50

th

ANNUAL REPORT 2015-2016 THE GEM & JEWELLERY EXPORT PROMOTION COUNCIL

109

THE GEM & JEWELLERY EXPORT PROMOTION COUNCIL

(A COMPANY LIMITED BY GUARANTEE AND NOT HAVING SHARE CAPITAL)

NOTES TO THE STANDALONE FINANCIAL STATEMENTS FOR THE YEAR ENDED 31ST MARCH, 2016

(ii)

Defined Benefit Scheme:

The Employees’ Gratuity Fund Scheme

managed by the Life Insurance Corporation

of India (LIC) is a defined benefit plan. The

present value of the obligation is determined

by the LIC based on actuarial valuation.

The estimates of future salary increases,

considered in an actuarial valuation, takes

account of inflation, seniority, promotion and

other relevant factors such as supply and

demand in the employment market. This is in

accordance with

Accounting Standards – 15

(Revised), “Employee Benefits”.

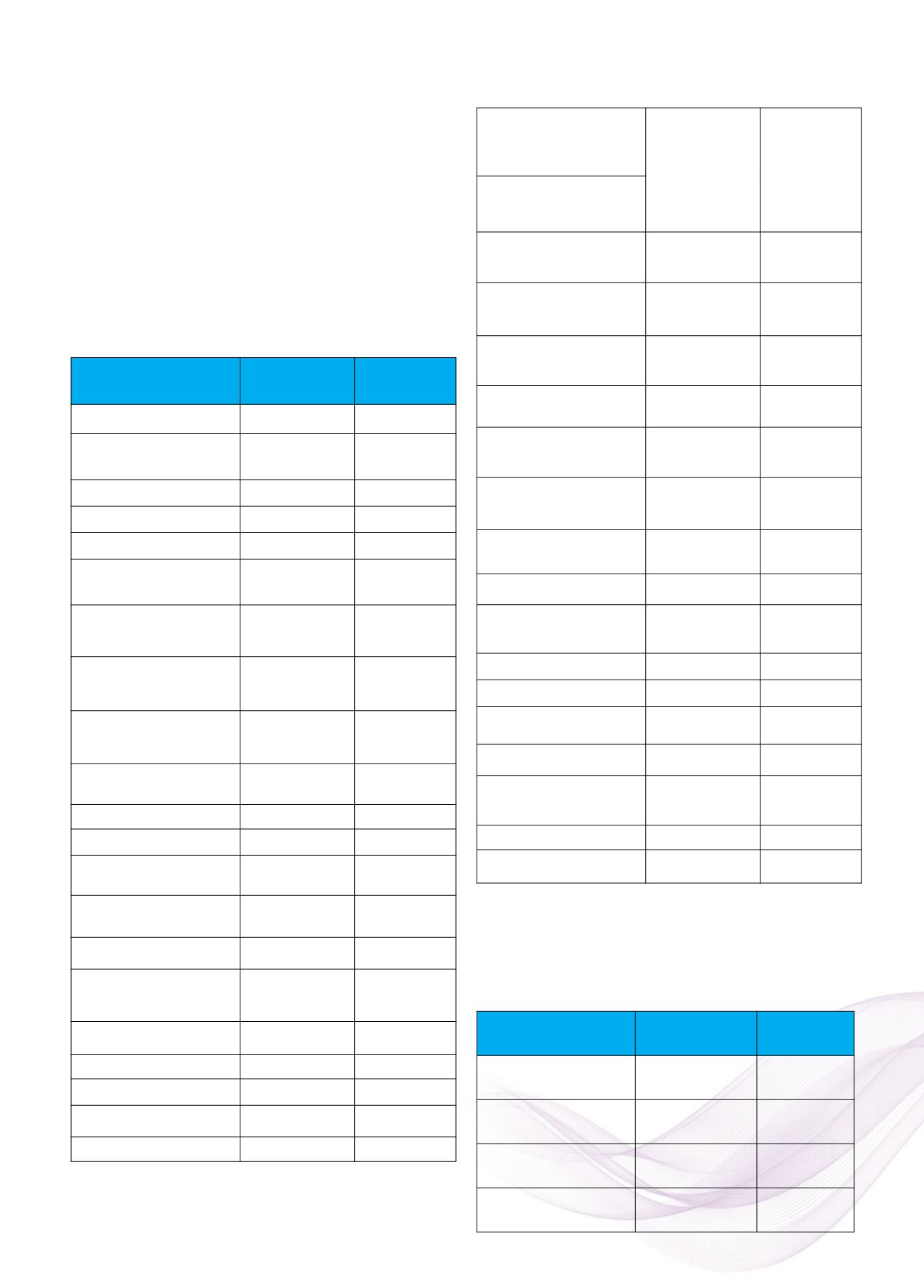

Particulars

Gratuity (Funded)

31

st

March, 2016

Rupees

31

st

March,

2015

Rupees

Present Value of the

Obligation

1. Present Value of

obligation as at beginning

of year

13,817,918

1,34,99,718

2. Interest Value

1,105,433

10,79,977

3. Current Service Cost

698,971

7,30,836

4. Benefits Paid

(1,000,000)

(24,58,677)

5.Actuarial (gain)/loss on

Obligation

106,972

9,66,064

6. Present Value of

Obligation as at end of

year

14,729,294

1,38,17,918

Changes in the fair value

of plan assets

1. Fair Value of Plan

Assets at beginning of

year

18,560,902

