14

T

he

U

nion

B

udget

2017-18

Personal Income Tax: Proposed Change

In order to broaden the tax base and in order to incentivise honest

tax payers and salaried employees, the finance minister proposed

certain changes in taxation on personal income.

Though the income slabs were kept unchanged, changes were

made in the tax rate for individuals. The following are the income

slabs and tax rates proposed by the finance minister.

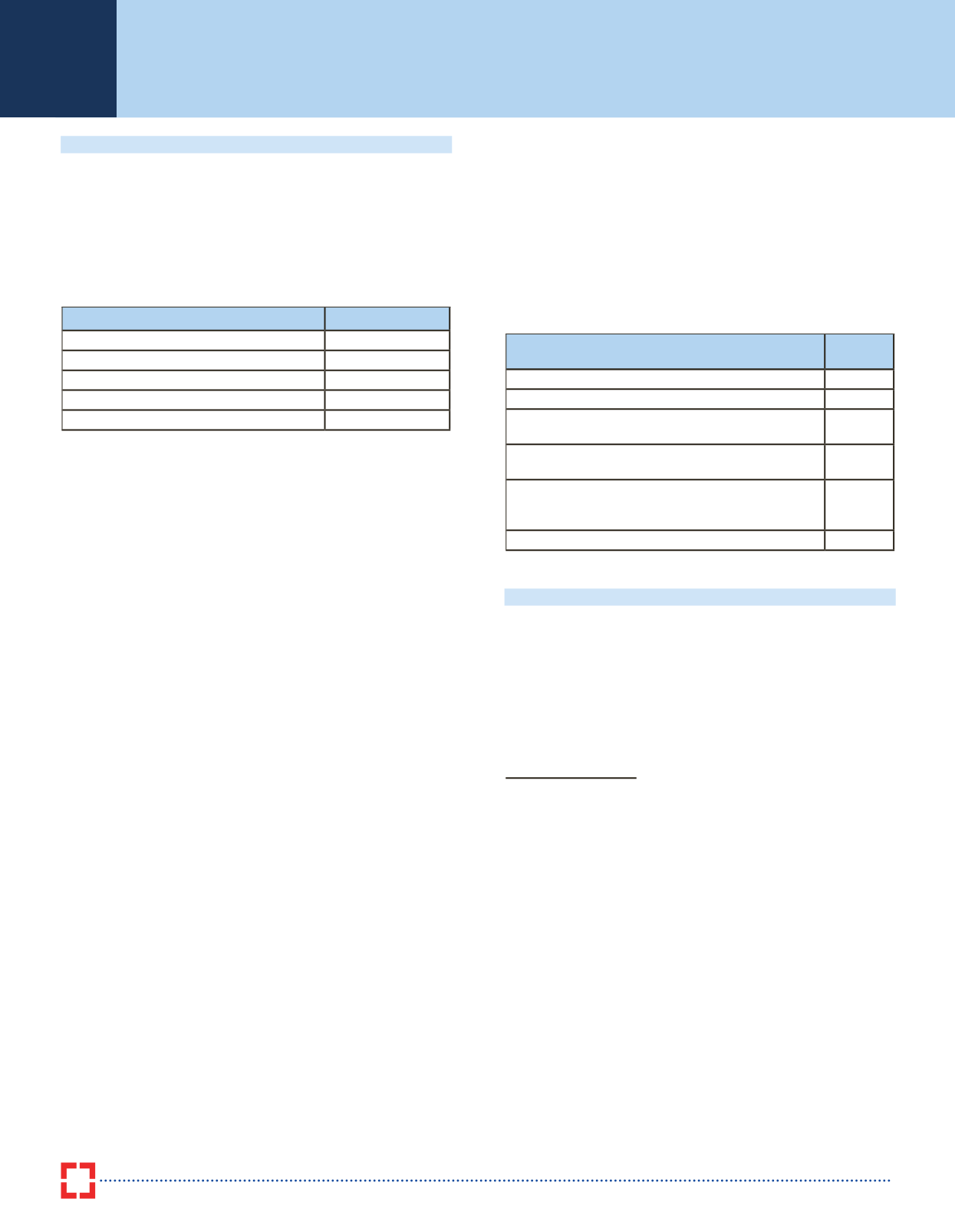

For individual Tax Payers

Tax Slabs

(2017-18)

Income

(

R

)

Tax Rate (%)

0 mn – 0.25 mn

0%

0.25 mn – 0.5 mn

5%

0.5 mn – 1 mn

20%

Above 1 mn

30%

The following points were proposed for individual tax payers:

• Existing rate of taxation for individual assessees between

income of

R

0.25 mn to

R

0.5 mn is proposed to be reduced to

5% from the present rate of 10%.

