19

B

ull ion

R

eview

The Month

The yellow metal found support at the beginning of the year.

Gold prices surged by about 7% towards the $1240/oz levels, as

against $1150/oz at the close of the year (2016). Meanwhile, the

uncertainty over President Trump’s policies has led to significant

corrections in the dollar’s strength over the last couple of weeks,

prompting investors and money managers to buy gold. The metal’s

safe haven status has also attracted investment with rising

geo-political risks.

On the other hand, global gold ETFs remained flat to marginally

negative during the last one month despite the price rise. This is

somewhat unusual as gold ETFs maintain a high positive correlation

with gold prices. During the month, the world’s largest Gold ETF,

SPDR Gold ETF’s holdings dropped by 23 tonnes ($0.9 bn) to

803 tonnes.

Gold has been in the thick of action in the last few months both

internationally and in the domestic market. On November 8, 2016,

the announcement of demonetisation apparently led to a spurt in

demand for the precious metals. The rush remained short-lived

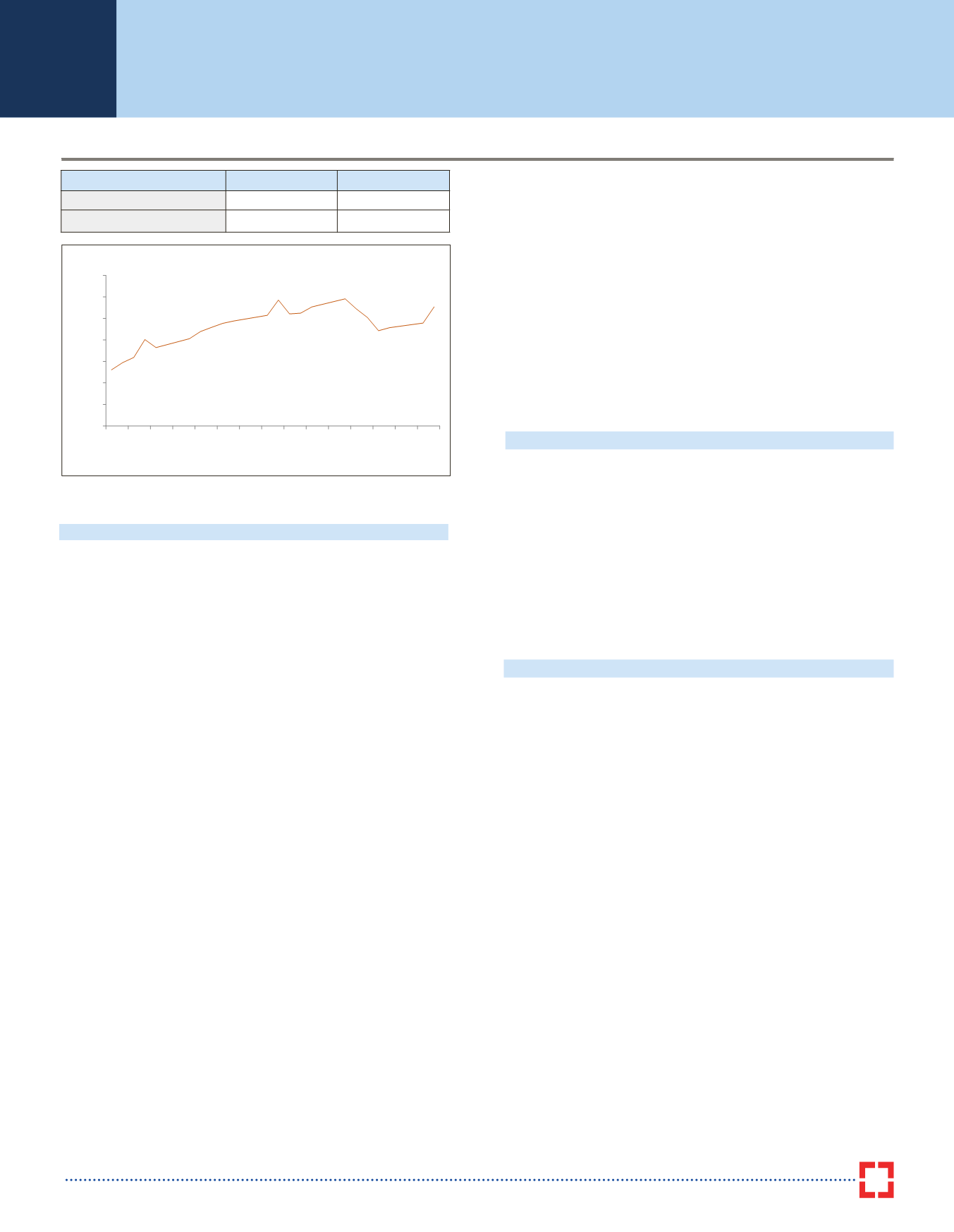

Gold Movement in January 2017

however, as scarcity of cash put demand off the market. We get

a sense that the impact of demonetisation is not going to create

any significant upheaval in the domestic bullion industry, and in

fact may help the trade to become more organised in medium to

long term.

Also, the gold trading community was hoping for a reduction in

custom duty for the precious metals in the Union Budget, which

kept domestic demand under check almost all through January.

However, with no custom duty change in the budget, we expect

pent-up demand to follow through in the coming weeks. Prices

in the domestic market are hovering around the

R

29500/10 gm

level and consumption may get affected if prices pierce through

the

R

30,000 mark.

Projection

Gold prices are likely to be driven by US policies and the FED’s

rate hike decision. They look stronger on charts though. However,

one cannot ignore the strong economic indicators coming out of

the US. March hike expectations are off the table now which is

supportive to gold prices. The $1250/oz level is key resistance and

sellers are likely to get active around these levels. We expect the

market to remain volatile in the coming months, and it can surprise

both the bulls and bears by testing the extremes of the range, i.e.,

$1180-1275/oz.

Disclaimer:

This communication is for informational purposes and is not

guaranteed as to accuracy, nor is it a complete statement of the

financial products or markets referred to therein. This is not a

recommendation, offer or solicitation to buy or sell any instrument

pertaining to any asset class including, but not limited to currencies,

interest rates, commodities and equities in underlying market or

any form of derivatives on any of them or a combination of any

of them. Neither HDFC Bank Ltd. (including its group companies)

nor any employees of HDFC Bank Ltd. (including those of its

group companies) accepts any liability arising from the use of this

communication.

Source:- Bloomberg & NCDEX

14-Feb-17

High

Low

USD - 1228.20

1218.10

1152.15

INR - 29074.00

29250.00

27591.00

1100

1120

1140

1160

1180

1200

1220

1240

2-Jan

4-Jan

6-Jan

8-Jan

10-Jan

12-Jan

14-Jan

16-Jan

18-Jan

20-Jan

22-Jan

24-Jan

26-Jan

28-Jan

30-Jan

Gold - USD Per Ounce