21

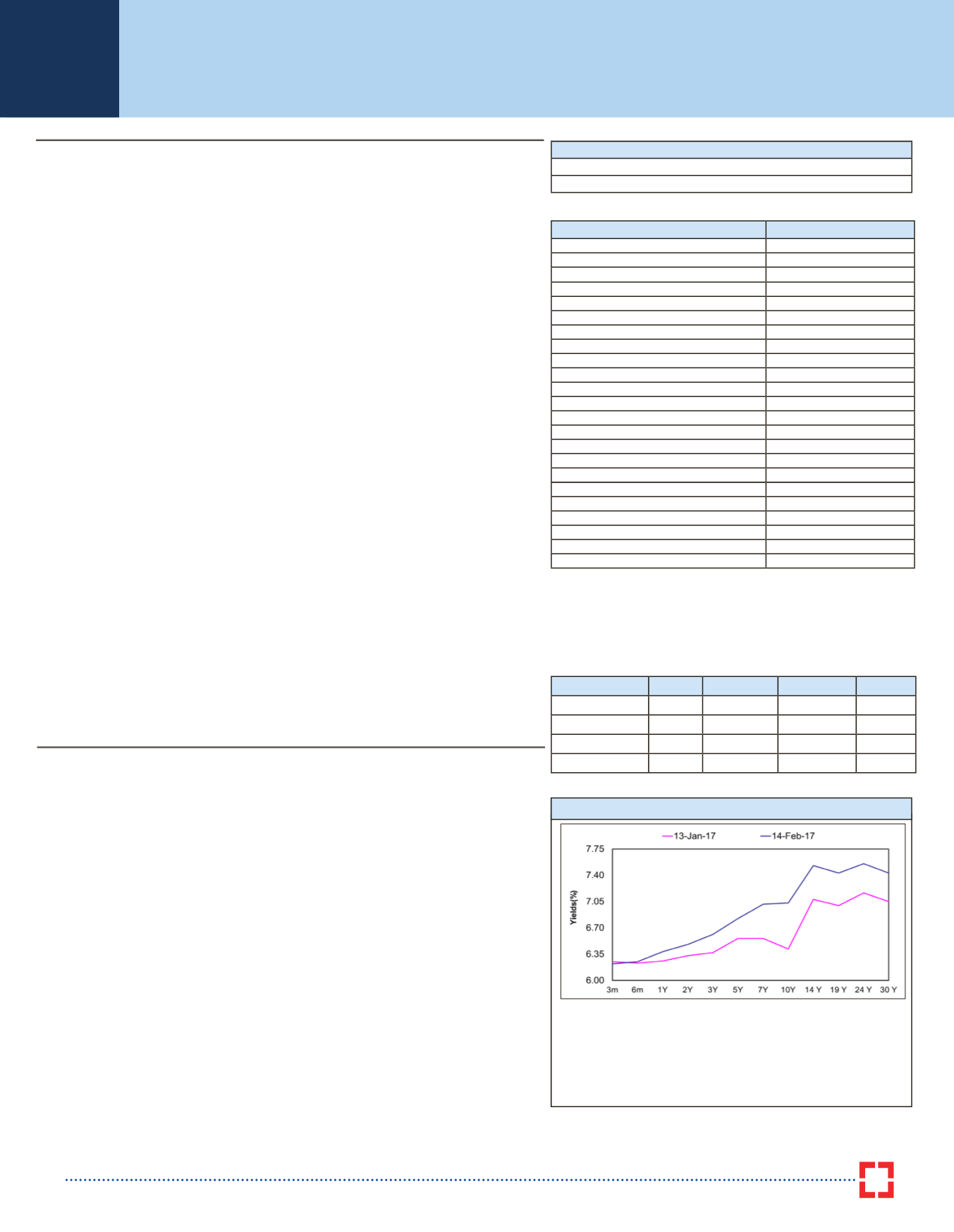

Period

Interest Rate(p.a.)

