50

th

ANNUAL REPORT 2015-2016 THE GEM & JEWELLERY EXPORT PROMOTION COUNCIL

108

22.

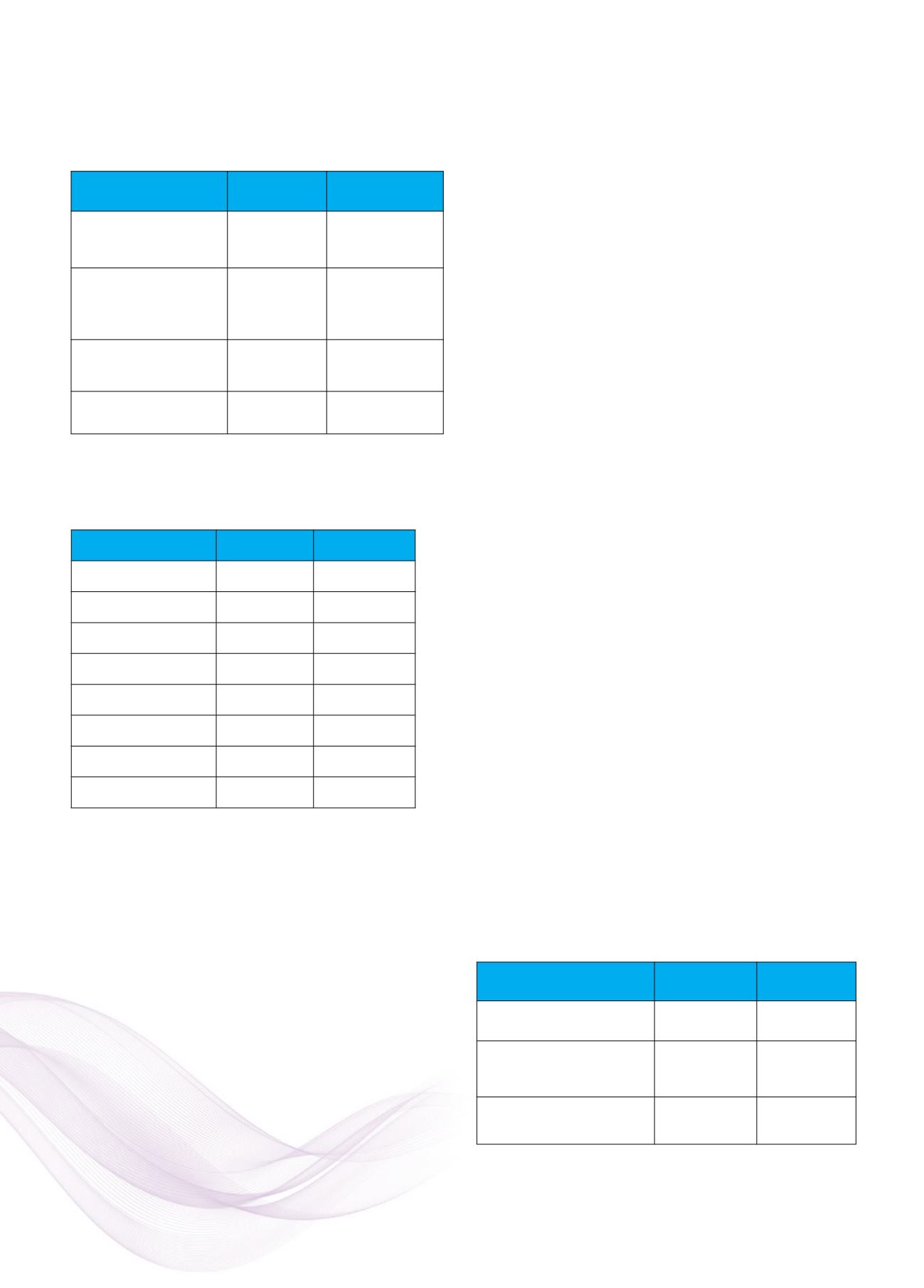

Contingent Liabilities:

