50

th

ANNUAL REPORT 2015-2016 THE GEM & JEWELLERY EXPORT PROMOTION COUNCIL

110

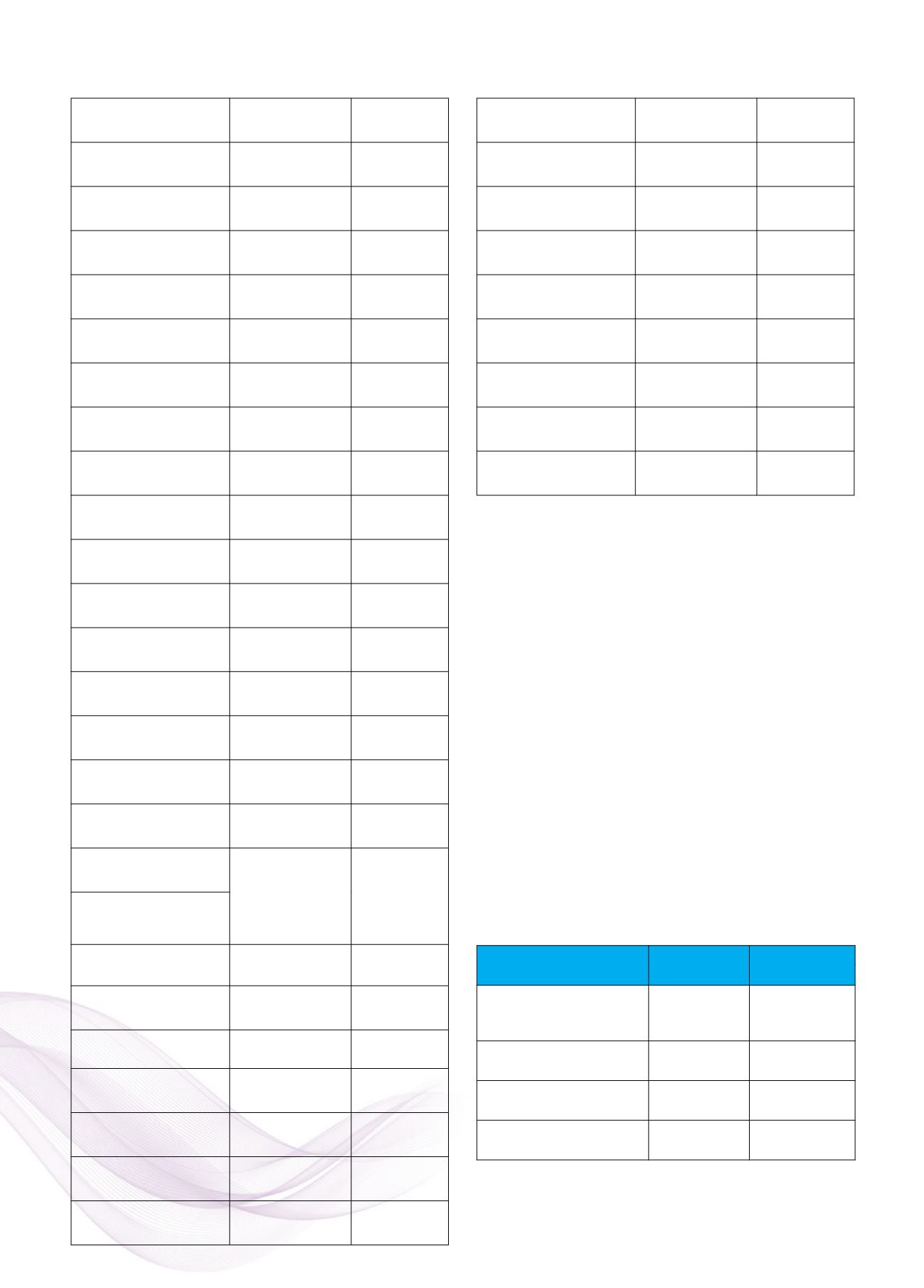

4. Benefits Paid

(1,186,222)

