15

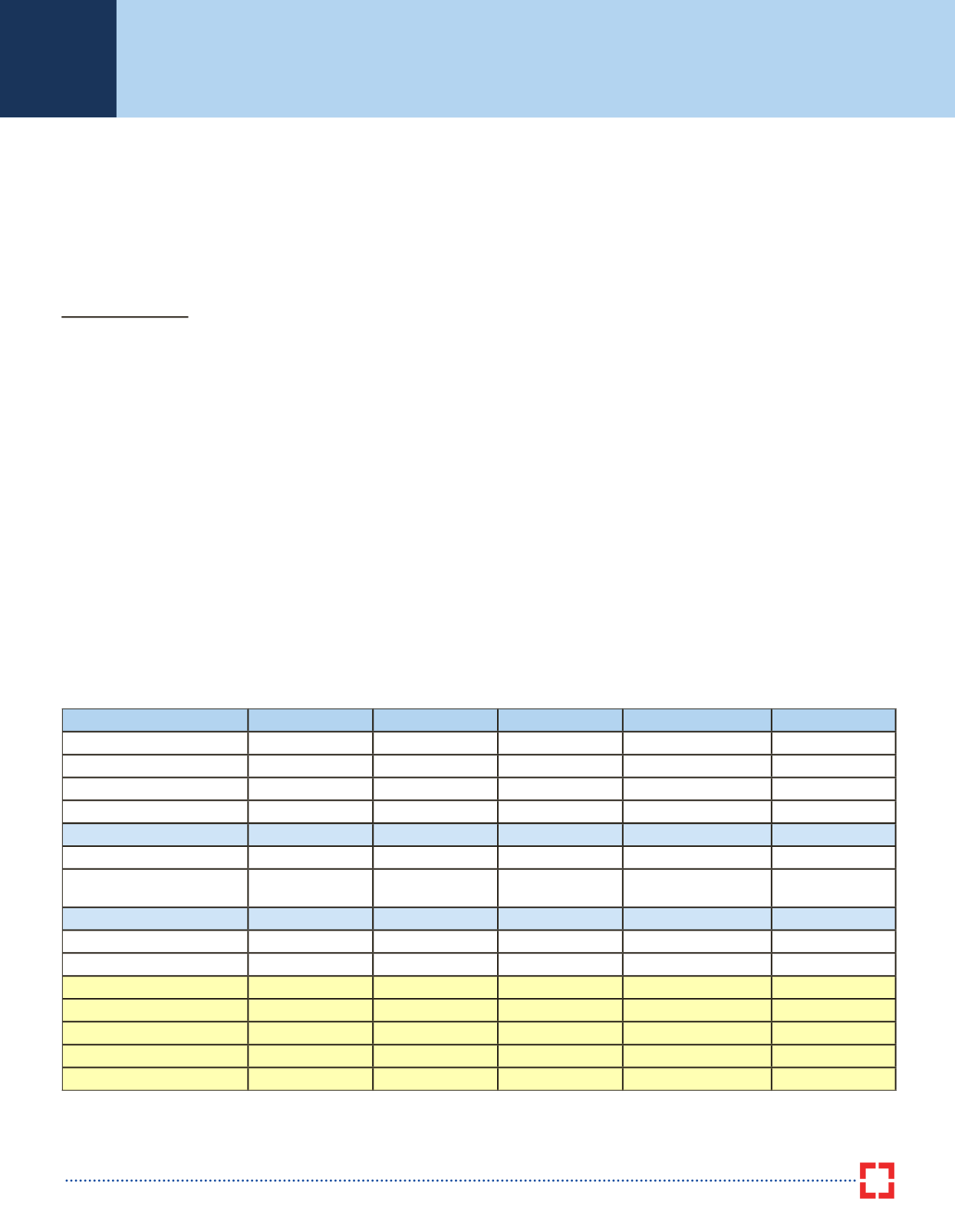

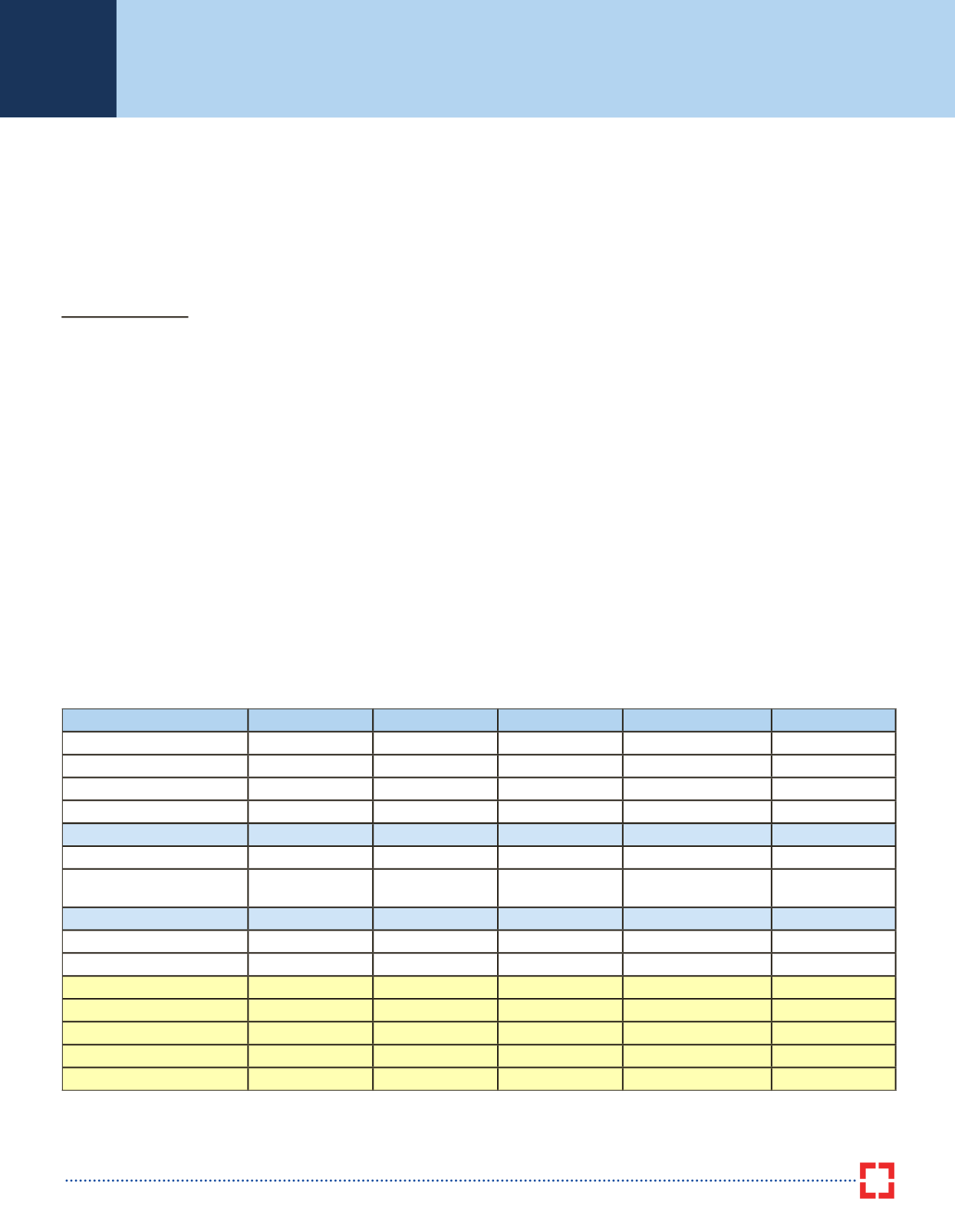

Particulars

R

Bn

2015-16 Actuals

2016-17 BE

2016-17 RE

2017-18 BE

% Change

A. Revenue Receipts

11950.25

13770.22

14235.62

15157.71

6.48%

Tax Revenue (net to centre)