• It has been proposed to introduce a surcharge of 10% on

tax payable by individuals whose annual taxable income is

exceeding

R

5 mn but not exceeding

R

10 mn. The surcharge

on tax payable by individual whose annual taxable income is

exceeding

R

10 mn remains unchanged.

• In order to incentivize cash less economy and transparency,

it is proposed that no deduction shall be allowed under the

section 80G in respect of donation of any sum exceeding two

thousand rupees unless such sum is paid by any mode other

than cash. This amendment will take effect from 1st April,

2018 and will, accordingly, apply in relation to the assessment

year 2018-19 and subsequent years.

• It has been proposed to reduce the period of holding from the

existing 36 months to 24 months in case of immovable property,

being land or building or both, to qualify as long term capital

asset. Also, the base year for indexation has been proposed to

be shifted from 1.4.1981 to 1.4.2001 for all classes of assets

including immovable property.

• It has been proposed to amend the section 54EC so as to

provide for investment in any bond to be eligible for exemption,

if it is notified by the Central Government and redeemable after

three years. This amendment will take effect from 1st April,

2018 and will, accordingly, apply in relation to the assessment

year 2018-19 and subsequent years.

• It has been proposed to phase out the deduction under section

80CCG (i.e. Rajiv Gandhi Equity Saving Scheme-RGESS)

from assessment year 2018-19. However, assessees who

have claimed deduction under this section for assessment

year 2017-18 and earlier assessment years shall be allowed

deduction under this section till the assessment year 2019-20.

This amendment will take effect from the 1st April, 2018 and

shall accordingly apply in relation to assessment year 2018-19

and subsequent years.

• It has been proposed that setting-off of loss under the head

“Income from house property” against any other head of

income shall be restricted to

R

2 lakhs for any assessment

year. However, the unabsorbed loss shall be allowed to be

carried forward for set-off in subsequent years in accordance

with the existing provisions of the Act. This amendment will

take effect from 1st April, 2018 and will, accordingly apply in

relation to assessment year 2018-19 and subsequent years.