(17,10,814)

5. Actuarial (gain)/loss on

Obligation

596,146

(18,58,268)

6. Present Value of

Obligation as at end of

year

5,345,195

45,10,130

Changes in the fair value

of plan assets

Fair Value of Plan Assets

at beginning of year

7,507,468

71,39,177

2. Expected Return on

Plan assets

600,439

6,23,254

3. Contributions

205,690

12,15,308

4. Benefits Paid

(1,186,222)

(17,10,814)

5. Actuarial gain/(loss) on

Plan Assets

Nil

Nil

6. Fair Value of Plan

Assets as at end of year

7,127,376

72,66,925

Fair value of plan assets

1. Fair Value of Plan

Assets at beginning of

year

7,507,468

71,39,177

2. Actual Return on Plan

assets

600,439

6,23,254

3. Contributions

205,690

12,15,308

4. Benefits Paid

(1,186,222)

(17,10,814)

5. Fair Value of Plan

Assets as at end of year

7,127,376

72,66,925

6. Funded Status

1,782,181

27,56,795

Excess of Actual over

estimated return on plan

assets

Nil

Nil

(Actual Rate of Return –

Estimated rate of return

as ARD falls on 31

st

March)

Actuarial

Gain/Loss

Recognized

Actuarial (Gain)/Loss on

obligations

(596,146)

18,58,268

Actuarial (Gain)/Loss for

the year – plan assets

Nil

Nil

Actuarial (Gain)/Loss on

obligations

596,146

(18,58,268)

Actuarial

(Gain)/Loss

recognized in the year

596,146

(18,58,268)

Present

Value

of

obligations as at the end

of year

5,345,195

45,10,130

Fair Value of plan assets

as at the end of the year

7,127,376

72,66,925

Fund Status

1,782,181

27,56,795

Net

Asset/(Liability)

recognized in Balance

Sheet

(1,782,181)

(27,56,795)

1. Current Service Cost

739,316

8,86,649

2. Interest Cost

384,885

5,32,782

3. Expected Return on

Plan Assets

(600,439)

(6,23,254)

4. Net Actuarial (gain)

loss recognized in year

596,146

(18,58,268)

5. Expenses Recognized

in the statement of

Income & Expenditure

1,119,908

(10,62,091)

1. Discount Rate

8%

8%

2. Expected Rate of

Salary Increase

4%

4%

26.

The Council has not received any intimation from

suppliers/creditors regarding their status under the

Micro, Small and Medium Enterprises Development Act,

2006 and hence disclosures, if any, relating to amounts

unpaid as at the year-end together with interest paid/

payable as required under the said Act have been

given to the extent such information is available with

the Company.

27.

Sundry Debtors, Sundry Creditors and certain

advances are subject to confirmation from concerned

parties and reconciliation, if any. The Management

does not expect any material difference affecting the

current year’s financial statements.

28.

In the opinion of the Committee of Administration of

the Council, the Non-Current Assets excluding Fixed

Assets, Current Assets, Loans and Advances are

approximately of the value stated in the balance sheet,

if realised in the ordinary course of business and Other

Liabilities are not in excess of the amounts reasonably

necessary.

29.