1,94,38,383

2. Expected Return on

Plan assets

1,538,428

15,81,196

3. Contributions

4. Benefits Paid

(1,000,000)

(24,58,677)

5. Actuarial gain/(loss) on

Plan Assets

Nil

Nil

6. Fair Value of Plan

Assets as at end of year

19,099,330

1,85,60,902

Fair value of plan assets

1. Fair Value of Plan

Assets at beginning of

year

18,560,902

1,94,38,383

2. Actual Return on Plan

assets

1,538,428

15,81,196

3. Contributions

4. Benefits Paid

(1,000,000)

(24,58,677)

5. Fair Value of Plan

Assets as at end of year

19,099,330

1,85,60,902

6. Funded Status

4,370,036

47,42,984

Excess of Actual over

estimated return on plan

assets

Nil

Nil

(Actual Rate of Return –

Estimated rate of return as

ARD falls on 31

st

March)

Actuarial Gain/Loss

Recognized

Actuarial (Gain)/Loss on

obligations

106,972

9,66,064

Actuarial (Gain)/Loss for

the year – plan assets

Nil

Nil

Actuarial (Gain)/Loss on

obligations

106,972

9,66,064

Actuarial (Gain)/Loss

recognized in the year

106,972

9,66,064

Present Value of

obligations as at the end

of year

14,729,294

1,38,17,918

Fair Value of plan assets

as at the end of the year

19,099,330

1,85,60,902

Fund Status

4,370,036

47,42,984

Net Asset/(Liability)

recognized in Balance

Sheet

4,370,036

47,42,984

1. Current Service Cost

698,971

7,30,836

2. Interest Cost

1,105,433

10,79,977

3. Expected Return on

Plan Assets

(1,538,428)

(15,81,196)