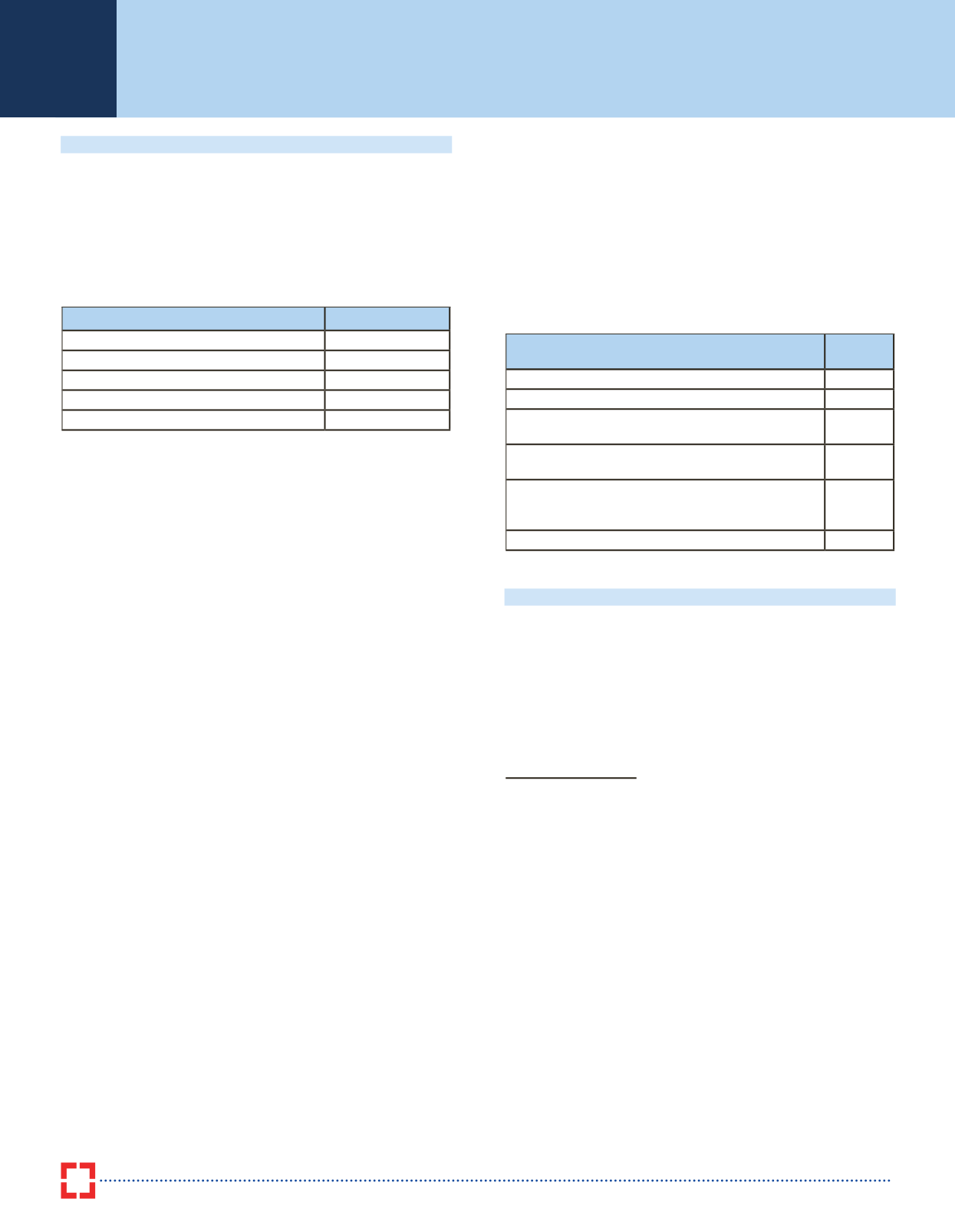

Details of tax deductions

Amount

(

R

)

Deduction u/s 80C

1,50,000

Deduction u/s 80CCD

50,000

Deduction u/s 80D on health insurance premium for

self

25,000

Deduction on account of interest on house property

loan (Self occupied property)

2,00,000

Deduction u/s 80EE* on interest paid on loan by an

individual for acquisition of a residential house

property

50,000*

Exemption of transport allowance

19,200

* For first time home buyers

Mutual Funds

Consolidation of schemes:

It is proposed to provide that cost

of acquisition of the units in the consolidated plan of mutual fund

scheme shall be the cost of units in consolidating plan of mutual

fund scheme and period of holding of the units of consolidated

plan of mutual fund scheme shall include the period for which the

units in consolidating plan of mutual fund scheme were held by

the assessee.

Debt Market Outlook

The Union Budget for FY18 was neutral from the perspective

of Indian bond markets. The finance minister continued to

follow the path of fiscal consolidation in line with market

expectations;

although the finance minister shifted the FRBM

target by another year to push through higher public spending

for providing an impetus to economic growth.

The fiscal deficit

target for FY18 has been estimated at 3.2% of GDP as against

earlier estimates of 3% of GDP in the previous budget.

The

fiscal deficit target of 3% of GDP for FY19 remains unchanged from

the previous estimates.

The gross and net market borrowings

for FY18 have been pegged at

R

5.8 trillion and

R

3.48 trillion,

respectively; and have remained largely unchanged from the

current fiscal’s revised market borrowings. The revised gross

and net market borrowings for FY17 were

R

5.82 trillion and

R

3.47 trillion.

On the day of the Budget the yields of the 10-year benchmark

G-secs fell initially on announcement of lower fiscal deficit and

net borrowings by the finance minister. However, the yields of the