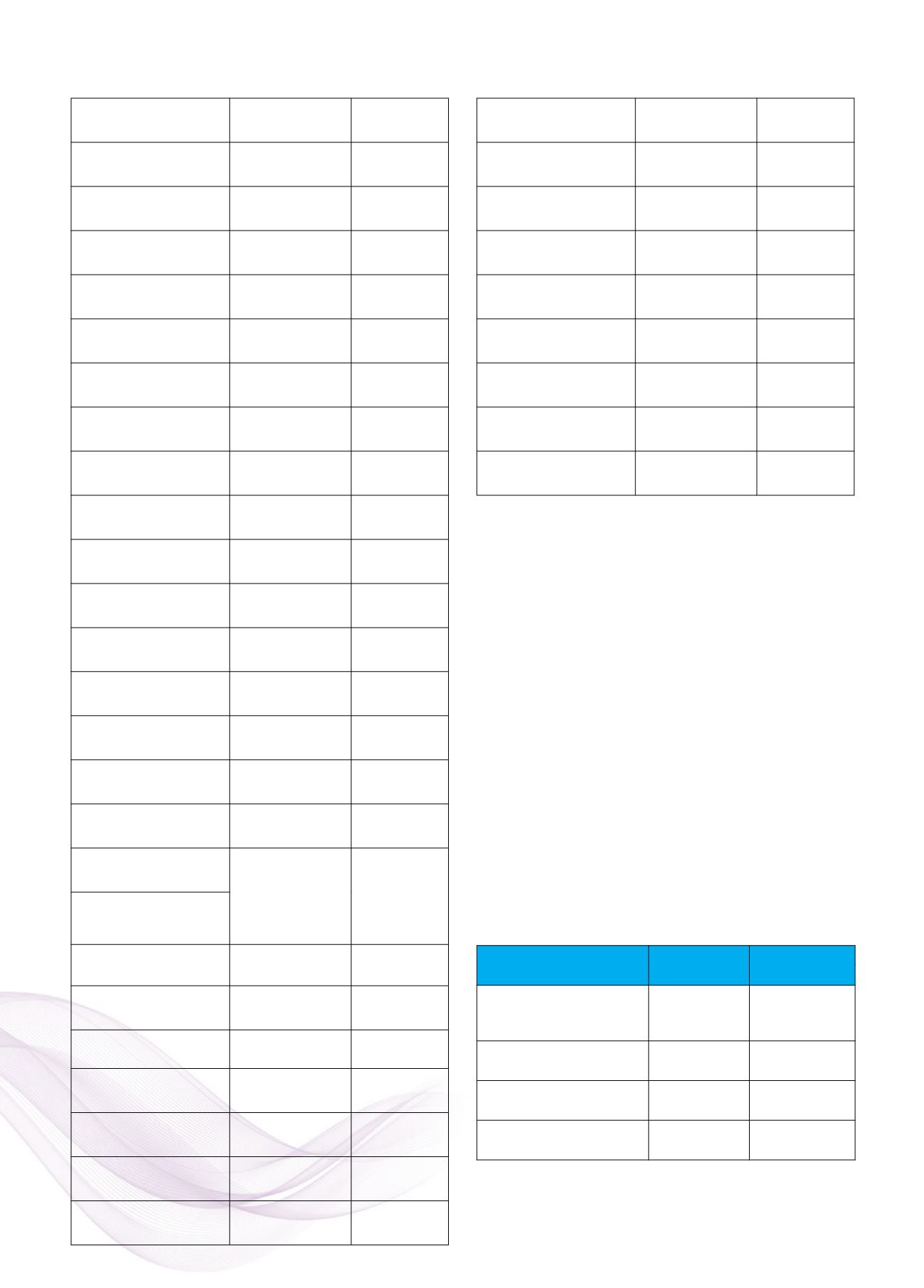

Earnings in Foreign Currency:

Particulars

2015-16

2014-15

Rupees

Rupees

India International Jewellery

Sow, 2015 (Stall Booking)

67,902,052

93,395,737

Signature IIJS, 2016 Show

2,260,198

2,351,784

India Gem & Jewellery

Machinery Expo, 2016

15,496,098

1,758,503

Global Gem & Jewellery

Fair – Dubai

-

988,981

THE GEM & JEWELLERY EXPORT PROMOTION COUNCIL

(A COMPANY LIMITED BY GUARANTEE AND NOT HAVING SHARE CAPITAL)

NOTES TO THE STANDALONE FINANCIAL STATEMENTS FOR THE YEAR ENDED 31ST MARCH, 2016