Particulars

2015-2016

Rupees

2014-2015

Rupees

Compensation payable

to Brand Ambassador

Nil

80,00,000

Claims by Employees/

Ex-employees of the

Council, pending in legal

suits

Not

ascertained

Not ascertained

Bank Guarantees

Outstanding

1,80,07,435 1,80,07,435

Income-Tax Demands

disputed in appeals

13,30,84,827 6,32,05,900

(e) The Commissioner of Central Excise, Thane II, has

determined and confirmed demand of Service Tax

and has imposed penalties as under:

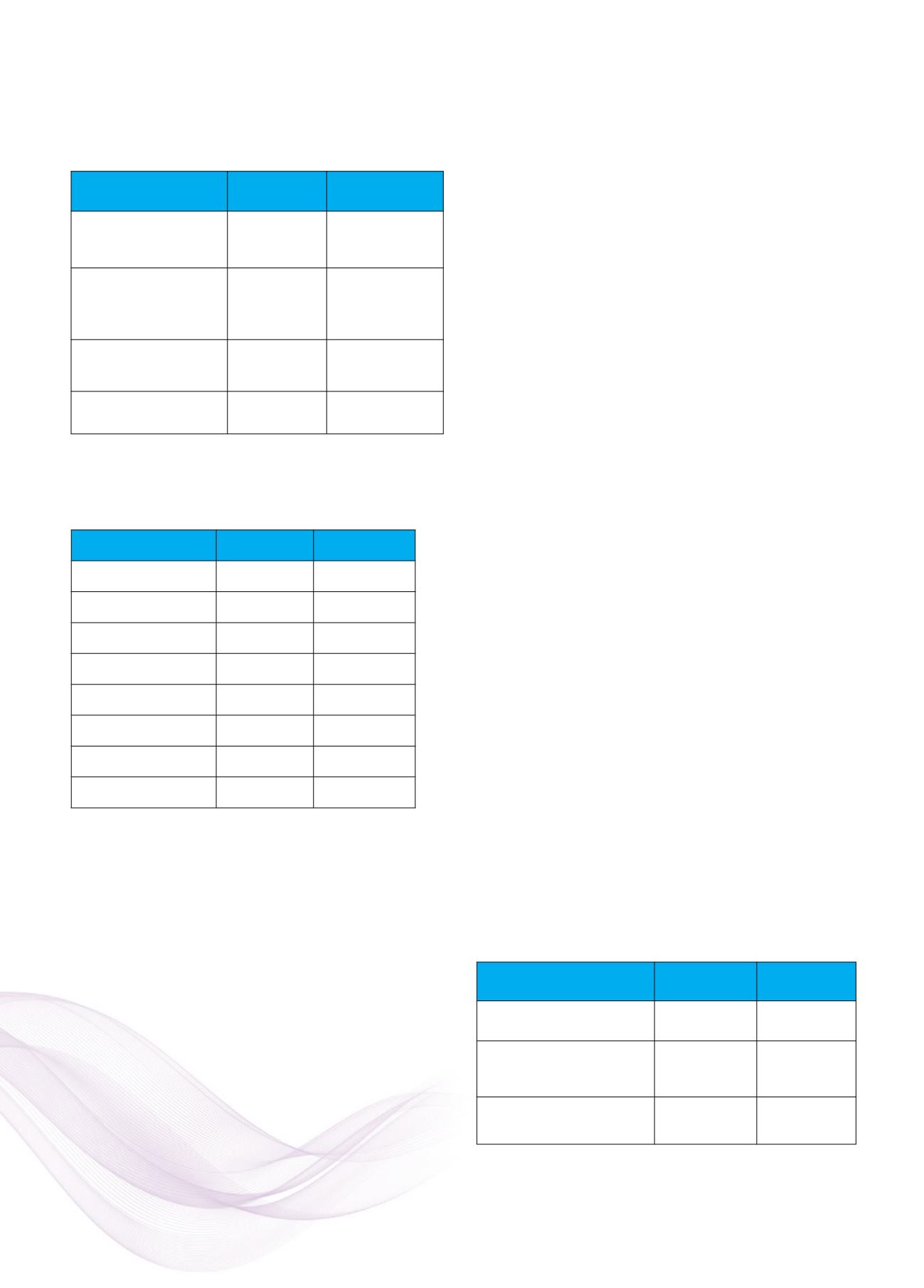

Particulars

2015-2016

Rupees

2014-2015

Rupees

F.Y.2005-06 TO

2010-11

Service Tax

12,05,15,496 12,05,15,496

Penalty

12,15,15,496 12,15,15,496

F.Y. 2011-12

Service Tax

2,70,25,001

2,70,25,001

Penalty

10,000

10,000

Interest on above

77,93,355

77,93,355

Total

27,68,59,348 27,68,59,348

The Council has preferred appeals before the Appellate

Tribunal against the Orders imposing the above

liabilities. The Council has also deposited a sum of

Rs.1,10,65,583/- as “Service tax paid under Protest”.

The liability if any, in respect of the above will be accounted

for when confirmed/upheld by the Appellate Tribunal.

(f) Estimated amount of contracts remaining to be executed

on Capital account and not provided for (net of advances):

NIL (2014-2015: Rs. 5.91 Lakhs)

23.

(1)

In terms of legal opinions obtained by the

Council, the Entertainment Duty under the

Entertainment Duty Bombay, Act 1923 (the

Act) is not leviable in respect of the exhibitions

being organized by the Council as such

exhibitions are purely ‘Trade Shows’ and not

‘Entertainment’ within the meaning of Section

2(a) of the Act.

(2)

However, the Hon’ble Bombay High Court

by its order dated 4

th

March, 2013 has

dismissed the writ petition filed by the Council

and has upheld the validity of the levy of the