9437.65

10541.01

10887.92

12270.14

12.69%

Non-tax Revenue

2512.60

3229.21

3347.70

2887.57

-13.74%

B. Capital Receipts

5957.48

6010.38

5908.45

6309.64

6.79%

Total Receipts (A+B)

17907.83

19780.6

20144.07

21467.35

6.57%

C.Scheme Expenditure

7251.14

8019.66

8698.47

9450.78

8.65%

D.Expenditure on Other

than Schemes

10656.69

11760.94

11445.6

12016.57

4.99%

Total Expenditure (C+D)

17907.83

19780.6

20144.07

21467.35

6.57%

Revenue Expenditure

15377.61

17310.37

17345.6

18369.34

5.90%

Capital Expenditure

2530.22

2470.23

2798.47

3098.01

10.70%

Revenue Deficit

3427.36

3540.15

3109.98

3211.63

3.27%

as a % of GDP

-2.5

-2.3

-2.1

-1.9

Fiscal Deficit

5327.91

5339.04

5342.74

5465.32

as a % of GDP

-3.9

-3.5

-3.5

-3.2

GDP

136613

152544

150754

168475

Budget at glance

* All figures in

R

Bn except the YoY % figures

10 year benchmark G-secs inched up and ended almost 1-2 bps

higher than the previous day’s closing levels.

The bond markets

remained at the sidelines post the budget announcements due

to lack of any positive surprises on fiscal deficit as well as net

borrowings in the Union Budget for FY18.

The yield on the old

10-year benchmark G-sec (7.59% GS 2026) rose by 1 bp, to end

at 6.55%; while the yield on the new 10-year benchmark G-sec

(6.97% GS 2026) rose by 2 bps to close at 6.43%.

Investment Strategy

The Union Budget for FY18 has maintained fiscal prudence

amidst limitations of slow private spending and push for

public spending.

The estimated gross and net market borrowings

of Central Government for FY18 have also remained broadly

unchanged from the revised borrowings in FY17.

This may not

lead to any significant rise in the net supply of G-secs in FY18

compared to FY17. This may mean that the overall supply of

G-secs in FY18 is likely to depend upon the net borrowings

from State Governments. Over the last five financial years

as of FY16, the combined borrowings of Central and State

Governments have been rising consistently every year.

However, higher deposit growth and muted credit growth is likely

to be favourable for the demand-supply dynamics.

The focus of the domestic fixed income markets will now shift

to the monetary policies from US FOMC and RBI. The hawkish

remarks by the US Federal Reserve Chair, Janet Yellen, in the

recent past have raised the market expectations of faster pace

of rate hikes in the US. This may lead to turbulence in global

financial markets and may impact foreign portfolio flows in

to Indian capital markets.

FPIs have been net sellers of Indian

bonds over the last four months as of January 2017. If such selling

continues then it is likely to increase the volatility in the Indian

G-secs. However, in such scenarios, domestic demand may limit

any sharp rise in the bond yields. Further, any reversal of FPI flows

is positive for bond yields.

Headline CPI inflation has moderated sharply in the recent

past on back of sharp decline in food inflation over the last

4 months. Rise in commodity prices, full implementation of

7th Pay Commission and implementation of GST poses upside

risks to inflationary expectations.

Further sticky core inflation

also remains a cause of concern for the RBI. However, higher

sowing of Rabi crops is likely to keep the food inflation benign.

This along will global financial volatility as mentioned above may

impact RBI’s monetary policy decisions.

Investments in Short Term Funds can be considered with an

investment horizon of 12 months. Investment intoMedium Term

Funds with an investment horizon of over 15 months can be

considered by moderate and conservative investors. Income/

Duration Funds can be considered by aggressive investors for

a horizon of 24 months and above; though preference currently

should be given to dynamically managed funds. Investors

looking to invest with a horizon of 1 to 3 months can consider

Liquid Funds, while Ultra Short Term Funds can be considered

for a horizon of 3 months and above.

T

he

U

nion

B

udget

2017-18