7 - 14 Days

3.50%

15 - 29 Days

4.25%

30 - 45 Days

5.50%

46 - 60 Days

5.75%

61 - 90 Days

5.75%

91 Days - 6 Months

5.75%

6 Months 1 Day - 6 Months 15 Days

6.00%

6 Months 16 Days

6.00%

6 Months 17 Days - 9 Months 15 Days

6.00%

9 Months 16 Days

6.25%

9 Months 17 Days < 1 Year

6.25%

1 Year

6.90%

1 Year 1 Day - 1 Year 3 Days

6.95%

1 Year 4 Days

6.25%

1 Year 5 Days - 1 Year 15 Days

6.25%

1 Year 16 Days

6.25%

1 Year 17 Days - 2 Years

6.25%

2 Years 1Day - 2 Years 15 Days

6.00%

2 Years 16 Days

6.00%

2 Years 17 Days - 3 Years

6.00%

3 Years 1Day - 5 Years

6.00%

5 Years 1 Day - 8 Years

6.00%

8 Years 1 Day - 10 Years

6.00%

Highlights:

Domestic liquidity conditions

improved during the period as funds continued to remain in the banking system

on account of RBI’s restrictions on cashwithdrawals. Higher deposit growth in the banking systemamidst muted

credit off-take also supported the system liquidity conditions. The daily average system liquidity as measured

by RBI’s Liquidity Adjustment Facility (LAF) was at a surplus of

R

~2.97 trillion during the period compared with

a surplus of

R

~1.53 trillion during the previous period. Absence of issuance of cash management bills (CMBs)

under Market Stabilization Scheme (MSS) also aided the rise in liquidity surplus during the period. Tracking the

liquidity conditions, the overnight call money rates turned volatile and hovered in the range of 5.75%-6.25%.

Government securities

turned volatile tracking global & domestic events and news flows, and closed on a

negative note during the period. The yield on the new 10 year benchmark G-sec, 6.97% 2026 bond, rose sharply

and closed at 6.88% as of 14th February 2017 as against 6.42% as of 13th January 2017, while the yield on

the old 10 year benchmark G-sec, 7.59% 2026 bond closed at 7.03% levels as against 6.56%. In the initial

part of the period anticipation over the outcome of the Union Budget for FY18. RBI’s 6th Bi monthly monetary

policy and caution regarding the economic policies of the US President Donald Trump, led the G-sec yields to

trade in a narrow range. US Federal Reserve Chair Janet Yellen’s hawkish comments in a speech also led to

the rise in the bond yields. Intermittently G-sec yields declined tracking the rise in the system liquidity surplus,

decline in the US treasury yields and some strength in the Rupee against the USD. In another development,

the RBI, in consultation with the government converted four securities from its portfolio maturing in 2017-18

having total face value of about

R

370.78 bn to longer tenor securities maturing in 2024-25 and 2029-30.

This led to positive market sentiments, as the market participants expected that this conversion will reduce

the gross market borrowing for FY18. In the second half of the period the bond yields rose sharply. Post the

announcement of the Union Budget for FY18 the G-sec yields rose marginally as though fiscal prudence was

maintained and the government’s market borrowing were kept almost at the previous year’s levels, there

were no positive surprises in the Union Budget FY18. However G-sec yields rose sharply following negative

sentiments after the announcement to the RBI’s 6th Bi monthly monetary policy. In the monetary policy, the

monetary policy committee (MPC) decided to keep the interest rates unchanged and shifted the policy stance

from “accommodative” to “neutral”. The change in stance of the MPC led to negative sentiments in the bond

markets, as it led the market participants to believe that the scope for further rate cuts has diminished. Apart

from the change in stance, the MPC also sounded cautious on inflation, categorically highlighting upside risks

to inflation in the near term.

India’s Consumer Price Index (CPI)

based inflation continued to decline for the sixth straight month on

back of sharp decline in the food inflation. The headline CPI inflation for January 2017 came in at 3.17% YoY

compared with 3.41% YoY in December 2016 and 5.69% YoY in January 2016. The decline in headline CPI

inflation was primarily due to the fall in food inflation, which was mainly driven by the contraction in Vegetables

and Pulses inflation. The Consumer Food inflation came in at 0.53% YoY in January 2017 as against 1.37% YoY in

December 2016. Core CPI inflation continued to be sticky and it rose in January 2017 compared to the readings

in December 2016. Core CPI for January 2017 came in at 5.07% as against 4.90% as of December 2016.