4. Net Actuarial (gain) loss

recognized in the year

106,972

9,66,064

5. Expenses Recognized

in the statement of Income

& Expenditure

372,948

11,95,681

1. Discount Rate

8%

8%

2. Expected Rate of Salary

Increase

10%

10%

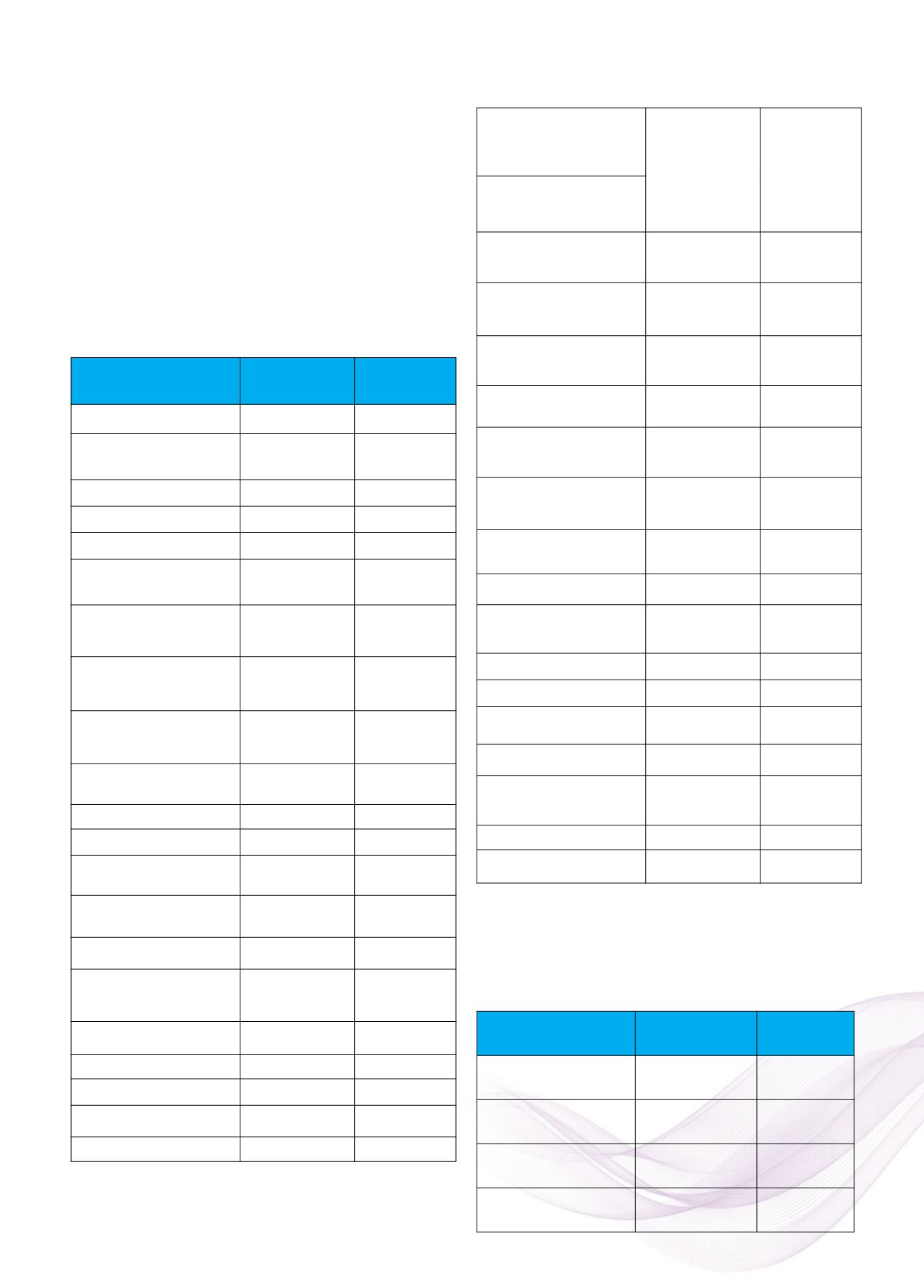

(iii) The Employees’ Leave Encashment Fund Scheme

managed by the Life Insurance Corporation of India

(LIC) is a defined benefit plan. The present value of the

obligation is determined by the LIC based on actuarial

valuation.

Particulars Leave

Encashment (Funded)

31

st

March, 2016

Rupees

31

st

March,

2015

Rupees

Changes in the present

value of obligation

1.

Present

Value

of obligation as at

beginning of year

4,811,070

66,59,781

2. Interest Valuew

384,885

5,32,782

3. Current Service Cost

739,316

8,86,649