Entertainment Duty.

(3)

The Council has preferred Special Leave

Petition (SLP) before the Hon’ble Supreme

Court against this Order and the Leave has

been granted. The matter is pending before

the Hon’ble Supreme Court.

(4) Pending, the matter before the Hon’ble

Supreme Court a sum of Rs. 41,68,958/- in

respect of India International Jewellery Show

(IIJS), 2015 and a sum of Rs. 15,94,916 in

respect of Signature IIJS, 2016 Show as

determined on the lines of the aforesaid Order

have been debited to the Statement of Income

& Expenditure for the year.

24.

The Hon’ble Bombay High Court and Income-tax

Appellate Tribunal, Mumbai Benches, in the case of

the Council in earlier years, have held that the Income

of the Council is eligible for exemption under Section

11 of the Income Tax Act, 1961. As such, no provision

towards Income-tax is being made in the accounts.

In view of the above, the mandatory Accounting

Standard AS-22 relating to “Accounting for Taxes

on Income” issued by the Institute of Chartered

Accountants of India, is considered not applicable in

the case of the Council.

25.

As per Accounting Standard AS-15(Revised) relating

to “Employee Benefits” the disclosure of employee

benefits as defined in the said Accounting Standard

are given below:

(i) Defined Contribution Plan:

Council’s Contributions to defined contribution

plan recognized as expenses for the year are

as under:

Particulars

2015-2016 2014-2015

Rupees

Rupees

Contribution to Provident

Fund

38,23,951 32,54,719

Contribution to Group

Gratuity Scheme

407,158

3,702

Contribution to Leave

Encashment Scheme

2,12,741 14,61,319

THE GEM & JEWELLERY EXPORT PROMOTION COUNCIL

(A COMPANY LIMITED BY GUARANTEE AND NOT HAVING SHARE CAPITAL)

NOTES TO THE STANDALONE FINANCIAL STATEMENTS FOR THE YEAR ENDED 31ST MARCH, 2016