India’s Index of Industrial Production (IIP)

contracted in December 2016 by 0.4% YoY as against a growth of

5.7% YoY in November 2016. Manufacturing output declined by 2% YoY, whereas mining and electricity showed

positive growth of 5.2% YoY and 6.3% YoY respectively in December 2016. Capital goods index declined by

3% YoY, whereas Consumer goods declined by 6.8% YoY.

Banks’ aggregate credit

growth as of 20th January 2017 stood at 5.9% YoY as against 10.9% YoY as of the

same period last year; whereas banks’ deposit growth continued to remain healthy at 13.9% YoY as against

10.50% YoY as of the same period last year.

Future Outlook

System liquidity

is expected to remain comfortable in the near term amidst higher deposit growth and muted

credit growth. However any measures taken by RBI to suck out excess liquidity might tighten the liquidity

conditions, especially during seasonal demand for funds. Also the recent relaxation of the withdrawal limits

from bank accounts, might put some pressure on banking system liquidity.

Demand-supply dynamics for G-secs

continues to be favorable, with the estimated gross and net government

borrowings for FY18 remaining broadly at similar levels as that of FY17. Also the demand for G-secs from banks

is expected to remain strong in the face of higher deposit growth and muted credit growth. However the net

borrowings of the state governments need to be watched closely, given the fact that the combined borrowings

of Central and State Governments have been rising consistently over the past five years.

Rise in commodity prices, full implementation of 7th Pay Commission and implementation of GST pose upside

risks to the

headline inflation

. Further sticky core inflation also remains a cause of concern for the RBI; though,

higher sowing of Rabi crops is likely to keep the food inflation benign. This along with global financial volatility

may impact RBI’s monetary policy decisions.

Going forward, the

bond markets

will be data dependent and track the movement in headline inflation and

international crude prices as well as exchange rate movement. The “neutral” policy stance in the monetary

policy resolution continues to give flexibility to the RBI to act if the headroom for rate cut is available. However

the change in stance may indicate that Indian interest rates may be nearing the end of rate cutting cycle, though

sudden reversal in interest rate direction is not expected as inflation continues to remain at lower levels and

within RBI’s comfort zone.

With sticky core inflation, continuous rise in crude oil prices and exchange rate volatility; the

volatility in bond

markets

are likely to increase in the near term. On the other hand, surplus liquidity conditions have ensured the

money market rates are near to policy repo rate.

Uncertainty from

global events

like the global monetary policies, economic policies of US president elect

Donald Trump, continuous strengthening of USD and continuous rise in US Treasuries and volatility in Emerging

Market bond yields are likely to increase in volatility in domestic bond markets.

Indicative Quotes

May’17 T Bill 6.22%

August’17 T Bill 6.25%

Note:-The above rates are for amount below

R

1 cr.

(There are differential rates for Senior Citizens)

HDFC FD

- (12-23 Months) – 7.15% (Reg. Monthly Income)

