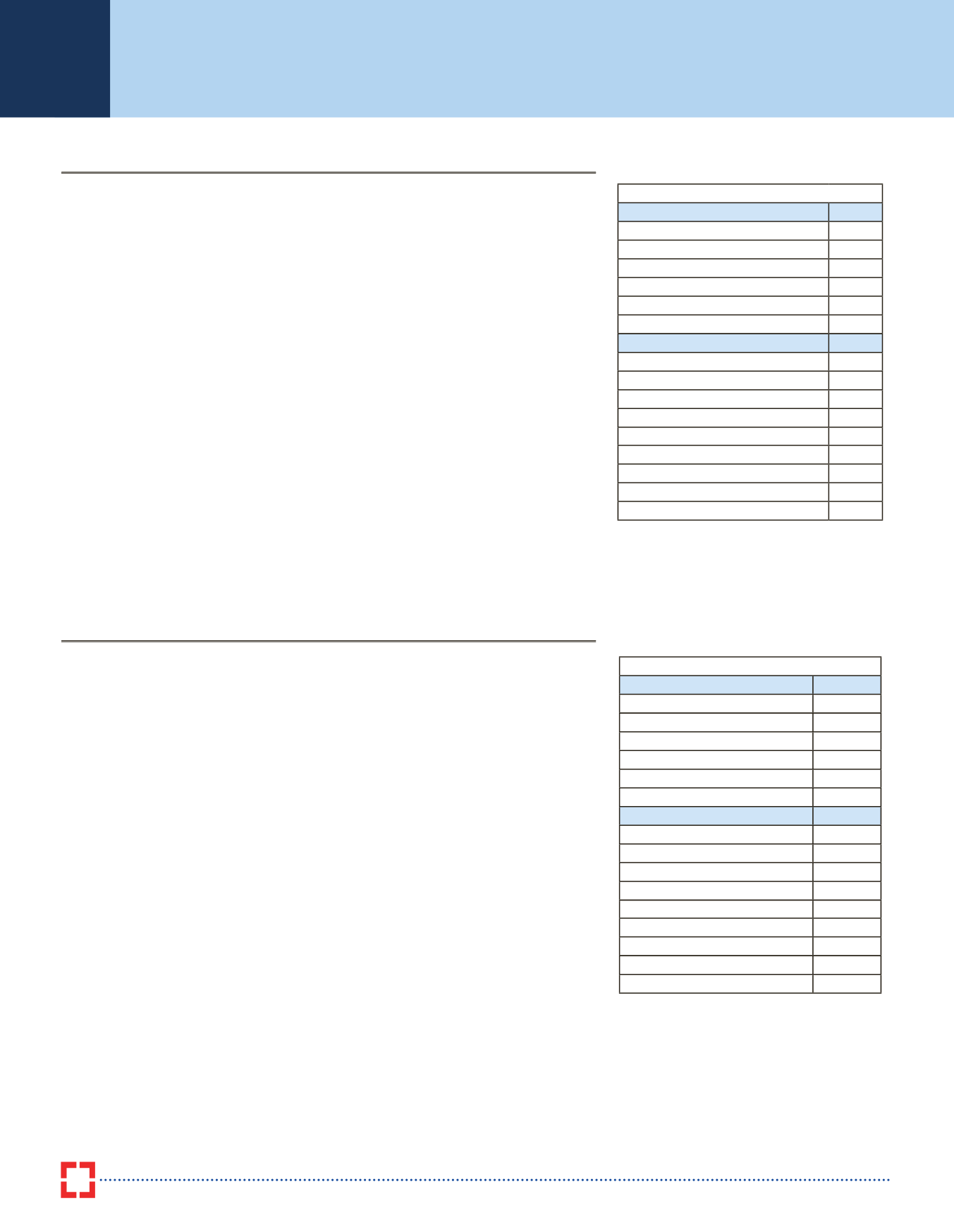

Top Holdings as on 31st January 2017

Company

%

State Bank of India

6.86

Larsen & Toubro Ltd.

6.74

ICICI Bank Ltd.

6.39

Infosys Ltd.

4.38

Tata Steel Ltd.

3.41

Total

27.78

Sector

%

Banks & Finance

20.71

Housing & Construction

8.64

Oil & Gas, Energy

8.04

IT

7.25

Auto & Auto Ancillaries

6.59

Total

51.24

Debt & Cash

25.60