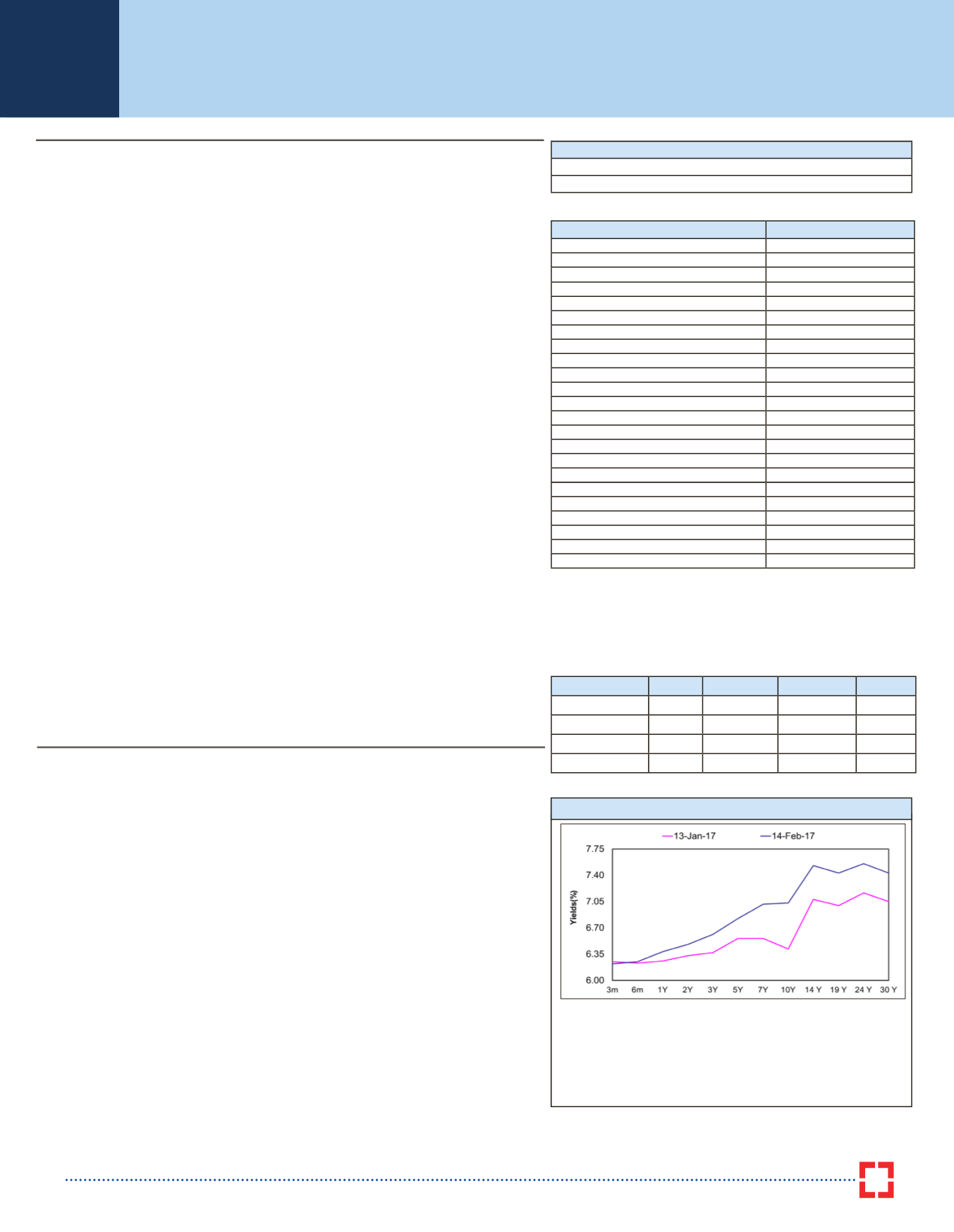

Key Rates

Current

1Mth ago 6 Mth ago 1 Yr ago

1 Yr G-Sec

6.39% 6.25%

6.80% 8.02%

5 Yr G-Sec

6.83% 6.56%

6.95% 7.74%

10 Yr G-Sec

7.03% 6.56%

7.08% 7.72%

5 Yr AAA Bonds 7.22% 7.01%

7.48% 8.30%

HDFC Bank FD Interest Rate (p.a.)

Government Securities Yield Curve

G-sec yields rose across the curve barring the very short end of the yield curve, on

account of negative sentiments. The very short end of the curve saw a marginal

decline following the rise in system liquidity surplus. Yields rose in the range of

2-46 bps across the curve. The 6.97% 2026 benchmark G-sec closed about 46 bps

higher on aMoMbasis. Terms spreads alsowidened during the periodwherein the

spread between the 1year and the 10 years G-secs rose to about 50 bps as of 14th

Feb 2017 as against 16 bps as of 13th Jan 2017; whereas the spread between 5

years and 30 years G-secs widened to 61 bps from 49 bps.

16 January 2017 to 14 February 2017

Yields

Call Rates range for Jan’17-Feb’17

High – 6.25%

Low – 5.75%

HDFC Bank Recommendation:

Investments in Short Term Funds can be considered with an investment horizon of 12 months. Investment into Medium Term Funds with an investment horizon

of over 15 months can be considered by moderate and conservative investors. Income/Duration Funds can be considered by aggressive investors for a horizon of 24 months and above; though

preference currently should be given to dynamically managed funds. Investors looking to invest with a horizon of 1 to 3 months can consider Liquid Funds, while Ultra Short Term Funds can be

considered for a horizon of 3 months and above.

D

ebt

O

verview

Source:- Bloomberg and in.reuters.com

Source:- in.reuters.com